Top HNI money managers made big money in 2020 with these stocks; should you buy?

The sharp recovery on Dalal Street from March lows helped portfolio managers to deliver a healthy return to their high net worth investors (HNI) last year with some of them delivering as high as 62% return. Overall, the year gone by stood highly tumultuous for equity investors. Where Covid-19 hit the financial markets during the […]

The sharp recovery on Dalal Street from March lows helped portfolio managers to deliver a healthy return to their high net worth investors (HNI) last year with some of them delivering as high as 62% return.

Overall, the year gone by stood highly tumultuous for equity investors. Where Covid-19 hit the financial markets during the first quarter of the year, liquidity measures taken by the central banks and governments supported the market to hit a fresh record high by December.

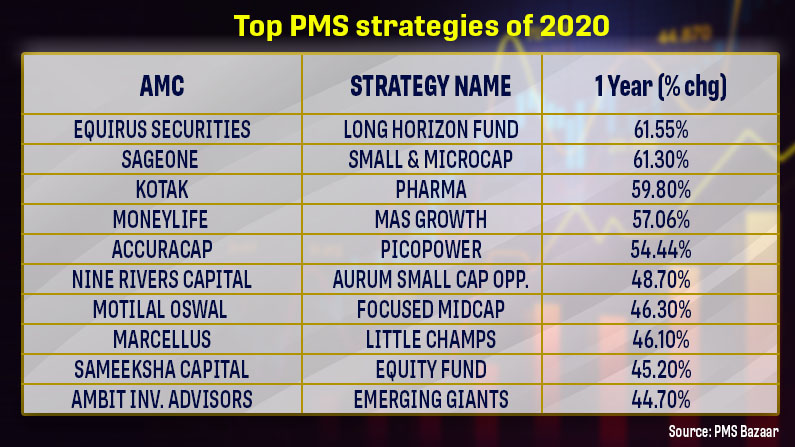

With a 61 per cent rally, Equirus Securities’ Long Horizon Fund emerged as top gainer of the year. On the other hand, the benchmark equity index BSE Sensex advanced 15.75% during the period and the broader BSE500 index advanced 16.80%. The BSE Midcap and Smallcap index gained 20% and 32%, respectively.

As of December 31, 2020, mid and smallcap players including APL Apollo Tubes, Manappuram Finance, Polycab India, Repco Home Finance and Garware Tech Fibres were among the major holdings of Equirus Securities’ Long Horizon Fund. The objective of the strategy is to invest in superior businesses with a view of a long-term view of 3-5 years.

Will mid and smallcaps continue to outperform in 2021? Axis Securities in its report said, “From a valuation perspective, the midcaps look attractive vs large caps. Historically, during the bull phase of 2017, midcaps were trading at 45% premium to large caps. The recent spate of IPOs and their success clearly indicates that the appetite for mid and small cap stocks.”

“Since November, small and midcaps are picking up steam and they should deliver solid returns in 2021 as economic uncertainties will reduce and volatility will decline. We believe volatility will decline significantly in 2021 which will lead to a small and mid cap rally,” the brokerage said.

Data collated by PMS aggregator PMS Bazaar also showed SageOne’s Small & Microcap gained 61.30% during the one-year period till December 31, while Kotak’s Pharma gained 59.80% and Moneylife’s MAS Growth strategy 57.06%.

Kotak’s Pharma had players like Sun Pharmaceutical Industries, Dr Reddy’s Labs, Cipla, Cadila Healthcare, Lupin, Aurobindo Pharma and Glaxosmithkline Pharma and Divi’s Lab as their major holdings as of December 31, according to PMS-AIF World. Top holdings of SageOne’s Small & Microcap and Moneylife’s MAS Growth strategy 57.06% were not available with the PMS data aggregator.

Commenting on the pharmaceutical sector, Anand Rathi Shares and Stock Brokers said, “We expect the momentum in acute product sales to continue as patient footfalls at hospitals and clinics are rising. Besides price hikes (5 per cent in December), launches and Covid’19-related products will add to growth.”

It further expects performances of MNCs such as Abbott and Pfizer to be robust. The domestic ranges of therapies of select domestic companies such as Torrent, Sun Pharmaceutical, Lupin and Ajanta Pharma are expected to outstrip the market in the near term.

Among other players, Nine Rivers Capital’s Aurum Small Cap Opportunities, Valcreate Investment Managers Life Sciences and Specialty Opportunities Strategy, Motilal Oswal’s Focussed Midcap, Marcellus’ Little Champs, Sameeksha Capital’s Equity Fund, Ambit Investment Advisors’ Emerging Giants, Centrum PMS’s Deep Value and Estee Advisors’ Long Alpha also gained between 44% and 50%.

Divi’s Laboratories, Abbott India, Sanofi India, Aarti Industries and GMM Pfaudler were among the top holdings of Valcreate Investment Managers Life Sciences and Speciality Opportunities.

On the other hand, Motilal Oswal Focused Midcap had stocks like Max Financial Services, Muthoot Finance, MAS Financial Services and Ajanta Pharma.

Other major performers including Centrum PMS’ Multibagger, Wize Market Analytics Capital Mind-Momentum Portfolio, Satco Capital Markets Growth & Momentum, Anand Rathi Impress PMS and Stallion Asset’s Core Fund also gained between 40% and 44% in 2020.