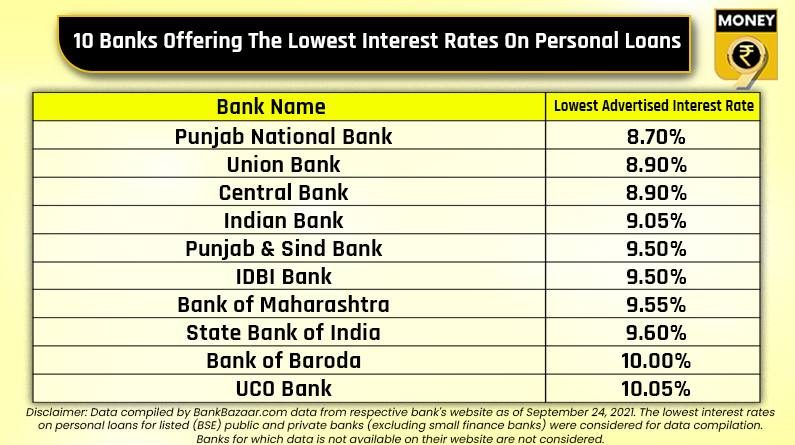

Personal loan: 10 banks offering lowest interest rates

But knowing interest rates is not enough. You also need to ask about processing charges, pre-payment and late payment fees.

Personal loans are popular for funding buying needs such as consumer goods, cars or homes. Due to smooth processing and easy availability, many people also opted for it as emergency cash for medical treatment during the peak of the second wave of Covid-19. However, interest rates on personal loans are higher compared with home and car loans, as there is no collateral against these loans. It is therefore important to check the rates before selecting the lender for getting the best offer.

“Personal loans are among the fastest forms of credit available to you. It is possible to apply and get a personal loan in your account in one single day or even a matter of minutes. So personal loans can be of help in case you have an immediate need for funds. Moreover, if you take personal loans against securities, such as an FD or insurance, the rate of interest at which you get the loan could be even lower than a home loan. So, by making the right choice, you can access funds quickly and cheaply,” said Adhil Shetty, CEO, BankBazaar.com.

If you are also looking for the best personal loan rates, we have collated a list for you in collaboration with Bankbazaar.com

But knowing interest rates is not enough. You also need to ask about processing charges, pre-payment and late payment fees. An individual must be aware of what one is signing for before taking a personal loan. Shetty said there are some more dos and don’ts that you must follow so that you get the best deal possible.

Here they are:

— Do know why you’re getting the personal loan

— Do your research and go for the lowest interest rates

— Do read the fine print

— Do take advantage of promotions

— Don’t skip loan repayments

— Don’t use personal loans for non-essential spending

— Don’t apply for multiple loans at the same time

— Don’t apply for a personal loan within 6 months of availing a personal loan

The next question is whether to go with a private or public sector bank. Private banks will have better customer services while for public sector banks, one may need you to visit the bank quite often. However, interest rates are indeed cheaper at public sector banks. “There is no difference between a private and public sector bank when it comes to personal loans. The interest rates and broad terms and conditions are all more or less at par,” said Shetty.