Petrol-diesel prices: 9 points of suffering

As the propensity to milk petrol and diesel for revenue grew, Indians had to pay a retail price that was a huge mark up compared to the price of crude

Earlier this week, Civil Aviation minister Jyotiraditya Scindia urged the states to reduce VAT on jet fuel to make life easier for the airlines, an embattled sector plagued by restriction during the pandemic. It provides an occasion to look at the larger picture of using petrol and diesel as the low hanging revenue fruits for the governments that have increasingly resorted to raising taxes — excise by the Centre and VAT by the states — to fund their expenditure.

If India has the dubious distinction of taxing petrol and diesel the most in the world, the reasons are not far to seek. A scrutiny of the retails prices of petrol and diesel down the years vis-à-vis the average crude price of the Indian basket would make it obvious.

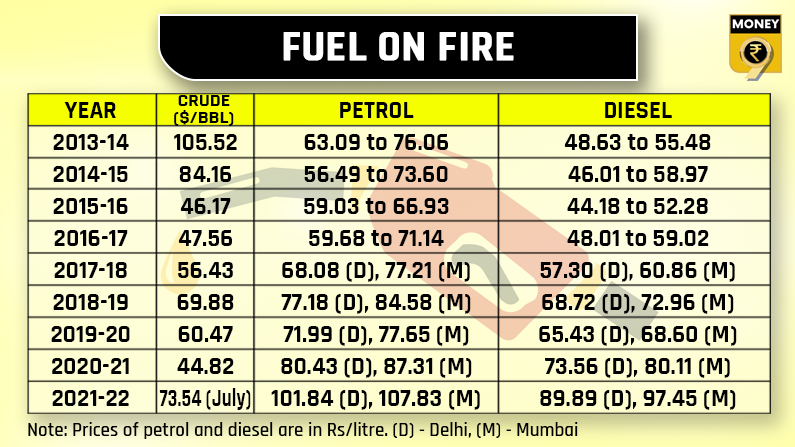

Money9 takes a look at the prices of crude and the retail prices of petrol and diesel over the past 9 years. Take a look.

Daily variation of retail price began from June 16, 2017. Prices on August 15 were considered for petrol and diesel in the past five years. The price of crude is the average price of the Indian basket of crude.

For the current year, the price of crude for July was considered.

From the above chart, it is clear that the retail price of both petro fuels have continuously risen despite huge fluctuations in the prices at which the country bought crude from the global market.

India imports nearly 80% of its crude oil requirements.

No revenue compromise

At least two agencies QuantEco and ICICI Securities have argued that there is room for excise reduction of up to Rs 8/litre. While QuantEco said it in the first week of July, ICICI Securities said in March that excise can be slashed by Rs 8.5 a litre.

“Assuming a moderate growth in petrol and diesel consumption in FY22 (post Q1 dip) as economy unlocks and mobility picks up, at current excise duty level we estimate gross excise collections at Rs 4.3 lakh crore in FY22 versus budget estimate of Rs 3.4 lakh crore (Rs 3.9 lakh crore in FY21),” QuantEco noted in its July report.

“We estimate excise duty on auto fuels in FY22 (April 2021 to March 2022), if it is not cut, at Rs 4.35 lakh crore versus budget estimate of Rs 3.2 lakh crore. Thus, even if excise duty is cut by Rs 8.5 per litre on or before April 1, 2021, FY22E budget estimate can be met,” ICICI Securities wrote in a note.

If under GST?

Economists at State Bank of India have said that if petrol and diesel are brought under GST, the former can retail at Rs 75 a litre while the latter can be sold at Rs 68 a litre. However, the reluctance to let go an easy source of revenue has prevented any state from suggesting to the GST Council in writing that the two auto fuels be brought under GST.

Policymakers are caught in a bind since the common people is facing all-round rise in prices due to the high taxes – more than 60% between the Centre and the states – on the one hand, and on the other, governments are raising resources to spend on different welfare schemes some of which have been adopted to provide relief from the pandemic.

Inflation impact

“A Rs 5 reduction in the excise duty of petrol and diesel would have a direct impact of about 8-10 basis points of softening on both CPI and WPI inflation, and equivalent amount of indirect or second order impact. Potentially a cumulative 15-20 basis points of moderation on both retail and wholesale inflation can be affected,” said Yuvika Singhal, economist at QuantEco.

According to figures submitted by former MoS finance Anurag Thakur in Lok Sabha earlier this year, in 2014-15, the government collected Rs 72,160 crore as taxes on petrol and diesel. In the first 10 months of 2020-21 (a Covid-hit year, when consumption was lower), the tax collected on these two items stood at Rs 2.94 lakh crore – a four-time rise compared to 2014-15 figure.

On July 5, Mamata Banerjee stated in a letter to Prime Minister Narendra Modi that the government collected Rs 371,725 crore in FY21 – a five-fold rise compared to the 2014-15 figure.

Download Money9 App for the latest updates on Personal Finance.

Related

- सरकार ने GST दरों में कमी के बाद पैकेजिंग नियमों को आसान बनाया

- GST दर सुधार पर परिषद की बैठक शुरू, तेदेपा का समर्थन, विपक्षी दलों ने राजस्व संरक्षण की मांग की

- एससीओ शिखर सम्मेलन में विकास बैंक की स्थापना को मंजूरी: चीनी विदेश मंत्री

- फिच रेटिंग्स ने भारत की साख को स्थिर परिदृश्य के साथ ‘बीबीबी’ पर रखा बरकरार

- कृषि, ग्रामीण श्रमिकों के लिए खुदरा मुद्रास्फीति जुलाई में घटकर 0.77 प्रतिशत एवं 1.01 प्रतिशत

- मंत्रिसमूह ने केंद्र के दो GST स्लैब के प्रस्ताव को स्वीकार किया