You can earn 8% interest on these fixed deposits; check all details here

There are two types of interest payment options on FDs — cumulative and non-cumulative.

- Rahul Chakraborty

- Last Updated : September 19, 2021, 15:12 IST

Fixed deposits constitute one of the secure investment avenues that guarantees consistent interest earnings. As an alternative to banks, anyone can opt for company fixed deposits to invest his or her hard earned money. On an average, company fixed deposits offer higher returns in comparison to bank fixed deposits across different tenures. Tamil Nadu Power Finance & Infrastructure Development Corporation Limited (TNPFC) is offering up to 8% interest rates on fixed deposits for tenure of one to five years to the general public. However, senior citizens will get up to 8.50% interest rate for the same.

Risk factor

Generally, company fixed deposits (FDs) carry higher risk than bank fixed deposits (FDs). Bank FDs up to Rs 5 lakh are secured with insurance cover offered by Deposit Insurance and Credit Guarantee Corporation (DICGC). But there is no such insurance cover for company FDs. In that case, everything depends on the overall health of these companies.

Tamil Nadu Power Finance is a wholly owned enterprise of Tamil Nadu government and registered with RBI as a non-banking finance company (NBFC). As the company is 100% owned by a state government, it is considered that there should be virtually no investment risk.

Tenure and payment

Tamil Nadu Power Finance offers FDs for the tenure of 12 months to 60 months. There are two types of interest payment options on FDs that are cumulative and non-cumulative.

Interest rates

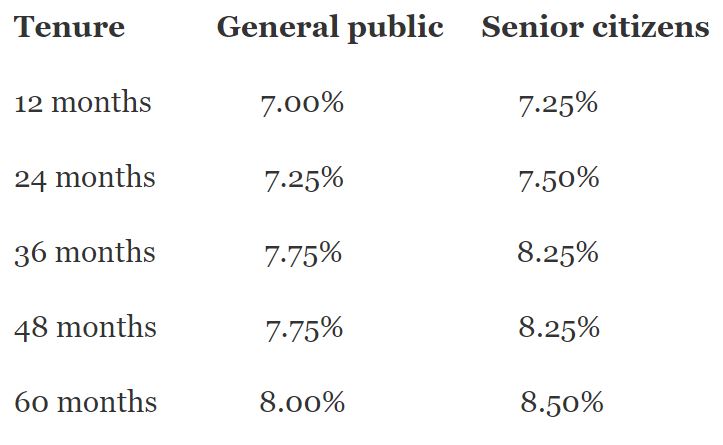

For cumulative the interest would be quarterly compounded and paid on maturity. The interest rates are in the range of 7% to 8% for the general public.

On the other hand, for non-cumulative deposits interest may be payable at monthly, quarterly, half-yearly or annually. The tenure of these FDs is for 2, 3, 4 and 5 years. Interest rates are in the range of 7.25% to 8% for the general public.

Take a look at interest rates offered by Tamil Nadu Power Finance on cumulative fixed deposit for individual investor:

Top bank FDs

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की