SIS buyback offer can fetch 27% returns, should you opt for it?

The buyback offer is at 27% premium to the closing price of 17th February Rs 433/-.

Security facility management and cash logistics solutions provider Security Intelligence Services (SIS) Ltd has announced a Rs 100 crore share buyback programme.

The company had a very strong year for cash flows, generating over Rs 550 crore of operating cash flow during the first nine months of FY21 and this buyback is intended to reward shareholders who have supported SIS over the years, the company said in a statement.

About the offer

The company in an exchange filing on February 15, 2021, said that it would buyback 18,18,181 equity shares at Rs 550 per share. The shares being bought represents 1.24% cent of the total paid-up equity capital as of March 31, 2020.

The buyback will be done through the “tender offer” route and the promoters and members of the promoter group of the company will participate in the proposed buyback.

As of February 12, the promoter and promoter groups held 73.10% of the total equity capital followed by foreign institutional investors that held 14.43% stake and mutual funds that owned 6.57% stake. A total of 5.90% equity is held by others.

The arbitrage opportunity

The buyback offer is at 27% premium to the closing price of 17th February Rs 433/-. A retail investor can benefit from this arbitration as the share are trading at a discount of Rs 117/- to the buyback offer price.

As per Securities and Exchange Board of India norms, 15% of the offer is reserved for retail investors with holdings up to Rs 2 lakh in the company. Hence to qualify as a retail investor one can buy a maximum of 363 shares (2,00,000/550 = 363).

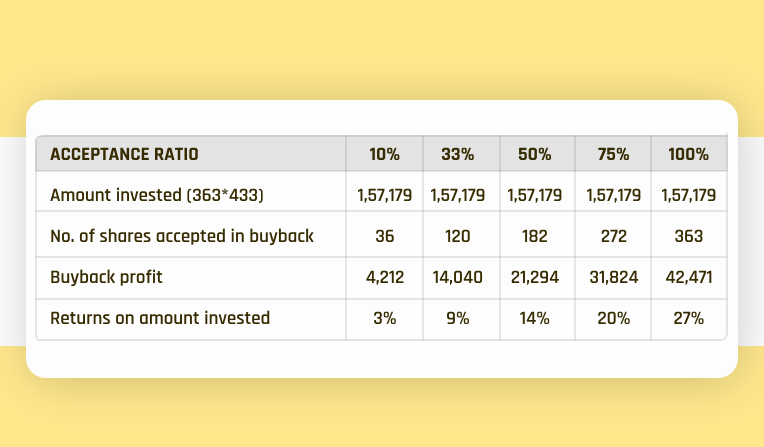

But the acceptance ratio will change your returns. Acceptance ratio is the number of shares accepted in a buyback offer as compared to the total number of shares tendered. The below matrix will help you better understand the returns under different acceptance ratios.

Market experts are of the opinion that retail investors can participate in the buyback offer as the acceptance ratio could be around 33%.

(Disclaimer: The above is for informational purpose only. Money9.com advises market participants to check with certified experts before taking any buy, sell or hold decisions.)