Looking to invest in RD schemes? Check out what small finance banks are offering

There are 10 small finance banks in the country and they are offering returns between 7% and 8%

In these worrying times marked by job losses and reduced salaries everyone is scouting for investments options that would give returns a bit higher than the bank deposits. The search for higher returns can lead one to small finance banks that are offering a higher rate than public sector banks and private sector banks.

Investment planners often endorse recurring deposits for medium-term time frames.

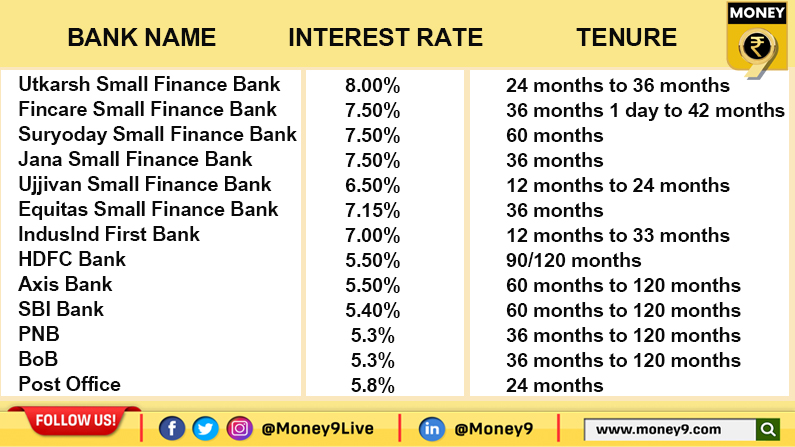

Let’s have a look at the rates being offered by these category of banks.

Utkarsh Small Finance Bank offers 8% interest rate in RD for tenures between 24 months and 36 months. Another bank Fincare Small Finance Bank gives 7.50% for a period of 36 months to 42 months.

Suryoday Small Finance Bank in 5-year term is giving its customers a rate of 7.50% in RD. Jana Small Finance Bank also offers 7.50% interest for a tenure of 36 months. Ujjivan Small Finance Bank gives a healthy 6.50% rate for 12-24 months.

Equitas Small Finance Bank gives 7.15% to its customers for a RD of 36 months.

Though not a small finance bank, IndusInd First Bank also gives 7.00% interest rate for a lock-in period of 12 months to 33 months.

On the other hand, large commercial banks are offering low RD interest rates.

HDFC Bank is giving 5.50% for a 90-month period. Axis Bank is also offering the same rate on RD for tenures between 5 years and 10 years. The returns of State Bank of India is 5.40% for terms between 5 years and 10 years.

The rate given by Punjab National Bank is 5.3% for 3-year to 10-year periods. The rate for Bank of Baroda is 5.3% for the same terms.

But the returns in post office is slightly higher at 5.8% for tenures of 24 months and above.

Tax on RD is deducted at source. This tax is levied at a rate of 10% only on the interest if the principal is more than Rs 40,000. If the principal is below Rs 40,000, no tax is chargeable.

A total of 10 small finance banks are operating in the country. These are AU Small Finance Bank, Equitas Small Finance Bank, Suryoday Small Finance Bank, Ujjivan Small Finance Bank, Utkarsh Small Finance Bank, Jana Small Finance Bank, North East Small Finance Bank, ESAF Small Finance Bank, Fincare Small Finance Bank and Capital Small Finance Bank.

The Reserve Bank of India has created the category of small finance banks in the last decade mainly to serve small business units, small and marginal farmers, micro and small industries and unorganised sector entities.

The first small finance bank to get the license from RBI was Capital Small Finance Bank. It got the license in April 2016.