Fuel credit cards: How to maximise benefits for free petrol, diesel

Fuel credit cards with their attractive offers may benefit you but only if you are savvy enough to make the most of it

- Aprajita Sharma

- Last Updated : August 9, 2021, 17:20 IST

The reward points and cashbacks on credit cards are enticing. At a time when fuel prices have crossed the century, availing free fuel with the help of fuel credit cards sounds amazing. Is it really possible? Technically, yes. But, you must know the fine-prints. Essentially you will be utilising reward points and cashbacks for different purposes such as flight tickets, gift vouchers or discounts on select outlets.

But it is not that simple. Understanding math is important. “We had worked on a project where credit card customers kept hoarding their points because one of the aspirational rewards was a dinner meeting with a supermodel, if you redeemed one million points. Technically, one could meet the supermodel. But practically, it would require them to spend, maybe, 50 million dollars on that card!” says Amit Das, Co-founder and CEO, Think360 – parent company of Algo 360.

Maximising benefits

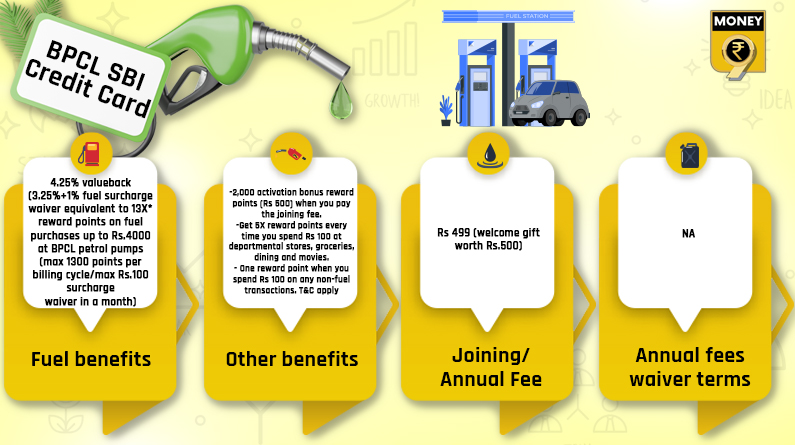

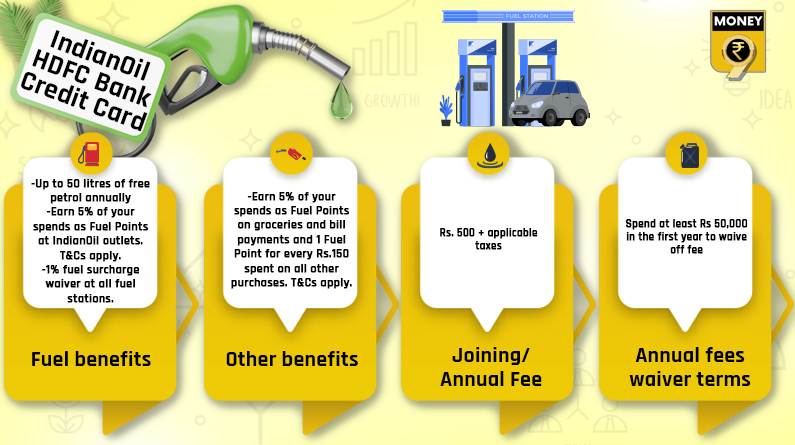

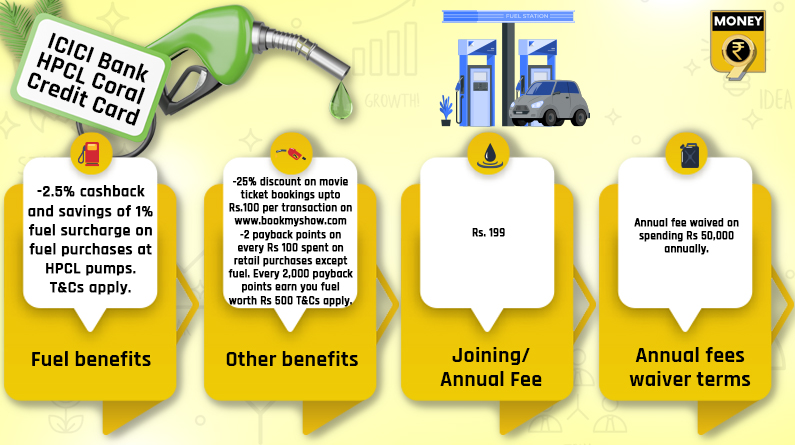

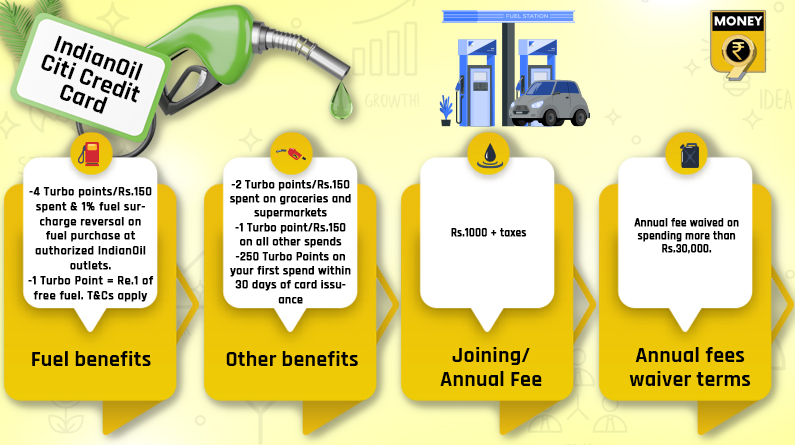

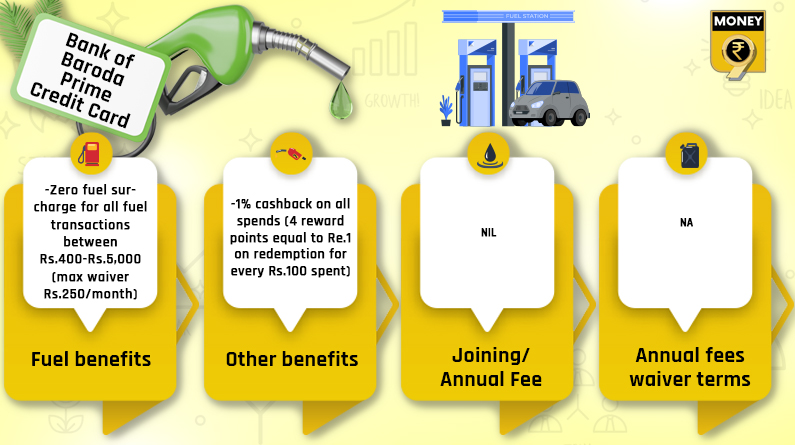

Every credit card is different. Some cards offer 1 point for Rs 100, while some others offer 1 point for Rs 40. Some will charge an annual fee while others may have no fee at all or a system to waive off the fee. There could be some that you can use at select fuel stations such as co-branded cards while some could be used at all stations. There could be riders too that the reward points can be availed only after you make a purchase of X amount. You have to do the maths for yourself.

“Fuel credit cards may have beneficial tie-ups with one chain of fuel pumps – e.g. HPCL, BPCL, etc. To maximise your benefits, you should stick to the same chain over and over again. To derive value out of these cards, it is necessary to plan your fuel purchases,” says Das.

