Petrol price today on 2nd August: Fuel prices remain static for 16th straight day in Delhi, Mumbai, Kolkata

According to Indian Oil Corporation, petrol prices in Delhi remained unchanged at Rs 101.84 per litre and diesel at Rs 89.87

Petrol prices remained stable for the 16th consecutive day while diesel held steady for 17 days in a row on Monday, August 2. Petrol prices had touched new high levels across the country on July 17 after rising by 30 paise.

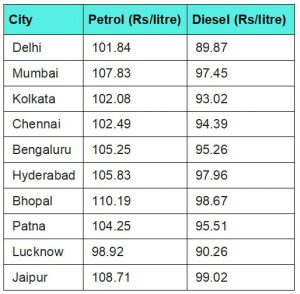

According to Indian Oil Corporation, petrol prices in Delhi remained unchanged at Rs 101.84 per litre and diesel is at Rs 89.87 per litre. In Mumbai, a litre of petrol and diesel will cost Rs 107.83 and Rs 97.45. Currently, fuel prices are highest in Mumbai among all metro cities.

The revision on 17 July had added up to Rs 11.15 for petrol and Rs 10.80 for diesel since May. The hike on July 17 was the 41st price hike in petrol since May 4 when fuel rates started increasing after the West Bengal elections. The prices were hiked 16 times in June and 9 times in July.

It has been predicted that petrol and diesel prices may go down this month as international oil prices are trading on the lower side. However, the constant hike in fuel rates across the country since May has burdened the common man.

Here is the list of fuel prices in top-10 cities

Fuel price above Rs 100 mark

Petrol prices have already crossed the Rs 100-mark in more than 20 states and union territories – Rajasthan, Madhya Pradesh, Maharashtra, Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, Jammu & Kashmir, Odisha, Manipur, Ladakh, Bihar, Punjab and others. Sri Ganganagar district of Rajasthan has the costliest petrol and diesel in the country with petrol selling at Rs 113.21 and diesel at 103.15 per litre.

Price changes due to these factors

In India, petrol and diesel prices depend on various factors like valuation of Indian Rupee(INR) against US Dollar(USD), consumption ratio of refineries and demand for fuel. The fuel prices are revised by oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum based on international crude prices and foreign exchange rates. Petrol and diesel prices get revised in India every day at 6 am.

Prices differ due to differences in taxes

Fuel prices differ from state to state depending on the incidence of local taxes such as VAT and freight charges. Central and state taxes make up for 60% of the retail selling price of petrol and over 54% of diesel. The union government levies Rs 32.90 per litre of excise duty on petrol. Rajasthan levies the highest value-added tax (VAT) on petrol in the country, followed by Madhya Pradesh.

Download Money9 App for the latest updates on Personal Finance.

Related

- सरकार ने GST दरों में कमी के बाद पैकेजिंग नियमों को आसान बनाया

- GST दर सुधार पर परिषद की बैठक शुरू, तेदेपा का समर्थन, विपक्षी दलों ने राजस्व संरक्षण की मांग की

- एससीओ शिखर सम्मेलन में विकास बैंक की स्थापना को मंजूरी: चीनी विदेश मंत्री

- फिच रेटिंग्स ने भारत की साख को स्थिर परिदृश्य के साथ ‘बीबीबी’ पर रखा बरकरार

- कृषि, ग्रामीण श्रमिकों के लिए खुदरा मुद्रास्फीति जुलाई में घटकर 0.77 प्रतिशत एवं 1.01 प्रतिशत

- मंत्रिसमूह ने केंद्र के दो GST स्लैब के प्रस्ताव को स्वीकार किया