Small finance banks: Check out best FD interest rates

Whoever is offering you a higher interest rate than the prevailing risk-free rate, you must look at the difference and the reason for the same

Fixed deposits are the safest form of investments, but interest rates — especially when the economy is in a low interest rate regime — are miniscule. In some cases where investors are in a higher tax bracket, the real interest rate could be negative, factoring in inflation. What to do? While debt mutual funds and equities could be an option, but if you are a conservative investor, you may give a try to fixed deposits in small finance banks. You may get a fixed deposit of three-five-year tenure for as high as 6.75% interest rate.

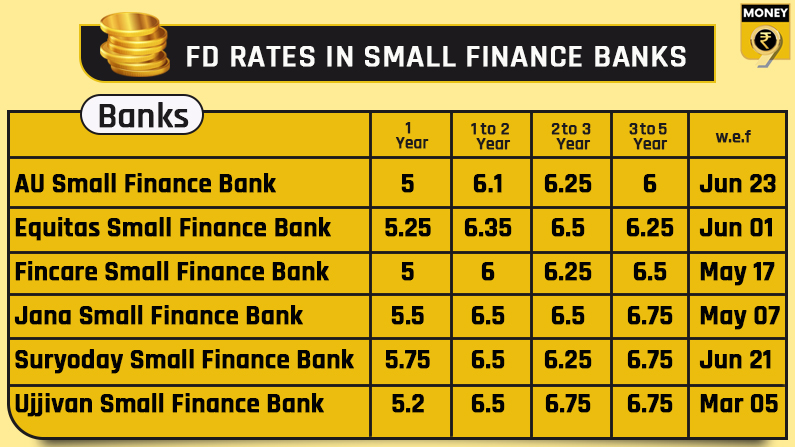

Data from Bankbazaar.com shows Jana Small Finance Bank, Suryoday Small Finance Bank and Ujjivan Small Finance Bank are offering FD rates of 6.75% for three-five-year tenure. A shorter tenure FD (two-three-year) could be available in the range of 6.25-6.75% in these banks.

Here goes the full table:

By comparison, State Bank of India is offering 5.30% interest rate on three-five-year FDs.

Why higher interest rates in small finance banks?

Whoever is offering you a higher interest rate than the prevailing risk-free rate, you must look at the difference and the reason for the same. While small finance banks are directly regulated by the central bank Reserve Bank of India (RBI), the asset quality is not as good as it is in public or even private sector banks. Such banks offer higher interest rate to attract more depositors so that their asset size grows. Moreover, their physical branches may not be easily available, while online banking may also not be so robust.

Don’t go beyond Rs 5 lakh

If one has to invest in a small finance bank, it is advisable one keeps the exposure limited to Rs 5 lakh. Remember deposits with scheduled banks (including small finance banks) come under the deposit insurance programme of DICGC (Deposit Insurance and Credit Guarantee Corporation).

It means deposits up to Rs 5 lakh are protected by the insurance. In case the small finance bank where you have put your money goes bust, the DICGC is liable to pay you up to Rs 5 lakh. Any deposit beyond Rs 5 lakh is not covered. Note that this is applicable for all FDs and savings accounts in a single name. If you have two FDs of Rs 7 lakh each, only Rs 5 lakh out of Rs 14 lakh will be insured. The Rs 5 lakh-limit also included the interest amount.

If you have a good amount of surplus money which you do not want to deploy in equities or debt funds, you may diversify it in a small finance bank keeping your exposure limited to Rs 5 lakh.