From demonetisation to Covid and elections, these 29 stocks never disappointed investors

At least 29 stocks on the BSE have managed to deliver positive returns year after year since March 2016.

At least 29 stocks on the BSE have managed to deliver positive returns year after year since March 2016. Indian equity markets have witnessed high volatility in the past five years on the back of key economic changes – from demonetisation to GST, Covid-induced crisis and elections.

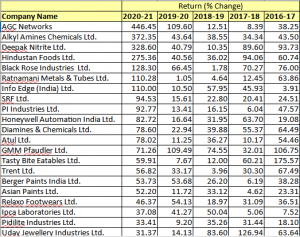

The list included players like AGC Networks, Alkyl Amines Chemicals, Deepak Nitrite and Hindustan Foods. Shares of AGC Networks gained 446% in FY21, 110% in FY20, 13% in FY19, 8% in FY18 and 38% in FY17. Likewise, Alkyl Amines Chemicals, Deepak Nitrite and Hindustan Foods advanced between 10%-372% during the past five financial years.

The BSE Sensex gained 68% in FY21, while it slipped 24% in FY20. The index advanced 17%, 11% and 17%, respectively,in FY19, FY18 and FY17, respectively. The BSE Smallcap index, while advanced 115% last fiscal, declined 36% and 12% in FY20 and FY19, respectively. It gained 18% and 37% in FY18 and FY17, respectively. Barring FY20 (down 32%) and FY19 (down 3%), the BSE Midcap advanced up to 90% the other three years.

Black Rose Industries, Ratnamani Metals, Info Edge, SRF, PI Industries, Honeywell Automation, Diamines & Chemicals, Atul Ltd, GMM Pfaudler, Tasty Bite Eatables, Trent, Berger Paints, Asian Paints, Relaxo Footwears, Ipca Labs, Pidilite Industries, Uday Jewellery, IGL, Nath Industries, Sanofi India, Whirlpool of India, Dabur India, Pfizer, HUL and Nestle India stood among other players which also delivered positive return year after year since the end of FY16. (See table).

Data source: Ace Equity, Money9

Commenting on the broader market, Gaurav Dua, SVP, Head-Capital Market Strategy, Sharekhan by BNP Paribas said, “Midcap companies could offer better returns in FY2022 and it would be more of stock pickers market now. Investors will have to carefully study and select individual companies as some of the midcaps benefit from the continued revival in the economy.” He likes Mahindra Lifesapces, Polycab, Kirloskar Oil Engines, Dalmia Bharat and Gland Pharma in the midcap and smallcap space. However, Dua prefers Mahindra & Mahindra, L&T, State Bank of India, HCL Tech and Ultratech in the largecap space.