Credit card: Here are ways to make optimum use of it

Typically, do not use more than 30-40% of your credit limit at a time. Decide the number of cards you wish to hold basis these factors

- Noopur Praveen

- Last Updated : July 14, 2021, 23:27 IST

Credit cards are tempting due to its flexibility and utility. However, the fear of overspending and falling into debt cannot be undermined in this process. This fear multiplies when you have more than one credit card at your disposal. The trick to use this facility efficiently inherently lies in a disciplined approach towards one’s spending and repayment abilities. But we’re constantly looking for smart hacks to manage credit cards simply because discipline is a hard virtue to imbibe, especially in money matters.

Retain your oldest credit card

So what is the basic thumb rule to manage multiple credit cards? Well, to begin with, one should understand there is no magic number of credit cards a person can or should have. What is essential is that you have the right card and you utilize it judiciously. For instance, if you do not travel much, a travel card is not of much use to you. Similarly, keep your utilisation rate low.

“Typically, do not use more than 30-40% of your credit limit at a time. Decide the number of cards you wish to hold basis these factors. Keep in mind that it is a good idea to retain your oldest cards as they have a much longer credit history,” said Adhil Shetty, CEO at BankBazaar.com.

Spend as per interest-free period

While credit card spending must be constantly under check, what always matters isn’t ‘how’ much you spend. Rather, the key is ‘when’ do you actually spend. You should plan your credit card expenditure according to the interest free periods.

This is a period between the date of a credit card transaction and the due date of repaying the bill.During this time, zero interest is charged on credit card transactions, except ATM cash withdrawals. However, this rule is applicable only when you repay the entire bill amount within the due date.

“Credit card spends need to be repaid only after the bill is generated and not at the time it is swiped. This gives users a window of as much as a month depending on when the purchase is made. After the bill is generated, users have 20-25 days to clear it. So long as the bill is paid in its entirety, this entire period is interest-free. Note that this is applicable only if the payment is made in full and not otherwise,” Shetty asserted.

Always compare EMIs

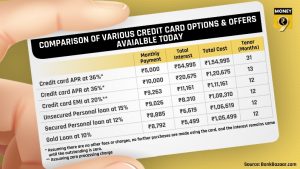

You should always compare the equated monthly instalment (EMI) options and offers on various credit cards before applying for a new one. Now, consider a credit card balance worth Rs 1 lakh and let’s see what are the payment options under various scenarios.

In the first case, the annual percentage rate (APR) is taken as 36% and the monthly repayment is Rs 5,000. Here, for a duration of 31 months, Rs 54,995 is the total interest while the outstanding cost will come to Rs 1,54, 995. Now, at the same APR, if the monthly payment is increased to Rs 10,000, the total interest reduces to Rs 20,675 for 13 months and the outstanding cost becomes Rs 1,20,675.

If you choose to convert this credit into a 12-month EMI at 20% interest, monthly repayment turns Rs 9,026 with a total interest of Rs 11, 161 and outstanding cost of Rs 1,11,161. Similarly, you decide to take an unsecured personal loan at 15% interest, you’ll be able to close it in a period of 12 months if you repay Rs 9,026 monthly. The total interest charged here would be Rs 8,310 and the total cost will be limited to Rs 1, 08,310. We have illustrated similar scenarios in the case of secured personal loan (12% interest) and gold loan (10% interest) as well.

Don’t deprive yourself of reward points

Credit card companies design their reward points, cashbacks and other benefits as per the target sector. This simply implies that if you’re smart enough to spread your credit card usage in a diversified manner, you can avail the best of these freebies.

For example, if you’re someone who likes to spend significant money across categories like travel, shopping, eating, fuel, etc., you can get multiple reward points from all the above categories and ensure a sizeable profit.

Should you opt for multiple credit cards?

It is all about managing credit smartly. The number of cards do not matter if you plan your expenses and repayment. A credit card is not a free pass. You need to be able to repay what you spend using it. If you go overboard, you will end up being unable to repay what you owe.

“You have the option of making a “minimum payment”— typically, 5% of the outstanding card balance to avoid paying penalties, but you still need to pay interest. Credit card debts attract among the highest interest rates, and you may have to pay as much as 40% interest on your unpaid amount. This is supplemented by late fees, collection charges, or even legal fees. Repeatedly making only minimum payments would keep you in debt for a long time,” Shetty explained.

If you don’t manage your debts well, you will get into debt traps – ever-deepening debt hard to get out of. If you default on your payments and apply for more credit, your credit score will take a beating. You will come across as credit-hungry, and would be either denied further credit or be able to avail them at only very high costs. This will push you further into debt.

Point to note

A credit card is not a free pass. You need to be able to repay what you spend using it. If you go overboard, you will end up being unable to repay what you owe. So plan your spends carefully and stick to them. Keep your credit utilization also within limits. Try not to exceed 40% unless there’s an emergency.

Download Money9 App for the latest updates on Personal Finance.

Related

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की

- इंडसइंड बैंक का बड़ा कदम, डेरिवेटिव अकाउंट में मिली गड़बडि़यों की वजह पता करने के लिए पेशेवर कंपनी की नियुक्त

- बैंक जमा पर बीमा की सीमा बढ़ाने से बैंकों के मुनाफे पर होगा असरः इक्रा

- बैंक डूबा तो अब मिलेंगे 8-12 लाख! सरकार बढ़ा सकती है इंश्योरेंस लिमिट

- बंद हो गया बैंक अकाउंट, SIP भी है लिंक तो तुरंत करें ये 5 काम

- J&K बैंक को SEBI की चेतावनी, 1 फीसदी से ज्यादा टूटा शेयर; जानें पूरा मामला