Banks or post office: Which is a better option to invest?

The current interest rate offered on PPFs is 7.1% per annum. This allows massive tax benefits under Section 80C of the I-T Act

- Noopur Praveen

- Last Updated : July 6, 2021, 13:59 IST

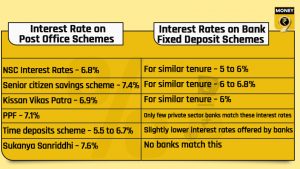

The interest rate on several bank deposits has fallen in the past few months and customers are worried about their returns. However, post office schemes have emerged as the savior here. They are backed by the government and investors can always look for long-term benefits while investing in schemes backed by the post office. This brings a lot of stability and a sense of accountability for your hard-earned money. Both these factors lack in case of private banks.

Post office Vs bank beposits

Often people save for their retirement in advance and deposit money for their old age in several ways. One of the most popular investment tool is a Public Provident Fund (PPF) because it offers high-interest rates as well as tax benefits. The current interest rates offered on PPFs is 7.1% per annum. This allows massive tax benefits under Section 80C of the I-T Act. Very few small, private sector banks manage to offer these rates for a fixed tenure.

In Post Office, the minimum investment that should be made to open a PPF account in a financial year is Rs. 500. This is great for those who cannot invest a huge sum of money on future svaings. You can enjoy EEE tax benefits under which the principal amount, the interest earned, and the maturity amount are exempted from taxes. One can also avail loan facility from the 3rd financial year if they opt for post office scheme.

Even other post office saving schemes like Sukanya Samriddhi Yojana or Senior Citizen Savings Scheme offer better interest rates in comparison to banks.

Open PPF with banks

Now you can open a PPF account with banks as well. But, many people get confused while choosing between post office and banks. So, how do you decide which option would be right for you?

Generally, it depends on each one’s preference, convenience and geographical location, etc. Some like to believe that opening a PPF account with a bank is more beneficial than opening it in a post office. If you open a PPF account in the same bank where you already have a savings account, you get a lot of other benefits. You get timely details of the account by availing net banking facility.

With this, customers can manage their PPF account on the phone itself. Whereas, if the account is opened in the post office, you may have to visit the branch office for most things. Therefore, bank option is more customer-friendly.

Having said that, you have to decide what is your priority. If you’re looking for great service like online banking, etc., banks can be a better bet but if interest rates and safety matter more – opt for post office schemes.

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की