Value of retail investor holdings almost doubles in FY21 to Rs 13.6 lakh crore: RBI

The value of retail holdings in companies listed on NSE increased to 6.9% as of March-end in 2021 from 6.5% during the same period last year

- Harsh Chauhan

- Last Updated : May 28, 2021, 14:18 IST

Covid-19 induced lockdown forced people to stay in their homes which had a severe impact on the economy and livelihoods. Many Indians sitting in their homes decided to enter stock markets to supplement their lost income. This reflected in RBI’s annual report for the financial year 2020-21.

The direct participation of retail investors in equities witnessed an increase during the year, with the opening of 1.43 crore demat accounts during 2020-21, as against 50 lakh demat accounts opened during the previous year, stated RBI in its annual report.

“The most important is the relatively poor returns by other assets and lower interest rates on bank deposits. Many of the investors have come for the first time. This coupled with technological proliferation provided very easy access to the market to people seating at home during the pandemic,” Niteen Dharmawat, co-founder, Aurum Capital said.

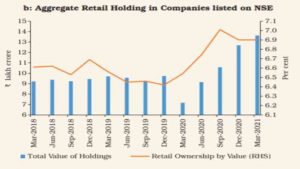

Besides the rise in demat accounts, the value of retail holdings in companies listed on NSE increased to 6.9% as of March-end in 2021 from 6.5% during the same period last year. In value terms, the retail holdings in NSE listed companies increased to Rs 13.6 lakh crore at the end of March 2021 as against Rs 7.2 lakh crore during the same period last year.

Resource mobilisation

Resource mobilisation through initial public offers (IPOs), follow-on public offers (FPOs), and rights issues increased by 43.1% to Rs 1.1 lakh crore during 2020-21 from Rs 76,965 crore in the previous year. Of these, Rs 46,060 crore were mobilised through 57 IPO/FPO issues, out of which 27 issues amounting to Rs 246 crore were listed on the small and medium enterprises (SME) platform of BSE and the NSE. Resource mobilisation through rights issues increased to Rs 64,059 crore during 2020-21 from Rs 55,642 crore in the previous year.

“One needs to know that any country which becomes more developed and has more companies growing, has more financial edge which leads to higher market cap. We are the only country in the world in the developing market space which has such kind of investor base of (6.9 crore), a growing number of companies, and market capitalization,” said Ashishkumar Chauhan, MD & CEO, Bombay Stock Exchange.

Is the bubble in stock markets rational?

India’s equity prices surged to record highs, with the benchmark index (Sensex) crossing the 50,000-mark on January 21, 2021, to touch a peak of 52,516 on February 16, 2021, which represents a 104% increase from the slump just before the beginning of the nationwide lockdown (i.e., since March 23, 2020) and a 68% increase over the year 2020-21. This order of asset price inflation in the context of the estimated 8% contraction in GDP in 2020-21 poses the risk of a bubble.

According to RBI’s analysis, the stock price index is mainly driven by money supply and FPI investments. Economic prospects also contribute to movement in the stock market, but the impact is relatively less compared to money supply and FPI. This assessment shows that liquidity injected to support economic recovery can lead to unintended consequences in the form of inflationary asset prices.

“Liquidity support cannot be expected to be unrestrained and indefinite and may require calibrated unwinding once the pandemic waves are flattened and the real economy is firmly on a recovery path,” explained RBI in its report.

Download Money9 App for the latest updates on Personal Finance.

Related

- KPMG को सेमीकंडक्टर इंडस्ट्री में तेजी की उम्मीद, जानें कौन से स्टॉक्स हैं सबसे आगे

- TCS-इंफोसिस समेत इन IT स्टॉक्स के आए टारगेट प्राइस, जेफरीज ने दी खरीदने की सलाह, 2025 में मिलेंगे अच्छे रिटर्न!

- इन म्यूचुअल फंड स्टॉक्स में भी है कमाई का मौका! ब्रोकरेज फर्म ने बोला 39 फीसदी तक मिलेगा रिटर्न

- Becoming a Crorepati, not a distant dream anymore!

- Markets getting ready for rush of IPOs

- SIP investments rising, so is SIP stoppage ratio!