ICICI Prudential Mutual Fund Launches ICICI Prudential Energy Opportunities Fund. NFO Open July 2-16, 2024

With the ongoing transition towards renewable energy and the government's focus on achieving net-zero emissions, the energy theme offers significant growth potential

Mumbai: ICICI Prudential Mutual Fund has annouced the launch of ICICI Prudential Energy Opportunities Fund, an open-ended equity scheme that will predominantly invest in the energy theme. This scheme aims to generate long-term capital appreciation by investing predominantly in equity and equity-related instruments of companies engaged in or benefiting from the growth in traditional and new energy industries/sectors, as well as allied businesses.

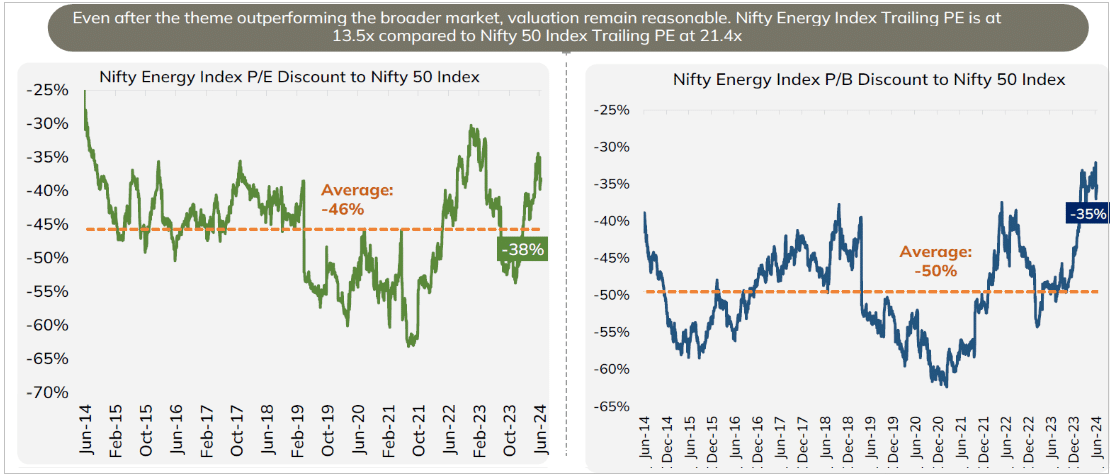

Speaking at the launch, ED & CIO of ICICI Prudential AMC and the fund manager of the offering, Sankaran Naren, observed, “Energy is the cornerstone of industrial growth and economic development. With the ongoing transition towards renewable energy and the government’s focus on achieving net-zero emissions, the energy theme offers significant growth potential. Through this scheme, investors can gain access to a diversified portfolio of companies across the energy value chain.” Adding further on valuations and recent performance, he says, “Although Nifty Energy Index has outperformed the broader market recently, the valuations remain reasonable, and investors may consider this scheme from a long-term perspective.”

Data as on June 14, 2024. Source: NSE. P/E: Price to Earnings, P/B: Price to Book Value

The scheme will be managed by Sankaran Naren and Nitya Mishra, and the benchmark for the scheme will be Nifty Energy TRI. ICICI Prudential Mutual Fund has one of the largest and most experienced investment teams in India. The fund managers are supported by a capable research team guided by sound investment process and risk management practices.

Why Energy Theme

India’s structural growth story is robust, with energy playing a major role in achieving growth targets. Energy demand is expected to rise over the next decade, driven by factors like climate change, premiumisation, a focus on manufacturing, and increasing per capita income. Numerous companies are involved in the energy value chain, offering opportunities for a diversified portfolio. This decade-long theme favours long-term investments, making it suitable for investors with a long-term horizon to invest in the scheme.

Investment Universe of the Scheme*

1. Power Ancillaries – Energy EPC, Power T&D value, Heavy Electrical Equipment, Energy efficiency plays (manufacturing electrical equipment’s for production, transmission & distribution of energy)

2. Oil Value Chain – Upstream (Oil Exploration & Production), Integrated refining and marketing (Refineries & Marketing), Standalone refining (Refineries & Marketing), downstream petrochemicals (Chemicals & Petrochemicals companies) and base oil processors (companies engaging in activities such exploration, production, distribution, transportation and processing of traditional & new energy), lubricants, oil field services (Oil Equipment & Services)

3. Green Energy – Companies undergoing energy transition, Solar value chain, Wind power value chain, Hydrogen value chain, Battery value chain (companies making components of new energy), Bio energy value chain (companies involved bio energy value chain), alternate fuel (companies making components of new energy)

4. Gas Value Chain – Gas transmission (Gas Transmission/Marketing), LNG terminal (LPG/CNG/PNG/LNG Supplier), City gas distribution (LPG/CNG/PNG/LNG Supplier)

5. Power Value Chain – Coal producer (Coal), power generation, power transmission, power trading