IFSC crosses $100 billion mark in banking transactions

IFSCA the regulatory regime at GIFT city is being benchmarked with global standards resulting in major traction from the financial services industry

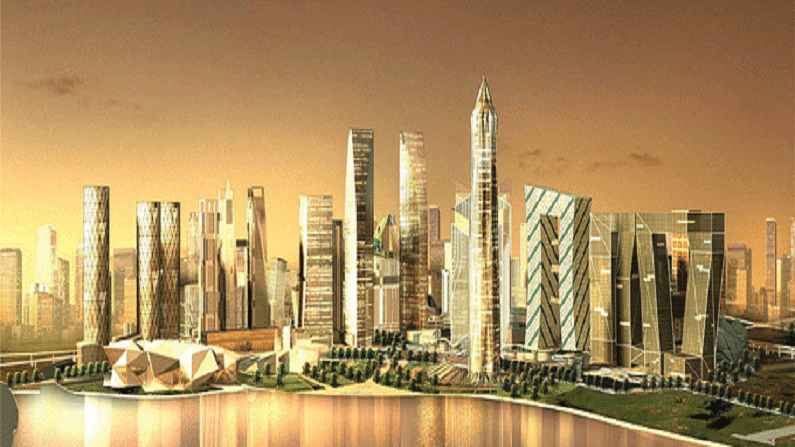

India’s maiden International Financial Services Center (IFSC) at Gujarat International Finance Tech (GIFT), city has recently crossed the $100 billion mark in total banking transactions. The city has witnessed a significant increase in banking sector activity, as many banks both foreign and Indian continue to set up their branches, with the latest being Citibank.

Ever since International Financial Services Centres Authority (IFSCA) assumed the role of the unified financial regulator for IFSC in India, the regulatory regime at GIFT city is being benchmarked with global standards resulting in major traction from the financial services industry.

Citibank becomes first US bank to set up branch at GIFT city

Citibank, on Monday, received a license from the IFSC authority to set up its banking unit at IFSC Center at GIFT city, Gujarat. This is the first US-based bank to set up a branch in the city and would serve both its Indian and global customer base.

Recently, Deutsche Bank became the first German bank to set up its banking unit at GIFT city, Gujarat. The bank has a presence in over 70 countries.

Leading Indian and foreign banks such as HSBC, Standard Chartered, Barclays Bank, State Bank of India (SBI), Bank of Baroda, ICICI Bank, Axis Bank, Kotak Mahindra Bank, HDFC Bank are all operating their branches from GIFT IFSC.