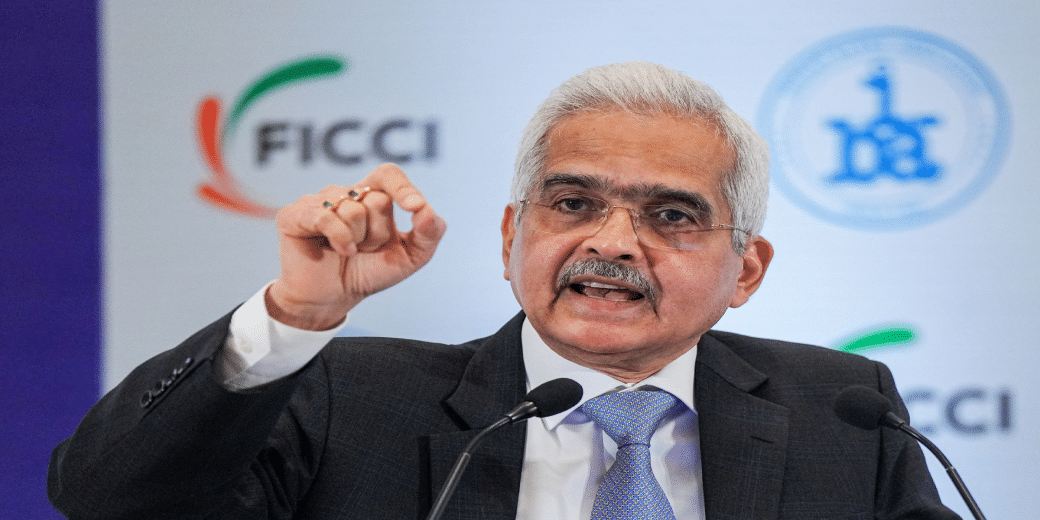

Steps on bank loans calibrated and targeted: RBI guv

"We have recently announced a few macro prudential measures in the overall interest of sustainability. These measures are pre-emptive in nature, they are calibrated and targeted," Shaktikanta Das said, addressing the annual FIBAC event in New Delhi.

The Reserve Bank of India Governor Shaktikanta Das on Wednesday said the central bank’s tougher stance on unsecured loans earlier this month is a “preemptive” move in the interest of sustainability.

Underlining that the banking system continues to be resilient and there is no immediate cause of worry for the system, Das advised lenders to be more cautious and spot any trend of risk building early.

“We have recently announced a few macro prudential measures in the overall interest of sustainability. These measures are pre-emptive in nature, they are calibrated and targeted,” Das said, addressing the annual FIBAC event here.

Speaking to reporters after delivering the speech at the event organised by industry lobby groupings Ficci and IBA, Das said it is very early to speak about a sunset date for the newly introduced norms.

It can be noted that after asking lenders to be cautious, the Reserve Bank had increased risk weights on unsecured lending for both banks and non-banks earlier this month.

More capital will have to be devoted for such riskier loans by a lender which will result in higher buffers in case of any stress, and the move will also make personal loans and credit card borrowings dearer for an individual.

Das said the RBI has left out loans taken for vehicle and home buying, and also lending to small businesses because of the benefit to growth that such segments portend, and also added that the central bank does not see a possibility of stress building up in such segments.

He asked lenders to strengthen their risk management practices and build additional buffers to face any situation if the business cycle turns adverse, and added that RBI has significantly strengthened its regulation and supervision.

“While banks and NBFCs are showing good performance now, sustaining it requires concerted efforts. In good times like these, banks and NBFCs need to reflect and introspect as to where potential risks could possibly originate,” he said.

Das said lending entities will continue doing stress tests and in a departure from the past, also advised entities in the “real sector” to undertake similar efforts.

On the RBI’s part, the central bank is undertaking efforts like on-site and off-site inspections, stress testing, vulnerability assessments, thematic studies and data-dump analysis, Das said, adding that these initiatives are being undertaken as part of its efforts to be proactive and forward looking in supervisory approach.

At a time when the system is reporting robust credit growth, Das asked lenders to avoid any form of “exuberance” in its business and to ensure that sectoral and sub-sectoral exposures are “sustainable”.

Banks and NBFCs also need to further strengthen their asset liability management, Das said, pointing out that the troubles in the US began because of an assumption that rates will be low for “eternity”, which was completely wrong.

Making it clear that he is not blaming the US Fed which had to hike interest rates at a quick pace because of the troubles on the inflation front, Das said, there has not been any such adverse impact of RBI’s policies courtesy the calibrated approach which comes from having seen multiple cycles.

He also asked lenders to not solely rely on algorithms for lending calls, and asked for routine upgrades in the algorithms which have helped make lending easier.

Stressing that the NBFC sector is a big borrower from the banking system and there is a deep interconnectedness between the two, Das asked banks to “constantly evaluate” exposure to NBFCs and the exposure of individual NBFCs to multiple banks.

Warning that concentrated linkages may create a contagion risk, Das asked the non-bank lenders to focus on broad basing their funding sources and reducing over dependence on bank funding.

In a message to both financial sector firms and India Inc, he said, “We are living in highly uncertain times in an interconnected world. New risks are emerging from time to time, new sources of risk are also coming up in such a scenario. Building further on resilience would be the best insurance against shocks and uncertainties.” Das told reporters that the regulator is not against the use of technology by any lenders, but said that its job is limited to forewarning about potential risks as it sees them.

He also said that the higher risk weights will be applicable for NBFC-microfinance institutions (NBFC-MFI) segment as well.

Meanwhile, when asked about attrition at banks, Das said the RBI is not interested in micromanagement and will leave it to the bank management to deal with the issue appropriately.

(With input from agencies)