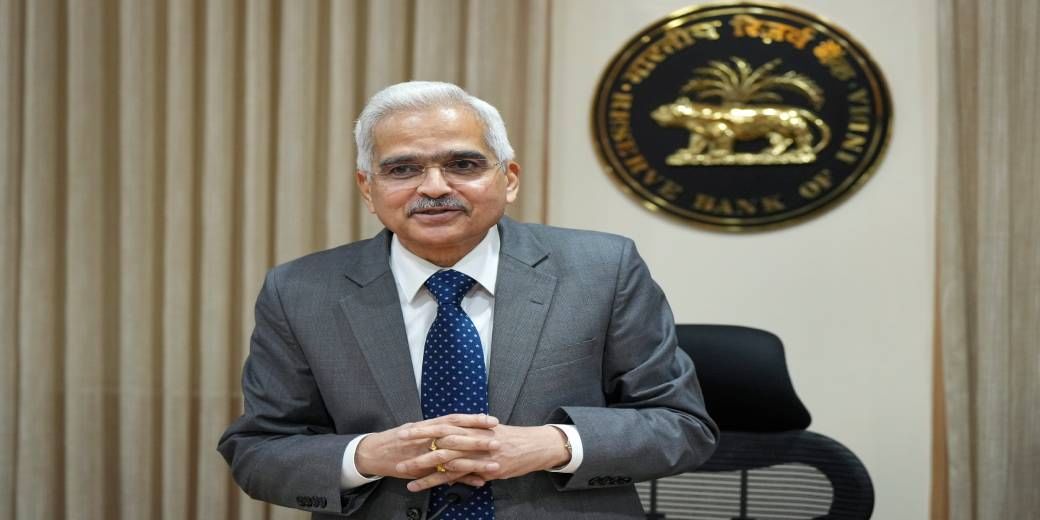

RBI guv lashes out at crypto assets at WEF in Davos

Das said that instruments that lack any underlying value pose big risks for emerging market economies

Within a week of the US market regulator Securities Exchange Commission giving a historic nod to the first cryptocurrency ETF, Reserve Bank of India governor Shaktikanta Das lashed out against cryptocurrencies at the World Economic Forum in Davos and cautioned that the apparent cryptocurrency “party” could be a step towards a danger zone for the emerging market economies.

Without mincing words, as he had been over the past few years on the topic of cryptocurrency, Das said that instruments that lack any underlying value pose big risks for emerging market economies. Only on January 10, in a landmark decision the capital market regulator of the largest economy in the world gave its nod to as many as 11 spot Bitcoin ETFs. The recognition immediately rang in cheer for the crypto assets and sent prices soaring.

“They (the US Securities and Exchange Commission) are the best judge of what is good for their country, so they have done it. I would not like to comment on what another regulator in another country has done. So far as India is concerned, we see a lot of risks and it is not necessary for us that what somebody else does, we simply adopt,” Das said at the event.

“I think some people are celebrating it as the party has just begun it began four-five years ago then it collapsed. Now, again the party has started but there are huge risks, particularly for emerging market economies. It has issues of money laundering, terror financing. There is no underlying (for cryptocurrencies).

Das has consistently and publicly aired his disapproval and criticism of crypto assets. He has even gone to the extent of arguing that it was a threat to monetary stability and could also turn out to be the source of the next major global financial crisis.

The RBI governor pointed out at the forum that India’s high GDP growth is sustainable since it originates from durable macroeconomic factors. But he was also quick to admit that food inflation which is proving to be rather volatile is the major headache of the institution.

“One area that is always on top of our agenda at the moment is the dynamics of food inflation, which is subject to global supply chain issues and also subject to unexpected weather events,” said Das.

The consumer price index-based inflation figures have displayed uncontrolled swings over the bigger part of 2023 which was largely attributed to volatility in food inflation. While the RBI is comfortable with a 4% inflation and has set it as a target, the value of the index in December 2023 is 5.69% a full 169 basis points above the central bank’s comfort level.

Das laid the blame for high vegetable prices in 2023 that drove retail inflation on the vagaries of weather. He also mentioned that they have to continuously respond to these supply challenges though they are completely out of the control of the monetary policy makers. Das also said that core inflation which is calculated by taking out food and petroleum prices from retail inflation was in a more comfortable territory.