I-T notices sent to 1 lakh for income mismatch

Notices have been sent to over 1 lakh tax assessees for income mismatch and with income over Rs 50 lakh

The income tax department has sent about 1 lakh notices to taxpayers for mismatch in the disclosed income. The department will complete the assessment by March 2024. The tax department has sent about 1 lakh notices to individuals with income above Rs 50 lakh for a mismatch in income disclosed in ITR versus information available with the department. Also, notices have been sent to non-filers of tax returns.

Under law, the department can reopen cases up to six years.

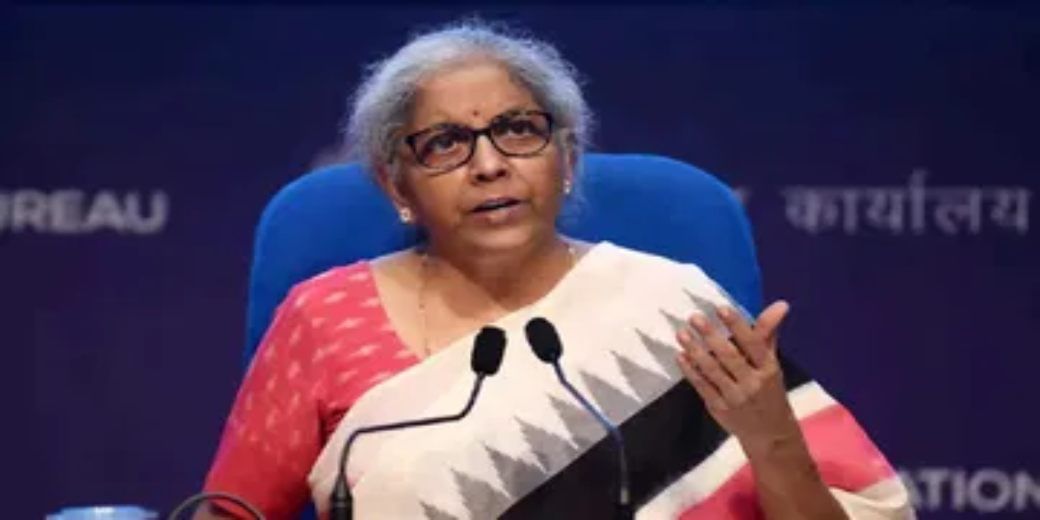

“Now no tax assessee will have to face reopening of tax assessment after six years. And in 4th, 5th and 6th year, they (tax officers) reopen the assessment only under certain situations,” finance minister Nirmala Sitharaman said at the 164th income tax day event.

“About 1 lakh notices have been issued and I’m being assured by the CBDT that by March 2024 that this entire 1 lakh (cases) will be cleared. That set of notices which have been issued based on the information that we had, for whose income was above Rs 50 lakh and certain other criteria… these assessments will be completed by March 2024,” the minister said. Sitharaman further said that the Central Board of Direct Taxes (CBDT) in May 2023 completed a scrutiny assessment of the 55,000 notices which they had sent pursuant to a Supreme Court judgement. “The board today is not sitting over notices which have been issued and ….it is not a place of discretion, it is not a place where people are gaming the system… there is a clear cut approach…,” Sitharaman added.

The Finance Minister said that the CBDT had completed the review work of 55,000 notices sent on the directions of the Supreme Court in May 2023. He said that despite not increasing the income tax rates, tax revenue is increasing due to the efficiency of the Income Tax Department. The government is trying to make taxation and its rates people friendly.

Over 4 crore ITRs filed

The Chairman of the Central Board of Direct Taxes (CBDT) said that for the financial year 2022-23, a total of more than 4 crore taxpayers have filed their income tax returns so far, of which half have been processed. Now before the last date, the rest of the taxpayers will also file their ITR. There has been an increase in taxpayers filing ITR year-on-year. If you also want to avoid the notice and penalty of the Income Tax Department, then file ITR by 31 July.

Download Money9 App for the latest updates on Personal Finance.

Related

- 80% of medical colleges not meeting minimum standards of regulator

- Delhi-NCR improves realty health, unsold stock down 57% in 5 years

- Govt gets a Rs 2.1 lakh cr cheque from RBI

- Vistara operations have stabilised: CEO

- Small savings rates left unchanged. Know the rates here.

- IRDA’s one-stop platform for all insurance activities