All you need to know about P2P lending

To spread the risk of default, most platforms offer two options. One is that of a normal marketplace, where individuals can interact individually with the lender/borrower. The other is more similar to regular investing, where you put in a certain amount every month, which then goes to a common lending pool.

Last month, Gurugram-based Yumna Ahmad found herself looking for some good investment avenues to invest a surplus of Rs 20,000. Everybody gave her the safe choices- mutual funds, fixed deposits, stocks, but Ahmad was looking to diversify, even take some risks with this money, if it meant higher returns.

That is when she stumbled across P2P lending, an alternative investment route that has been getting increasingly popular over the last few years. So, she decided to go ahead with it.

What is P2P Lending?

Peer to peer lending, as the name suggests, is when two parties connect online and transact directly, without the need of an intermediary like banks. One of these is a lender, who has surplus funds to lend, and the other is a borrower, who is in need of money.

On the surface, it is a win-win situation for both. The lender usually earns about 10-12% annually on their loan amount, which is seen as an investment, while the borrower’s immediate fund requirement is also met. These loans can only be financed by an RBI-registered NBFC, like Faircent, Liquiloans, who often partner with more popular consumer-facing finance applications like Jupiter, PhonePe, Cred to disburse them.

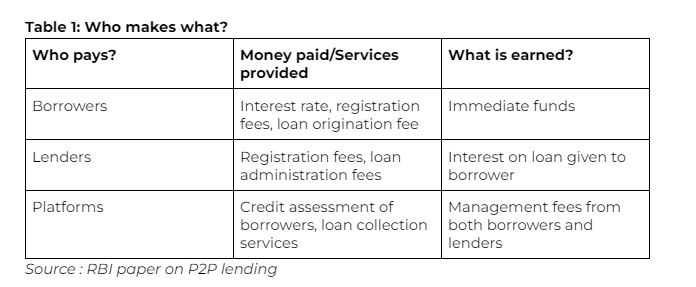

Here is a breakdown of all the costs incurred by the borrower and lender:

Who is borrowing?

P2P platforms come in handy for those who have weak credit scores, and hence, find all conventional loan routes closed for them. A recent report by LenDen Club noted that 87% of its borrowers were under the age of 40. On an average, they borrowed about Rs 75,000, mostly for medical emergencies. The need is genuine too, since the total monthly income does not exceed Rs 30,000. Only 6% of the borrowers had income above Rs 75,000.

Who is lending?

Surprisingly, the salaried class make up for 60% of all the lenders. More than 50% of the lenders on the platform are less than 40 years of age, and they like to bet big. About 48% of the lenders preferred to invest more than Rs 10 lakhs. Only a minuscule 15% were interested in lending up to Rs 2 lakhs.

How are these platforms run?

Per media reports, the overall AUM of this sector is not very high, standing at Rs 2,500-3,000 crores. What differentiates P2P lenders from regular banks is that they do not make any profits from the difference between the lending rate (earned from borrower) and interest rate (earned by lender). All their earnings come from bringing together and managing the borrower and lender on a singular platform.

To spread the risk of default, most platforms offer two options. One is that of a normal marketplace, where individuals can interact individually with the lender/borrower. This requires a higher starting amount.

The other is more similar to regular investing, where you put in a certain amount every month, which then goes to a common lending pool and is spread over multiple borrowers to reduce the risk of loan default by a single individual. An example of this is the 12% Club, which credits the investor’s account with 12% interest p.a.

Noida-based business analyst Gaurab invested Rs 1,000 in May, 23 to try out the application. Today, his investments stand at around Rs 1,069. The growth has not been staggering, but Gaurab remains optimistic.

What should you remember during P2P as investor

As per RBI guidelines, the duration of loans disbursed via these platforms should not exceed 36 months. But most of these sites clearly highlight that they are, in no way, guaranteeing the delivery of the returns endorsed on their website.

While these might be normal disclosures, the lack of a formal redressal mechanism in this space makes it difficult for lenders and borrowers to seek reprieve. At most, investors and lenders can ask for solutions via each platform’s internal dispute resolution methods, which often prove inadequate.

Sample this from the Liquiloans website :

Each lender should evaluate their risk appetite and understand all the risks associated with the lending transactions and that the P2P platform does not assure return of principal / payment of interest. The platform shall NOT be held liable for any loss of capital or returns.

However, for Nitesh Buddhadev, a finance professional himself, the process of investing via Liquiloans has been good. “Liqui loan offers up to 10% returns, and I feel it is the most conservative and reliable amongst all P2P models and great business model”, he notes.

As per RBI disclosures, you cannot invest more than Rs 50,00,000 across all P2P platforms, with the singular loan amount not going above Rs 50,000.

Says Viral Bhatt, co-founder, MoneyMantra, Mumbai-based PF advisory, “Investing in P2P lending platforms should never be your only or even the main investment . While you can allocate some percentage of your portfolio to this segment, depending on your risk profile, goals, and time horizon, a common rule of thumb is to invest no more than 10% of your portfolio in such alternative assets, including P2P lending”.

“This is generally considered a high-risk, high-reward investment, as you are lending to individuals or businesses that may not have a good credit history or collateral. Even though you can reduce your risk by choosing platforms that have strict screening criteria, offer protection schemes, or diversify your loans across multiple borrowers, there remains a high chance of you losing your funds”, he continues.

What should you remember in P2P investing as a borrower

Most platforms auto-debit the EMI amount from your linked bank account on a specified date (usually between 1-10 of every month). However, the penal charges, in case of a missed EMI installment are very high. Take a look at what some of these NBFCs charge in case you miss a payout.

More often than not, there are no options for any loan foreclosure. This is what irked Gaurab, who works in Cisco as a business analyst, when he tried to close his loan from CRED. Moreover, if your default continues, a case can be filed against you under Section 138 of the Negotiable Instruments Act, 1881

“While the entire process was smooth, I could not foreclose my loan in the month I had a surplus. Either I had to pay the mentioned amount, or pay back the entire loan amount at once. I could not change the amount I wanted to pay back on my will”, he notes.

Aparna Ramachandran, co-founder, Rectify Credit, India’s first credit advisory, vehemently advocates against taking loan from P2P platform, calling it a sign of poor financial health.

“Loans via P2P lending platforms are only availed by those who have bad credit scores, and hence, have been rejected by all other conventional loan givers. It is never a borrower’s first choice, and is often a last, desperate resort. The platform plays well into this by charging exorbitantly high interest rates, which can even change during the loan tenure. Additionally, the overhead charges, like administration, foreclosure etc that platforms levy can run into thousands, and are often non-negotiable”

“What’s important to remember is that even though these loans can help you ride a financial crisis, they leave you with a larger money battle. That is because you are stuck paying back a loan at unjust interest rates and undue costs. And despite being aware of it pinching your pocket, there is little you can do about it. For me, the writing on the wall is clear- Don’t ever borrow from P2P platforms”, she signs off.