Guaranteed pension not on radar, says PFRDA chief Deepak Mohanty

Mohanty noted that guarantees come at a cost, albeit with relatively lower returns. Staying invested in markets for the long-term is bound to deliver handsome returns.

The Pension Fund Regulatory and Development Authority (PFRDA) chairman Deepak Mohanty said introducing guaranteed pension is not on PFRDA’s radar. Mohanty, instead, advocates multiple options to be made available to citizens, so that they can consolidate their twilight year finances via one such single scheme, or through a combination of them all.

“Even though in absolute terms, our pension corpus is a sizable Rs 9.58 lakh crore, it only makes up about 3% of GDP. If we add up all our pension assets, including pension from APY, EPF and others, it does not cross 16% of GDP,” he noted.

This is when the global average in this regard, according to World Bank data, stands at 29.44%. In fact, some of the best pension systems in the world have assets equal to 90-100% of their GDP.

Mohanty noted that guarantees come at a cost, though with relatively lower returns. In contrast, “NPS currently offers solid yield, with its 1-year returns nearing 12.57%. Any guarantee is sure to bring this down. And in a way, if a subscriber rides out the market cycles and stays invested in NPS for the long haul, substantial returns are guaranteed”, he notes. He, however, said, this will have no bearing on the minimum assured returns scheme, which is in the pipeline and consultations are nearing a decision.

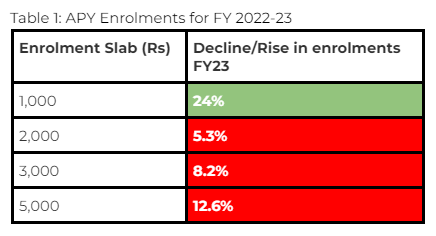

Additionally, the requisite capital needed to furnish guarantee would have to come from PFRDA, not the government, like it is with APY. The chairman highlighted the gender balance amongst Atal pension scheme subscribers, as opposed to what is observed in NPS. Recent figures suggest that enrolments in APY have been majorly driven by uptakes in the lowest slab i.e. Rs 1,000. Moreover, these were prompted by workers in the informal sector, mostly aged 21-30.

Acknowledging the serious lack of pension literacy in India, Mohanty noted how the current NPS system is maturing. However, making it mandatory would not be possible, given the employment structure in India, where 90% people work in the unorganized, informal sector, with no stable, steady source of income.