9 mistakes to avoid while taking gold loan

Gold loan offers greater flexibility in terms of loan repayment. Apart from EMI repayment mode, borrowers can opt for customised payment option

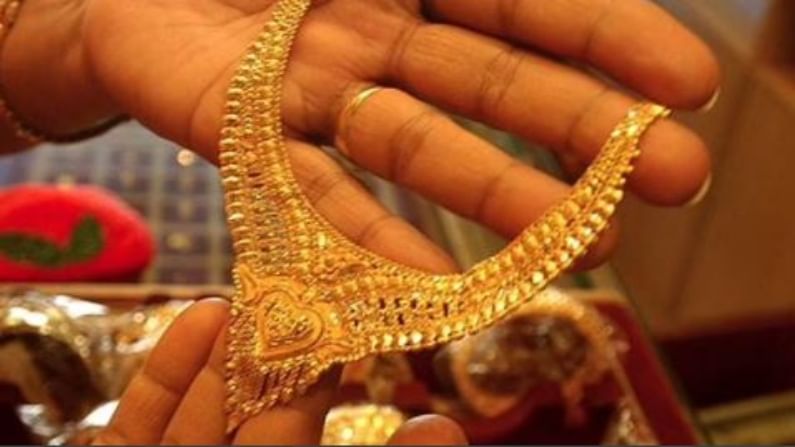

The pandemic has prompted a lot of Indians to pawn gold jewellery and take loans to stave off financial crisis in the family. Several banks and some leading gold loan companies are waiving processing fee and offering low rate of interest to attract customers. However, when looking for a gold loan then you should not commit these nine mistakes, no matter how urgent the requirement for cash is.

Check Interest rate

Gold loan interest rate can range between 8.85% and 30% per year depending on the risk assessment of loan applicant by the lender.

RBI allows loan value maximum up to 75-80% of the gold’s value. Interest rate may also depend on the loan amount. Lenders charge higher interest rates on gold loans with higher LTV ratio to make up for the higher risk involved.

To avoid the burden of higher interest rate, go for those lenders who are offering higher LTV ratio at lower interest rate.

Prepayment charges

While lenders usually do not charge any prepayment fee for gold loan, some may charge up to 2.5% of the outstanding amount if closed before the completion of the tenure.

Given that the prime objective of making prepayments is to save on the interest cost, prepayment penalties would reduce the benefit of prepayments. Hence, opt for a lender that charges minimal or no prepayment/ foreclosure fee.

Repayment structure

Gold loan offers greater flexibility in terms of loan repayment. Apart from EMI repayment mode, borrowers can opt for customised payment option. You can repay only the interest component every month leaving the principal component to be repaid on the maturity date.

Some lenders also allow borrowers to repay interest component upfront at the time of loan sanction while allowing principal repayment at the end of the tenure. So before taking a gold loan one should check all the repayment clause of the bank of the NBFC.

Check lender’s profile

Before taking a gold loan, you must check the profile of the lender. It is important since you would be keeping your expensive jewellery with them.

Needless to say, public sector banks are the most secure. Double-check the lenders profile, NBFC or any other company from which you want to raise a loan.

Processing fee

While some lenders charge a flat processing fee starting from as low as Rs 10/gm, processing fee levied by some lenders may depend on the loan amount. It is usually between 0.10% and 2% of the loan amount.

There are lenders who waive off processing fees, especially during the festive season. As the processing fee can be of a sizeable amount, especially in case of big-ticket loans, it is better to compare processing fees charged by various lenders. Recently SBI, HDFC Bank and Muthoot Finance waived processing fee.

Repayment capacity

As gold loan tenure can range anywhere between seven days to five years, opt for a tenure on the basis of your repayment capacity. If you are opting for the EMI option, factor in monthly contribution required for other financial goals. Settle for shorter tenure if you can comfortably repay your gold loan EMI by the due date.

Purity of gold

Banks and NBFCs grant loans on gold with purity of 22 karat or above. So if you have gold which is less pure, it may not help. When pledging a gold ornament with other precious gems studded in it, only the weight and purity of the gold will be considered for deciding the loan value.

The value of gemstones will not be considered. But remember banks do not accept gold bars for giving out gold loan, nor do they accept gold bullion or gold coins above 50 grams.

Hidden charges

Ignoring hidden charges associated with taking a loan against gold can prove to be costly in the long run. Before taking a loan please cross check all the charges and clear with the staff whether there is any hidden charge or not.

Common charges include processing fee, appraisal fee, foreclosure charges, penal charges on late payment, and auction-related charges. These hidden charges are often layered within the terms and conditions, and you should always factor in these charges before you settle down for the final agreement.

Neglecting after loan service

It might seem unnecessary at the start, but during the tenure of repayment, you will face certain challenges for which you need to have good support from your gold finance company or the banks.

Big gold finance companies like Muthoot or Manappuram provide good after-sales services to their clients. You should check all the rules and regulations regarding after loan service of the banks as well.