Banks go slow settlement with wilful defaulters

The intention of the banks is to prepare a thorough and fool-proof framework for such deals that might be later taken to courts and scrutinised for acts of commission and omission

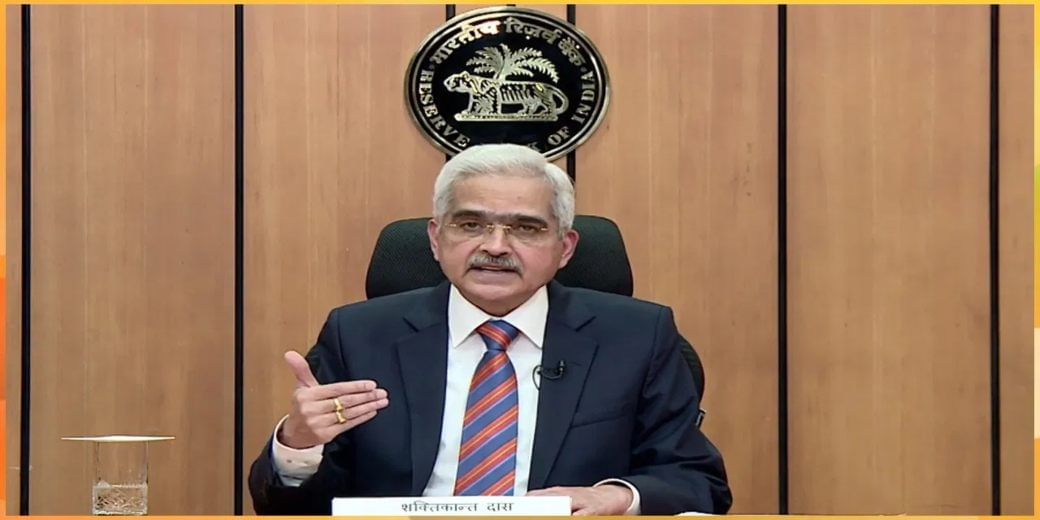

Banks want to defer by six months the implementation of a Reserve Bank of India direction on negotiated settlement of accounts that are marked fraud or relate to wilful default, The Economic Times has reported. Though the central bank issued the circular instructing transparent but quick settlement of such accounts and realisation of locked up assets, banks want to go slow on the proposal. These would typically be one-time settlements.

The intention of the banks is to prepare a thorough and fool-proof framework for such deals that might be later taken to courts and scrutinised for acts of commission and omission.

The RBI circular “Framework for Compromise Settlements and Technical Write-offs” dated June 8 raised quite a few eyebrows. However, on June 20, the central bank issued a clarification that it did not ask banks to strike compromise settlements with debtors who were categorised as fraud or wilful defaulters.

Banks had written back to RBI seeking clarifications. Realising the sensitivity of the matter, banks had also approached the finance ministry for opinions.

Protection to officers

One of the main concerns expressed by the banks is the safety of their officials if they enter such settlements with debtors (frauds and/or wilful defaulters) whose intentions are held suspect.

“There are some issues that need to be addressed. If banks go ahead with a one-time settlement (OTS) agreement, specifically in cases of wilful default, will they have the same level of protection as is available in cases resolved under the Insolvency and Bankruptcy Code?” a government official, who is aware of the developments in this matter, told the newspaper.

It is clear that bank officials are apprehensive about being investigated by vigilance and investigative agencies if questions are raised on such settlements later. They want express assurances from the central bank on this potentially troublesome matter. The banks expressed their concern immediately after the circular was issued and it is clear their concerns have not been addressed so far.

Empowering staff

On its part, the RBI had said on June 20 that the provision that empowered banks to strike compromise settlements with fraud or wilful defaulters was not new but had been in effect for the past 15 years. It also emphasised that the objective was to empower the lender to quickly realise the assets. “Apart from the time value loss, inordinate delays result in asset value deterioration, which hampers ultimate recoveries,” said the explainer from the banking regulator.

Apart from one-time settlements, RBI had also said that banks could accommodate such defaulters with fresh loans after a ‘cooling off’ period of a year after a compromise settlement has been reached.

In its communication on June 8 the central bank had said that boards of banks must be made a party to compromise settlements and technical write-offs. RBI also made it clear that the officials approving the settlements must be senior to those who sanctioned the loan in the first place.

Banks now also want to know whether the full board has to approve negotiated settlements or different sub-committees of the board can take on the responsibility.

“If that is the case, will it now be that all non-fraud OTS settlements, irrespective of the amount, need to get board approval, which previously were done at regional office level?” said a banker on conditions of anonymity.

Bank unions have opposed the new circular by the RBI arguing that it would, among other things, be a disincentive for borrowers who strive to make payments on time and according to rule.