Adhil Shetty, founder and CEO, Bankbazaar.com advises to calculate redemption rate. “If you have collected 10,000 reward points at year-end then calculate the worth of it. Can you get more discounts on fuel? Is it possible to get free merchandise or a shopping card? Identifying the actual value proposition will differ for every customer. Are benefits offered even relevant for you? You should make these calculations,” he suggests.

One of the major points is to keep a note of joining fees and annual charges. “If there is an annual fee of Rs 2000-5000, then you are already minus this amount. There could be a condition that if you make fuel expenses of more than Rs 1 lakh it will be reimbursed. If you think you can easily cross this limit in a year, go for it,” says Shetty.

Most customers have to pay a joining fee too apart from the annual fee. Let us say the joining fee is Rs 200. “Even if you are earning 4 points on every Rs 150 spent, to earn 200 points (i.e. Rs 200), you will need to spend 150*50= Rs 7500 on fuel, to recover the joining fee paid. So, a bike-rider who spends Rs 1000 in a month on fuel, may not realize any value from the fuel card for the first seven months,” says Das.

Fuel credit cards with their attractive offers may benefit you but only if you are savvy enough to make the most of it. Have it only if fuel expenses form a significant chunk of your monthly expenses.

Download Money9 App for the latest updates on Personal Finance.

Related

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की

- इंडसइंड बैंक का बड़ा कदम, डेरिवेटिव अकाउंट में मिली गड़बडि़यों की वजह पता करने के लिए पेशेवर कंपनी की नियुक्त

- बैंक जमा पर बीमा की सीमा बढ़ाने से बैंकों के मुनाफे पर होगा असरः इक्रा

- बैंक डूबा तो अब मिलेंगे 8-12 लाख! सरकार बढ़ा सकती है इंश्योरेंस लिमिट

- बंद हो गया बैंक अकाउंट, SIP भी है लिंक तो तुरंत करें ये 5 काम

- J&K बैंक को SEBI की चेतावनी, 1 फीसदी से ज्यादा टूटा शेयर; जानें पूरा मामला