Are direct plans losing their shine?

A 'Direct Plan' allows you to invest in mutual funds directly without involving or routing the investment through any distributor/agent

- Himali Patel

- Last Updated : July 31, 2023, 17:07 IST

Heading: Why are investors continuing to seek comfort in distributors when buying mutual funds?

Thumbs option: Are direct plans losing its shine? / Who should invest in regular plan and direct plan?

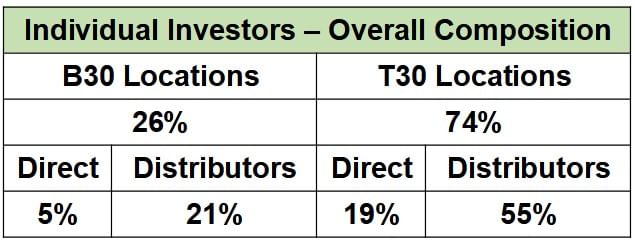

Consider this; 55% of retail investors’ assets, including those of high net-worth individuals (HNI’s), are from the top 30 cities (T30), brought in by distributors as of June 2023, according to data by AMFI. On the other hand, Direct investments account to 19% of individual assets in T30 cities.

Similarly, when it comes to beyond the top 30 cities (B30), 21% of the assets of individual investors are brought in by distributors, and a mere 5% of assets are from direct investment.

T30 refers to the top 30 geographical locations in India, and B30 refers to the locations beyond the top 30. The T30 cities include Mumbai, Delhi, Jaipur, Kolkata, and Chennai, among others.

Going by the above numbers, retail investor mutual fund investors are riding on strong backup from distributors.

Let’s understand what direct and regular plans in the mutual fund industry are and why distributors are still taking center stage when it comes to investing in mutual funds:

Which way to go, direct or regular?

A ‘Direct Plan’ allows you to invest in mutual funds directly without involving or routing the investment through any distributor/agent.

Whereas, under the ‘Regular Plan,’ one may opt to invest in mutual funds with the assistance of a Mutual Fund distributor/agent.

Why has there been growth in the Distributor industry in the mutual fund industry?

As per the AMFI, the total number of accounts (or folios) as on June 30, 2023, stood at 14.91 crore, while the number of folios under Equity, Hybrid, and Solution Oriented Schemes, wherein the maximum investment is from retail segment stood at about 11.91 crore.

Further, as per AMFI, the Assets Under Management (AUM) of the Indian Mutual Fund Industry, as on June 30, 2023, stood at Rs 44.39 trillion. The mentioned data indicates that the mutual fund industry in India has successfully attracted a growing number of retail investors.

Although the Securities and Exchange Board of India (Sebi) and the Association of Mutual Funds in India (AMFI) have implemented various categorisation and scheme rationalisation methods in recent years, with so many schemes debuting this year, selecting a scheme still remains a daunting task for the average investor.

As people become more informed about investment opportunities, they seek guidance from distributors to make well-informed decisions aligned with their financial goals.

Further, Sebi has introduced investor-friendly regulations and guidelines that ensure transparency, investor protection, and proper training for distributors.

“The Amfi data on the growth of distributors implies that distributor-driven assets still remain the key to the growth of the mutual fund industry. With the rise of technology and low cost, people seem to find distributors a convenient option where they get advice and guidance and do not pay high charges. Direct plans, while cheap, don’t help, support or guide in tough times and hence the lackluster growth in direct investment numbers,” said Shweta Jain, CFP, Founder of Investography.

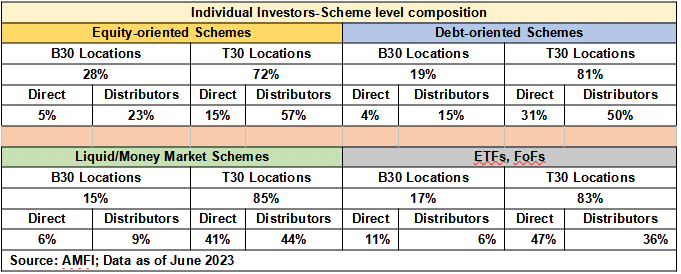

The below data table highlights that the share of distributors amongst various mutual fund categories, except ETFs, still remains high as compared to direct plans:

What should be the course of action for the investors?

The Direct Plan and Regular Plan are two options within the same mutual fund scheme with the same portfolio and fund manager. The main difference is the expense ratio, where Direct Plan carries a lower expense ratio compared to the Regular Plan.

This is due to the Direct Plan doesn’t involve any distributors or agents, saving on distribution costs and commissions. Consequently, the Direct Plan has a higher Net Asset Value (NAV) than the Regular Plan.

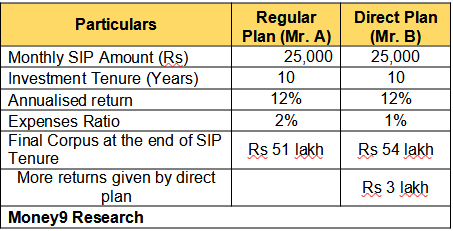

The TER difference between regular and direct plans might range from 0.5% to 2%. Below is the difference between regular and direct plans for some mutual fund schemes.

Let’s see how your SIP investment of Rs 25,000 a month can generate more returns than the regular plan over 10 years. Mr. A invested Rs 25,000 a month in SIP through a Regular plan for 10 years at an expected return of 12% and expense ratio of 2%. Whereas Mr. B invested Rs 25,000 a month in SIP through the Regular plan for 10 years at an expected return of 12% and expense ratio of 2%. Whereas Mr. B also invested Rs 25,000 a month in SIP through a Direct plan for 10 years at an expected return of 12% and an expense ratio of 1%. After 10 years, Mr. B with the Direct plan has earned more returns of Rs 3 lakh as compared to Mr. A with the Regular plan.

Conclusion Over time, the lower expense ratio in the Direct Plan leads to higher returns, benefiting long-term investors. However, investing in Direct Plans requires adequate knowledge and awareness of mutual funds, and it may only be suitable for experienced investors, who don’t need assistance of the distributors or financial advisors.

Download Money9 App for the latest updates on Personal Finance.

Related

- Top 25 Best Selling Cars in the US Q1 2025 Ford Leads Tesla Holds, and Sedans Make a Comeback

- Vegan vs Non-Vegetarian: Which Diet Is More Nutritious and Better for Your Health?

- होंडा ने हेडलाइट समस्या को ठीक करने के लिए वापस मंगवाई CB300R मोटरसाइकिलें

- RBI ने लगातार दूसरी बार रेपो दर में कटौती की, कर्ज होंगे सस्ते

- Tata Motors की वैश्विक थोक बिक्री चौथी तिमाही में 3% घटकर 366177 इकाई

- सुरक्षा मानदंडों को पूरा करने की बढ़ती लागत की वजह से दाम बढ़ा रही हैं कार कंपनियां