Petrol price today on 3rd August: Fuel prices remain static for 17th straight day in Delhi, Mumbai, Kolkata

Petrol prices in Delhi remained unchanged at Rs 101.84 per litre and diesel is at Rs 89.87 per litre

Petrol prices remained stable for the 17th consecutive day while diesel held steady for 18 days in a row on Tuesday, August 3. Petrol prices had touched new high levels across the country on July 17 after rising by 30 paise.

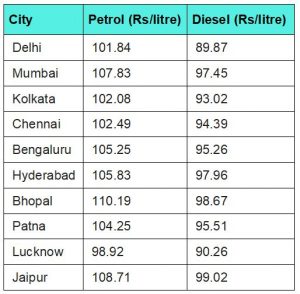

According to Indian Oil Corporation, petrol prices in Delhi remained unchanged at Rs 101.84 per litre and diesel is at Rs 89.87 per litre. In Mumbai, a litre of petrol and diesel will cost Rs 107.83 and Rs 97.45. Currently, fuel prices are highest in Mumbai among all metro cities.

The revision on 17 July had added up to Rs 11.15 for petrol and Rs 10.80 for diesel since May. The hike on July 17 was the 41st price hike in petrol since May 4 when fuel rates started increasing after the West Bengal elections. The prices were hiked 16 times in June and 9 times in July.

It has been predicted that petrol and diesel prices may go down this month as international oil prices are trading on the lower side. However, the constant hike in fuel rates across the country since May has burdened the common man.

Here is the list of fuel prices in top-10 cities

Fuel price above Rs 100 mark

Petrol prices have already crossed the Rs 100-mark in more than 20 states and union territories – Rajasthan, Madhya Pradesh, Maharashtra, Andhra Pradesh, Telangana, Karnataka, Tamil Nadu, Jammu & Kashmir, Odisha, Manipur, Ladakh, Bihar, Punjab and others. Sri Ganganagar district of Rajasthan has the costliest petrol and diesel in the country with petrol selling at Rs 113.21 and diesel at 103.15 per litre.

Price changes due to these factors

In India, petrol and diesel prices depend on various factors like valuation of Indian Rupee(INR) against US Dollar(USD), consumption ratio of refineries and demand for fuel. The fuel prices are revised by oil marketing companies like Indian Oil, Bharat Petroleum and Hindustan Petroleum based on international crude prices and foreign exchange rates. Petrol and diesel prices get revised in India every day at 6 am.

Prices differ due to differences in taxes

Fuel prices differ from state to state depending on the incidence of local taxes such as VAT and freight charges. Central and state taxes make up for 60% of the retail selling price of petrol and over 54% of diesel. The union government levies Rs 32.90 per litre of excise duty on petrol. Rajasthan levies the highest value-added tax (VAT) on petrol in the country, followed by Madhya Pradesh.