UPI payments record highest growth at 185% in 2020-21

Digital payments in India grow faster as economy gets back on the growth curve but the pandemic refuses to relent

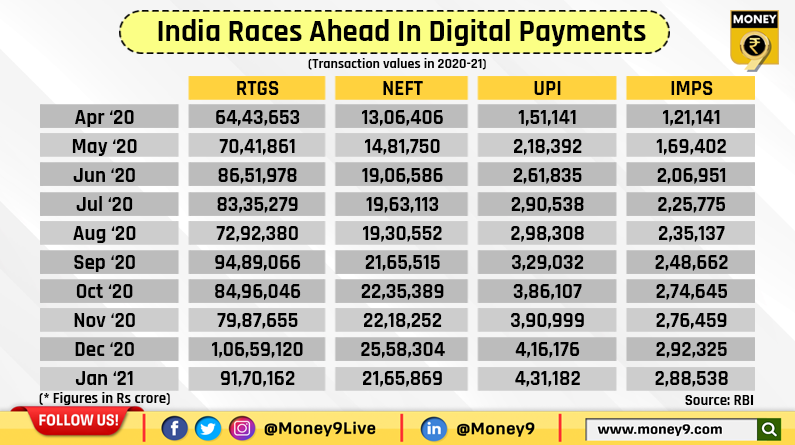

Digital payments in India are growing leaps and bounds, serving as a catalyst in the country’s economic revival. While there has been a sustained growth momentum in both wholesale and retail segments, Unified Payments Interface (UPI) payments have reported a massive 185% growth in last 10 months to Rs 4,31,182 crore in January 2021 from the beginning of the fiscal when the UPI payments pegged at Rs 1,51,141 crore in April 2020, according to the Reserve Bank of India (RBI).

UPI, developed by the National Payments Corporation of India (NPCI), works as a quick real-time payment system to instantly transfer funds between two bank accounts using a mobile platform. The UPI payment network has grown steadily month on month since the lockdown-induced deceleration.

There are at least a dozen apps that provide the UPI feature, including PhonePe, Paytm, BHIM app, MobiKwik, Google Tez, Chillr, Paytm Payments Bank, SBI Pay, iMobile and BOB UPI.

Market estimates predict that by 2025, digital payments in India could grow three-fold to over Rs7,000 trillion on account of the policies for ushering in financial inclusion and the rapid digitisation of merchants, said the Reserve Bank of India (RBI) in its February 2021 bulletin.

“Coursing through January 2021, wholesale transactions via the Real Time Gross Settlement (RTGS) system continued to post double digit growth of 14.1% (year-on-year) in volume, over and above 20.2% in December 2020. In the retail segment, the volume and value of transactions through the National Electronic Funds Transfer (NEFT) increased by 10.3% and 12.3%, respectively, on top of the high growth recorded in the preceding two months,” said the RBI bulletin, adding that estimates for February 2021 have indicated acceleration in growth for both RTGS and NEFT.

In January 2021, transactions through the Immediate Payment Service (IMPS) have recorded a massive growth in volume and value at 33.5% and 33.1%, respectively, on top of 38.7% and 38.6% growth registered in the previous month. According to RBI, UPI transaction volume accelerated to 76.5% in January 2021, a jump of 6 percentage points over December 2020, while value growth was steady at an impressive 99.4%.

The central bank believes that the recent transaction volume caps enforced on third-party app providers (TPAPs) on the UPI by the National Payments Corporation of India (NPCI) are likely to promote competition in this space. In November 2020, NPCI imposed a 30% volume-based cap on the share of transactions by TPAPs and payment service providers, effective from January 2021, primarily to address potential risks.

According to the RBI, there has been an uptick in bill payments through the Bharat Bill Payment System (BBPS), with a growth of 84% in volume (86.2% in December 2020) and 106% in value (97.9% in December). Run by NPCI, BBPS offers interoperable bill payment service to customers through a network of agents, enabling multiple payment modes, and providing instant confirmation of payment. The central bank said BBPS activity has been buoyed by increasing consumer affinity for digital modes and the swift response of billers by on-boarding on to the system.

As the digital transactions peaked, the RBI has also gone on war-footing with several regulatory actions.

In January 2021, it constituted a working group to study all aspects of mobile app-based digital lending activities among regulated as well as unregulated financial entities to ensure establishment of an appropriate regulatory approach that strikes a balance between financial innovation and consumer protection.

Subsequently, in February, it issued a ‘Master Direction on Digital Payment Security Controls’ laying down minimum standards for banks and card-issuing entities to ensure safety of digital transactions. The central bank has also operationalised its Payment Infrastructure Development Fund, effective from January 1, 2021, which is aimed at scaling up digital payment infrastructure in tier-III to tier-IV centres.

To ensure speedy grievance redressal, the RBI said it will set up a 24×7 digital payment helpline and roll out a `One Nation, One Ombudsman’ scheme to integrate the current three ombudsman facilities into one.

The major news from the innovation space is the commencement of the test phase of the first cohort of the Regulatory Sandbox with the theme ‘Retail Payments’ and announcement of the second cohort with the theme ‘cross-border payments’. Responding to the growing popularity of contactless payments during the pandemic, the RBI has also enhanced the limits for contactless card transactions and e-mandates for recurring transactions through cards (and UPI) from Rs5,000 from the earlier Rs2,000 starting from January 1, 2021.

It has also begun a long process to give licenses to private companies who will operate NPCI-like digital payment infrastructure, which will, in turn, be used by e-commerce companies, banks and others.