Canara Bank vs PNB vs BOI: Check FD rates after latest revision

Canara Bank, Punjab National Bank, and Bank of India offer FD tenures ranging from 7 days to 10 years

- Rahul Chakraborty

- Last Updated : August 20, 2021, 15:32 IST

A fixed deposit (FD) is one of the most conventional ways of depositing money. It is a preferred option for many Indians as it is considered one of the safest avenues. It offers fixed returns based on the given tenure. All major private and public sector banks in the country offer FD tenures ranging from 7 days to 10 years.

FD interest rates of different banks vary by deposit amount, deposit tenure and type of depositor. In the past 20 days at least five major banks have revised FD rates. Out of them three are public sector banks – Canara Bank, Punjab National Bank (PNB) and Bank of India (BOI). If you are planning to invest in fixed deposits, it’s always better to know the recent changes and compare the rates offered by various banks.

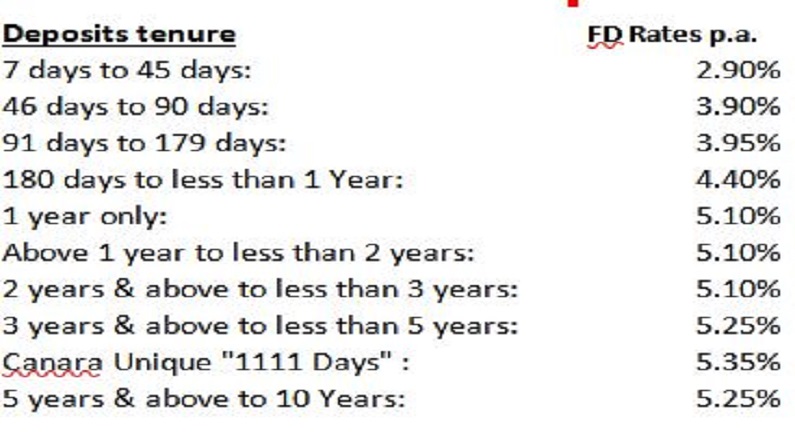

Canara Bank

Canara Bank, one of the major public sector banks, offers interest rates between 2.90% and 5.35% below Rs 2 crore on FDs between tenures of 7 days and 10 years for the general public. These rates came into effect on and from August 8, 2021.

Take a look at tenure wise interest rates for the general public:

For senior citizens

Canara Bank offers an additional interest rate of 50 basis points or 0.50 percentage point over and above general customers on FDs only for 180 days to 10 years tenure for senior citizens. After the recent revision, Canara Bank is now offering the minimum 2.90% to maximum 5.85% interest rates to senior citizens tenure ranging from 7 days to 10 years.

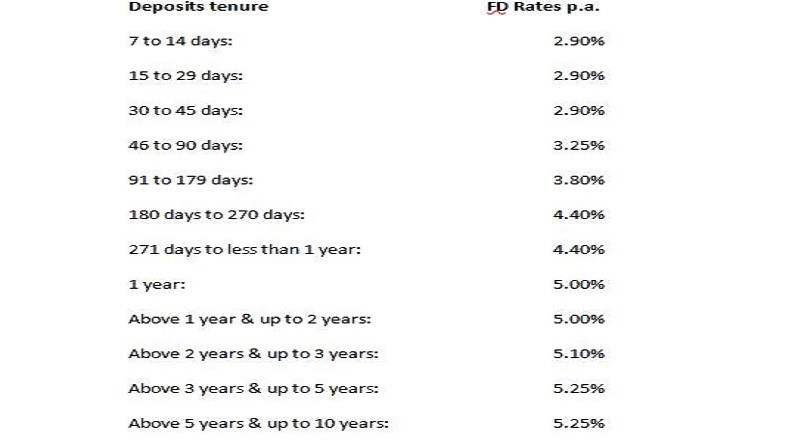

Punjab National Bank

Punjab National Bank (PNB) has recently revised interest rates on fixed deposits. After the latest revision, this public sector bank offers interest rates between 2.90% and 5.25% on deposits below Rs 2 crore for tenures between 7 days and 10 years for the general public. The new rates on term deposits came into effect on and from August 1, 2021.

PNB rates for senior citizens

PNB offers an additional interest rate of 50 basis points or 0.50 percentage point more than general customers on term deposits of less than Rs 2 crore for senior citizens for all maturities.

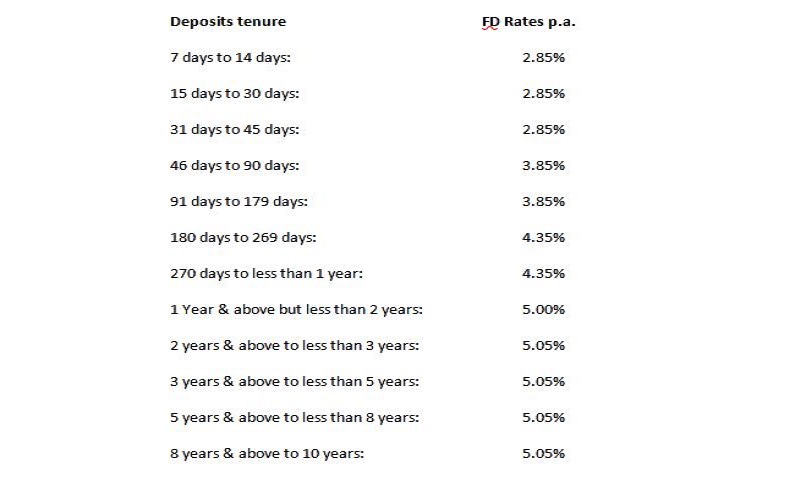

Bank of India

Bank of India is now offering 2.85% to 5.05% interest on term deposits for the general public for 7 days to 10 years tenure. The new rates on term deposits were applicable from August 1, 2021.

Take a look at tenure wise interest rates on FDs less than 2 Crore for the general public:

BOI FD for senior citizens

Bank of India (BOI) offers an additional interest rate of 50 basis points or 0.50 percentage point more than general customers to senior citizens on term deposits of less than Rs 2 crore for tenure of 6 months and above to 10 years.

SBI Special Platinum Term Deposits

To celebrate India’s 75th year of Independence, State Bank of India (SBI), the country’s largest lender, recently introduced a special deposit scheme called platinum term deposits for retail depositors. Under this scheme customers can get additional interest benefit up to 15 bps or 0.15% on term deposits for 75 days, 75 weeks, and 75 months tenors. This scheme will remain open till September 14.

Take a look on SBI platinum term Deposits interest rates for the general public:

Download Money9 App for the latest updates on Personal Finance.

Related

- PhonePe vs. GPay: Indian digital payment giants up for a tussle

- Why are e-comm users turning extra cautious? How to avoid dark pattern attacks?

- Worst deposit crunch in 2 decades, RBI urges banks to explore new ways to increase deposits

- Microsoft Global Outage: What led to the ‘Blue Screen of Death’?

- Save your card from getting cloned!

- Project Nexus: A UPI-like platform for cross-border payments