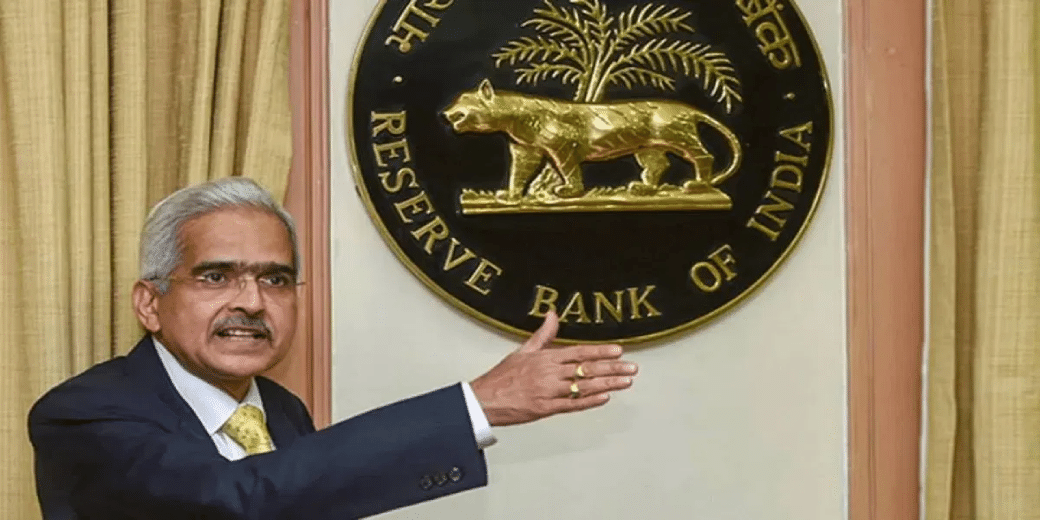

RBI fines ICICI, Kotak Mahindra Bank

The Reserve Bank on Tuesday said it has imposed a penalty or Rs 12.19 crore on ICICI Bank and Rs 3.95 crore on Kotak Mahindra Bank for non-compliance of certain regulatory norms.

- Shivram Krishnan

- Last Updated : October 17, 2023, 18:08 IST

The Reserve Bank on Tuesday said it has imposed a penalty or Rs 12.19 crore on ICICI Bank and Rs 3.95 crore on Kotak Mahindra Bank for non-compliance of certain regulatory norms. The penalty on private sector lender ICICI Bank has been imposed for contravention of norms related to ‘Loans and Advances-Statutory and Other restrictions’ and ‘Frauds classification and reporting by commercial banks and select Fls’.

In the case of ICICI, RBI said the bank sanctioned/committed loans to companies in which two of its directors were also directors; marketed and engaged in the sale of non-financial products and failed to report frauds to RBI within the prescribed timelines.

In another statement, the RBI said the penalty on Kotak Mahindra Bank Limited has been imposed for contravention of directions related to “Managing Risks and Code of Conduct in Outsourcing of Financial Services by banks”, “Recovery Agents engaged by Banks”, “Customer Service in Banks”, and “Loans and Advances – Statutory and Other Restrictions”.

It said Kotak banks failed to carry out annual review/due diligence of the service provider; failed to ensure that customers are not contacted after 7 pm and before 7 am; levied interest from disbursement due date instead of the actual date of disbursement, contrary to the terms & conditions of sanction, and levied foreclosure charges despite there being no clause in the loan agreement for levy of prepayment penalty on loans recalled/foreclosure initiated by the bank. In both cases, the RBI said the penalties are based on the deficiencies in regulatory compliance and is not intended to pronounce upon the validity of any transaction or agreement entered into by the banks with their customers.

Download Money9 App for the latest updates on Personal Finance.

Related

- ICICI बैंक को 49.11 करोड़ रुपये के टैक्स डिमांड का मिला नोटिस

- बैंक कर्ज वृद्धि धीमी पड़कर 4.9 प्रतिशत पर: आरबीआई

- PSU के लिए शेयर बाजार से हटने को स्वैच्छिक ढांचा लाएगा SEBI, एफपीआई नियम होंगे सरल

- केनरा बैंक ने सभी बचत खातों में न्यूनतम शेष पर जुर्माने को खत्म किया

- SBI ने FD पर ब्याज दर में 0.20 प्रतिशत की कटौती की

- बैंक ऑफ महाराष्ट्र ने रिटेल लोन दरों में 0.25 प्रतिशत की कटौती की