Personal loan versus loan against MFs: Nine banks with lowest interest rates

While you will still be holding MF units in your folio and the new investment in the fund can continue, the ownership of the fund goes to the bank

- Aprajita Sharma

- Last Updated : July 15, 2021, 13:15 IST

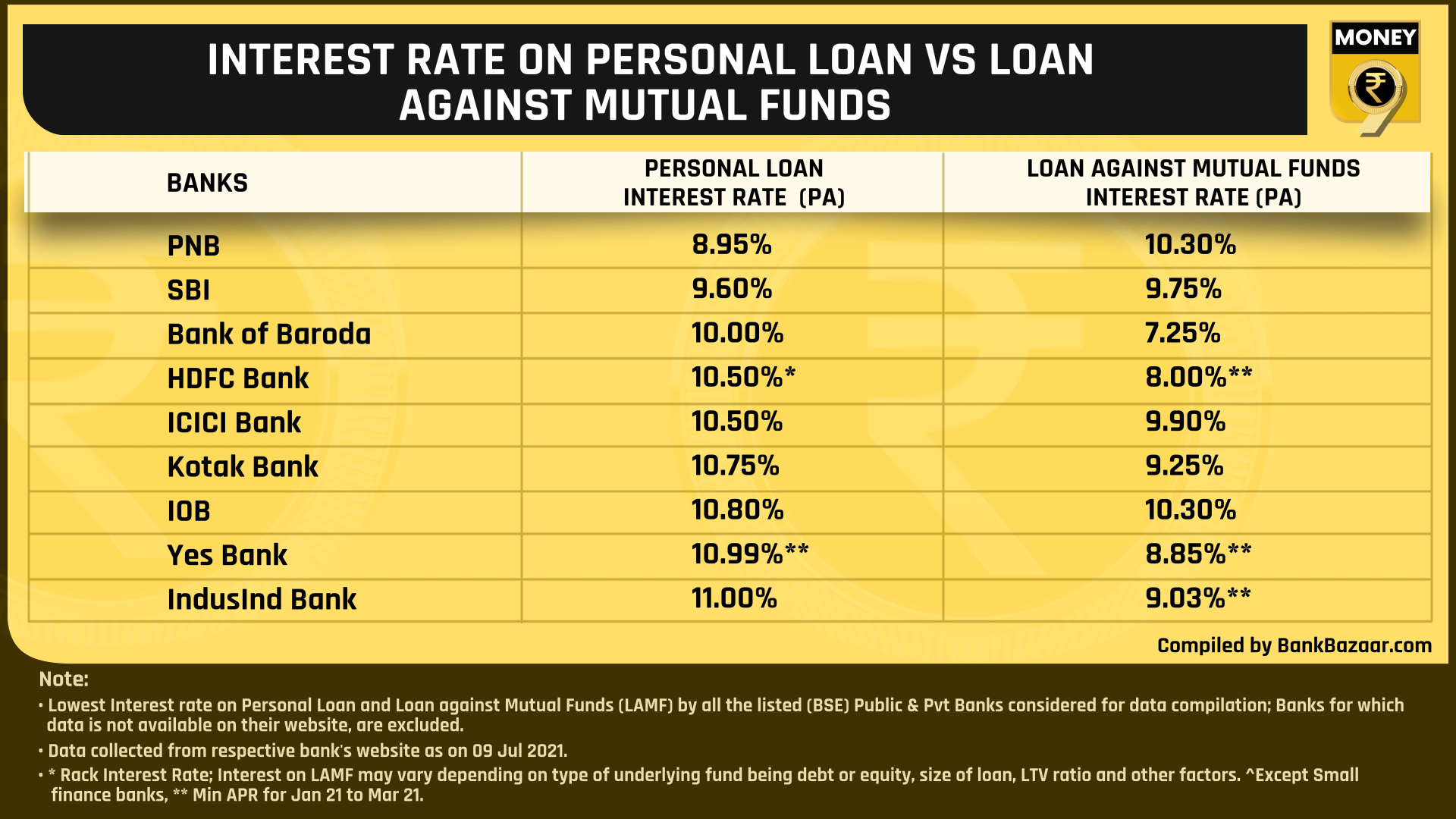

It is hard to pay for all expenses just on your salary. Often we need loan for various purposes. Most people usually go for personal loan, which is unsecured and hence interest rate is on the higher side. Not many people know that you can take loan against mutual funds. If you have good amount of funds in your mutual fund schemes, you can take loan against your MF units. Since this will be a secured loan, the bank will charge comparatively lower rates on the same.

You need to pledge your MF units with the bank. The bank will set an overdraft limit. The loan amount will depend on the existing market value of units in the folio and the tenure you choose.

While you will still be holding MF units in your folio and the new investment in the fund can continue, the ownership of the fund transfers to the bank. Here comes the role of a lien. Lien is a document that gives the bank the right to sell your MF units or hold it. You need to approach the fund house and request them to generate a lien in the name of the bank.

Points to note

Equity markets are volatile. The value of your MF units today may not be equal tomorrow. If the market nosedives for some reason, the value of your MF units will go down as well. While the bank takes into account the market downside when they fix the overdraft limit, in case the market fall breaches their estimate, they may sell your units to make up for the balance. Your overdraft limit can never be higher than the value of your MF units.

“If the markets rise, however, the borrower cannot redeem his MF units. Redemptions can happen only when the loan is paid,” says Harshad Chetanwala, CFP and co-founder MyWealthGrowth.com.

Chetanwala says that if you have a longer horizon in mind and a need for a bigger amount, go for personal loan. However, if you have a short-term financial crunch, loan against a mutual fund will be better.

Download Money9 App for the latest updates on Personal Finance.

Related

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की

- इंडसइंड बैंक का बड़ा कदम, डेरिवेटिव अकाउंट में मिली गड़बडि़यों की वजह पता करने के लिए पेशेवर कंपनी की नियुक्त

- बैंक जमा पर बीमा की सीमा बढ़ाने से बैंकों के मुनाफे पर होगा असरः इक्रा

- बैंक डूबा तो अब मिलेंगे 8-12 लाख! सरकार बढ़ा सकती है इंश्योरेंस लिमिट

- बंद हो गया बैंक अकाउंट, SIP भी है लिंक तो तुरंत करें ये 5 काम

- J&K बैंक को SEBI की चेतावनी, 1 फीसदी से ज्यादा टूटा शेयर; जानें पूरा मामला