RBI policy bodes well for economy, growth and employment: Analysts

RBI stance is aimed at giving a boost to consumption and economy, while also keeping a tab on inflation. The accommodative stance is likely to continue till the economy improves.

- Rahul Oberoi

- Last Updated : June 5, 2021, 09:08 IST

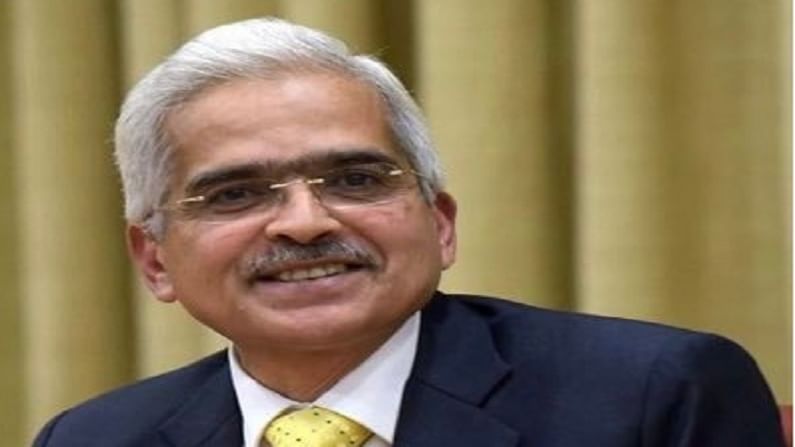

Market watchers believe that the announcements made by the RBI Governor Shaktikanta Das on Friday will support financial assets and the Indian economy amid the ongoing uncertainty over the Covid-19 pandemic.

While maintaining the status quo on interest rates, Das said Monetary Policy Committee (MPC) voted unanimously for keeping the interest rate unchanged and decided to continue with its accommodative stance as long as necessary to support growth and keep inflation within the target.

The RBI on June 4 left the repo rate unchanged at 4% as the economy faces the heat of the second Covid wave. This is the sixth time in a row that the MPC headed by Das has maintained the status quo. RBI had last revised its policy rate on May 22, 2020, in an off-policy cycle to perk up demand by cutting the interest rate to a historic low.

Here’s what experts have to say on the policy decision.

VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services

The announcement of G-SAP 2.0 to the tune of Rs 1.2 lakh crore will ensure adequate liquidity in the system. On tap liquidity window for contact intensive sectors is an unconventional measure to mitigate the sufferings of segments like hotels, restaurants, tourism, bus operators, beauty parlours, saloons etc. Upward revision of inflation rate will raise bond yields marginally in the short run.

Sandeep Bagla, CEO, TRUST Mutual Fund

The policy bodes well for financial assets as well as the real economy, growth and employment as RBI has again stated its resolve to maintain conducive conditions to support durable growth. The policy is pragmatic, at the same time progressive and pre-emptive in its approach.

Anuj Puri, Chairman, ANAROCK Property Consultants

Had it not been for the pandemic, the RBI would have definitely taken a different stance for the benchmark rates today. Considering the rate at which inflation is rising presently in the country, the RBI would have sought to increase the key rates. However, since the economy is still under pressure due to the pandemic and inflation is rising due to supply-side issues coupled with overall consumption sluggishness, it has maintained the status quo on benchmark rates.

This is the sixth time in a row that RBI has kept the benchmark rates unchanged, in a clear response to the exigencies of the Covid-19 pandemic uncertainties. It is certainly positive for home loan borrowers as the floating retail loan rates (which are directly linked to external benchmark repo rates) has been at the lowest level of the last two decades. The continuation of this low-interest rate regime works very well for all borrowers as the environment of high affordability is likely to continue for some more time.

Deepthi Mathew, Economist at Geojit Financial Services

The Governor cautioned about the factors that could put upward pressure on inflation. The announcement of G-SAP 2.0 at Rs 1.2 lakh crore for Q2FY22 shows RBI’s commitment to keeping the bond yields in check. The inclusion of SDL on G-SAP would support state government borrowings from the market.

Aurodeep Nandi, India economist and vice president, Nomura

Monetary policy hand-eye coordination is getting increasingly complicated, as the second wave is impacting growth comes at a time of rising inflationary pressures. The RBI’s policy actions today were largely on expected lines — keeping all three levers — rates, stance and forward guidance unchanged and dovish, while relying on G-SAP as a tool to deliver further accommodation and to prevent any premature tightening of financial conditions. For now, we expect the RBI to remain accommodative for the foreseeable future, and the timing of the RBI’s ‘policy pivot’ towards normalisation will remain crucially contingent on the economy’s ‘vaccine pivot’ towards sustainable growth recovery.

Shishir Baijal, chairman and managing director, Knight Frank India

The RBI has continued its growth supportive policy stance. Measures to enhance liquidity support to most vulnerable touch-sensitive sectors and small businesses and expanded credit exposure limit for resolution is a great move. As the nation attempts to recover from the second wave of pandemic, there is a dire need to provide monetary policy support – on account of both easy availability and lower cost of funds – to households and businesses alike. Besides the monetary policy intervention, as we come out of graded regional lockdowns and further resume economic activities, there is a greater need to provide adequate financial support to jump-start consumption demand. Demand stimulant measure like credit subsidy or tax waivers even for a limited period can play a transformative role until we reach the pre-Covid-19 normalcy thresholds.

Naveen Kulkarni, chief investment officer, Axis Securities

Support for stressed segments through the on-tap scheme for contact intensive sectors, expansion of resolution framework 2.0 by increasing limit of loans from Rs 25 crore to Rs 50 crore and special liquidity window to SIDBI will help smoothen out stress in the real economy, and this will be beneficial especially to the small borrowers and MSMEs. Maintaining the status quo on policy rates and accommodative stance was in line with street expectations. We believe the continuation of low-interest rates will boost demand in the housing sector and also help improve the overall consumption in the economy.

Shravan Shetty, MD, Primus Partners

The RBI has kept its stance of looking at durable growth and also provided support to the most impacted on-tap additional liquidity window for Rs 15,000 crore for contact-intensive sectors. Given the inflation is currently more supply-driven than demand, we believe RBI focus on growth is right.

Anirban Chakraborty, MD and CEO, TFCI

RBI’s step to mitigate the loss felt by the contact intensive sectors like tourism and hospitality industry, through a separate liquidity window of Rs 15,000 crore is a welcome measure. Further, decisions like additional Rs 16,000 crore special liquidity facility to SIBDI for further supporting MSMEs, broad-basing the Covid-19 related Resolution Framework and status quo on repo rate signals accommodative stand of the regulator.

Download Money9 App for the latest updates on Personal Finance.

Related

- KPMG को सेमीकंडक्टर इंडस्ट्री में तेजी की उम्मीद, जानें कौन से स्टॉक्स हैं सबसे आगे

- TCS-इंफोसिस समेत इन IT स्टॉक्स के आए टारगेट प्राइस, जेफरीज ने दी खरीदने की सलाह, 2025 में मिलेंगे अच्छे रिटर्न!

- इन म्यूचुअल फंड स्टॉक्स में भी है कमाई का मौका! ब्रोकरेज फर्म ने बोला 39 फीसदी तक मिलेगा रिटर्न

- Becoming a Crorepati, not a distant dream anymore!

- Markets getting ready for rush of IPOs

- SIP investments rising, so is SIP stoppage ratio!