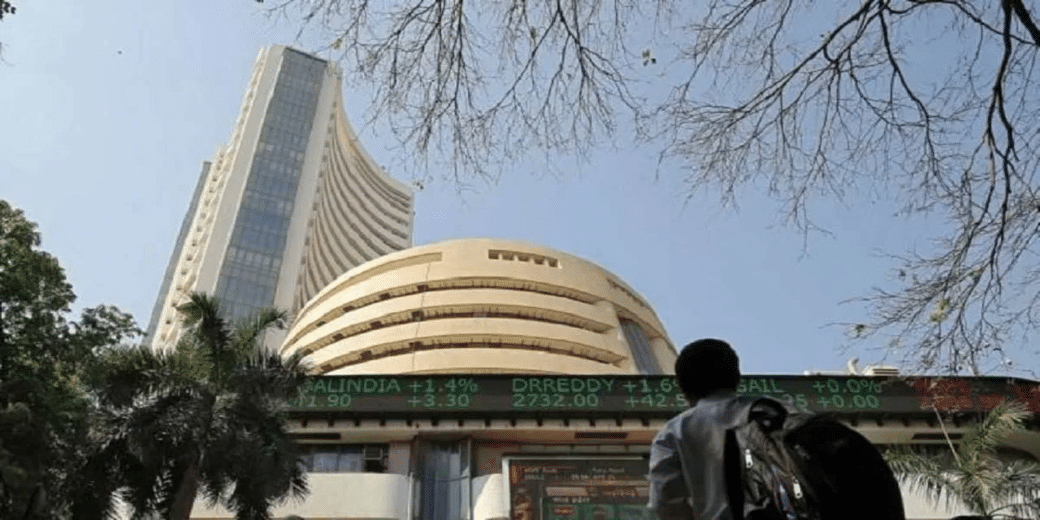

FPIs, DIIs, make rush to invest in India's growth in March

As of 3rd April, FPIs have bought shares worth Rs 1,908 crores, preceded by a massive investment of Rs 35,098 crores in equities last month

Domestic mutual funds are making a rushed beeline for the Indian stock markets, pumping in as much as Rs 45,120 crore into domestic stocks in March, 2024. This stood at Rs 30,285 crores four years ago, i.e. in March 2020. Notably, March witnessed 3x more buying as compared to previous month’s activity. FPIs closely followed suit, becoming net equity buyers in March, with purchases worth Rs 30,900 crores.

Overall, as per media reports, mutual funds have put in a staggering Rs 1.88 lakh crore in equities during 2023-24. In contrast, foreign portfolio investors (FPI) invested a total of Rs 2.08 lakh crore in Indian markets during FY24. The narrowing gap between investments made by domestic and foreign investors is an encouraging sign, seen as representing a retail investor’s increasing trust in India’s long-term growth.

The inflows witnessed last month are only preceded by the historic influx triggered by the pandemic in March 2020, when domestic MFs injected around Rs 30,300 crore in the markets. In all, domestic institutional investors (DIIs), which also include insurance firms and pension funds in addition to domestic mutual funds, have poured in a massive Rs 56,300 crore in Indian markets last month. This is only marginally higher than Rs 55,600 crore these DIIs had put in the markets in March 2020.

As of 3rd April, FPIs have bought shares worth Rs 1,908 crore, preceded by a massive investment of Rs 35,098 crore in equities last month. According to market experts, about 40% of all equity inflows recorded over the past two years have been in small and mid-cap funds.

Data suggests that mutual funds have made net equity purchases of about Rs 82,500 crore in this calendar year. One of the major reasons for this prevailing bullish sentiment is the rapidly rising investor awareness and inclination towards systematic investment plans (SIPs).

As per AMFI data for February 2024, SIP contributions marked an all-time high of Rs 19,186.58 crore, whereas the total number of SIP accounts stood at 8.20 crore. Even mutual fund folios registered in February 2024 stood at 17.42 crore.