Ethereum emerges from the shadows of Bitcoin

If Bitcoin is the face of cryptocurrencies, Ethereum is emerging as the engine that powers the next phase of growth

- Vikram Subburaj

- Last Updated : May 12, 2021, 15:20 IST

References to cryptocurrencies and Bitcoin have become synonymous in the last few years. Bitcoin has been carrying the baton of popularising the concept of blockchain-led cryptocurrencies and the potential they hold in disrupting global establishments. The growing adoption has also enabled it to become a quintessential crisis asset for safeguarding investments.

In this context, Ethereum, often touted as Bitcoin’s loyal lieutenant, has silently been finding momentum to grow into something bigger. Unlike Bitcoin, which is strictly used either as an asset or as a currency, Ethereum is a blockchain based platform with varied use cases. Multiple applications on blockchain are based on Ethereum’s network including prominent projects of DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens). This is made possible by the use of ‘smart contracts’ that are essentially programming on top of a blockchain. The analogy of a laptop (blockchain) having an operating system (Ethereum) on which apps (DeFi) are developed is apt.

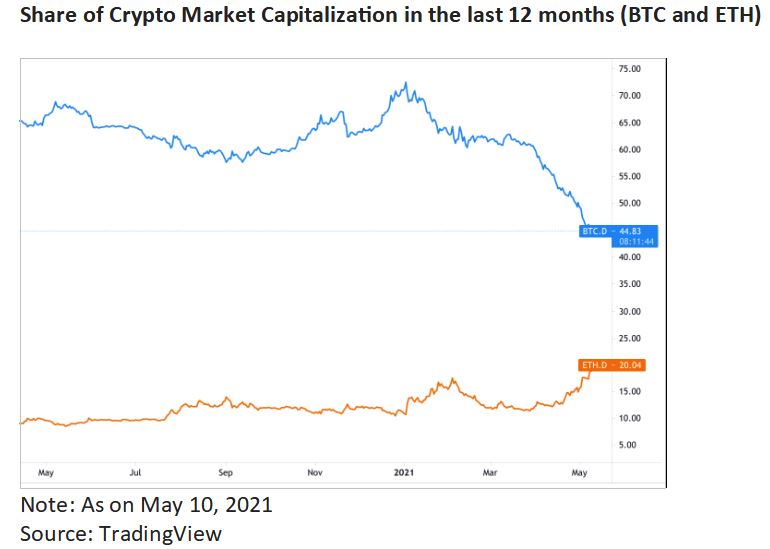

Given this context, the potential that Ethereum (ETH) holds is obvious. The price of ETH has grown multi-fold in 2021 (450%+) to ~$4,000 currently. The more impressive stat is that of market capitalization – in recent weeks, ETH has reduced Bitcoin’s (BTC) traditional dominance of 50% and is quickly catching up with the leader. For context, Ethereum’s current market cap of $450B was achieved by Bitcoin in December 2020.

Talks of a flip (ETH overtaking BTC’s market cap) are widespread in the crypto ecosystem in recent weeks. Such an monumental event will end the trend of altcoins (all coins except BTC) strictly following Bitcoin’s growth story. However, the path will not be straight forward. Gaining investors’ confidence to dethrone Bitcoin can only be achieved if Ethereum finds a way to deliver optimizations that improve day to day operations and drive away the threats.

Driving Optimisations

Ethereum has often been criticised for congestion on its network that support millions of transactions across applications – this eventually leads to higher fees for transactions on average. While Bitcoin can afford the slow ‘proof of work’ method of validating transactions, Ethereum needs to be lighter and quicker to achieve scale. Multiple network alternatives like Cardano have sprung up in recent years that address this specific pain point.

Ethereum is adapting to this new reality with the much anticipated ETH 2.0 network upgrade project that started in 2020. ETH 2.0 promises a migration to ‘proof of stake’ method that in turn will help scale transaction speeds and lower costs. Ethereum’s coin supply may also get reduced along with the planned upgrade. If successful, ETH 2.0 will lead to higher adoption of the Ethereum platform away from cheaper alternatives. Price hikes are definitely on the cards as adoption increases along with a reduction in coin supply. The project is expected to be completed by end of 2021.

Ethereum as an investment option

Given the possibilities, Ethereum has emerged as a strong number two asset for crypto investors. While Bitcoin continues to be preferred as a store of value, Ethereum can grow faster with the same stability. In India, we advise all investors to hold a majority share of their crypto investments in Bitcoin and Ethereum. If Bitcoin is the face of cryptocurrencies, Ethereum is emerging as the engine that powers the next phase of growth.

(The writer is CEO and co-founder, Giottus Cryptocurrency Exchange. Views expressed are personal)

Download Money9 App for the latest updates on Personal Finance.

Related

- Top 5 Bitcoin Myths Debunked: What Every Crypto Investor Needs to Know

- Crypto and NFTs Explained: How They Work and What Sets Them Apart

- What Is Blockchain and Why It’s Crucial for Cryptocurrency? Explained Simply

- Understanding Crypto Gas Fees: Why You Pay and How It’s Calculated

- Crypto Airdrops Explained: How Free Tokens Are Changing the Investment Game

- Binance finalises initial registration with FIU