Soon, you can start SWP from your NPS fund

- Ira Puranik

- Last Updated : June 19, 2023, 16:25 IST

The Pension Fund Regulatory and Development Authority (PFRDA) is now planning to bring in greater flexibility in terms of withdrawing one’s retirement funds. As per PFRDA chairman Deepak Mohanty, the plan will be implemented by September 2023. Read on to know what the new plan could impact for those retired and the ones approaching their twilight years.

What is the current structure?

Presently, upon touching 60 years, an NPS subscriber can only take out up to 60% of his total retirement corpus as a lump sum. The remaining 40% has to compulsorily go towards purchasing an annuity plan. These plans offer the subscriber a fixed monthly payout for the rest of their lives, in exchange of a lump sum, one-time or regular payments.

So, for instance, under the present system, if you have a retirement fund of Rs 2,00,000 under NPS, you can only withdraw up to Rs 1,20,000 when you turn 60. The remaining Rs 80,000 will have to go towards ensuring that you have a steady payout avenue ready by means of buying an annuity plan.

What are the proposed changes?

Now instead to withdrawing the 60% corpus, subscribers will have the option of opting for a systematic withdrawal plan till the age of 75. This would mean the funds with NPS will keep earning returns even as the money is drawn from the corpus. Subscribers can choose a monthly, quarterly, half yearly or yearly payments.

According to Mohanty, the change was prompted due to investor concerns about people wanting to continue in their return generating fund, as opposed to locking their money away in a relatively-less lucrative annuity plan.

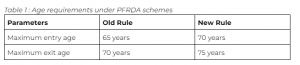

On another note, PFRDA has also pushed the age-range for entry and exit in various PFRDA schemes, by about 10 years. Table 1 : Age requirements under PFRDA schemes

How will this change impact your retirement corpus? As of March, 2023, PFRDA had around Rs 8,95,133 crore as assets under its management. This is also expected to cross the Rs 10 lakh crore threshold in the first half of 2023. With access to better healthcare facilities and caregiving services, life expectancy is also inching forward. By 2100, India’s average life expectancy is estimated to hit 82 years, a 57% improvement from the current standards of 70.19 years.

As people begin to live longer and continue to stay gainfully employed till their late 60s, the necessity of their retirement corpus generating high returns to accommodate inflation-adjusted lifestyles will also be needed. On this front, equity delivers better results, as opposed to annuity plans. Also, added flexibility in terms of determining how one can receive and utilize their retirement fund further adds to user’s ease.

Adds Pune-based retirement advisor Sanjeev Dawar, “With increased life expectancy & higher expenses towards medical care, it becomes important that inflows continue for life time. This is necessary not only for self but for your spouse as well. In such a case, one option a retiree can consider is an SWP or systematic withdrawal plan. A retiree can generate a regular income through SWP by investing a lumpsum amount after retirement”

“This will be similar to investing the retirement corpus in a Mutual Fund scheme and scheduling a SWP. It not only offers a flexibility in terms of defining the SWP amount, there is an inbuilt advantage of capital growth and tax efficiency. It also offers option of capital withdrawal in case of an emergency. This will certainly suit individuals who are not very conversant with the financial or capital market”, he notes

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- PhonePe vs. GPay: Indian digital payment giants up for a tussle

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Why are e-comm users turning extra cautious? How to avoid dark pattern attacks?