Is it the right time to invest in Silver ETFs?

Diversifying your portfolio is essential, and there are several ways to do so. One way is to invest in silver exchange-traded funds

- Himali Patel

- Last Updated : May 29, 2024, 20:11 IST

A recent report on gold and sliver by Motilal Oswal Financial Services says silver could outperform gold over a longer period. As per the data, gold and silver have witnessed noteworthy year-to-date increases of 13% and 11%, respectively, from the last cycle of the new year that starts with the auspicious occasion of Akshaya Tritiya.

Does that mean it is time for Sliver ETFs to shine going forward? Diversifying your portfolio is essential, and there are several ways to do so. One way is to invest in silver exchange-traded funds (ETFs), passively managed funds that invest in physical silver.

What is Silver ETF?

Silver ETFs are tradeable on stock exchanges like any other security, providing exposure to silver prices. The fund manager must invest at least 95% of the fund’s assets in physical silver or in products like Exchange Traded Commodity Derivatives (ETCDs), which have silver as the underlying asset.

Investing in silver through a silver ETF can help you save on the cost of storage and insurance premiums on the physical silver. Silver ETFs are designed to produce returns that correlate with the price of silver domestically. However, according to SEBI rules, mutual fund houses must keep the tracking error for Silver ETFs within 2%.

Tracking error is critical to understand because it represents the deviation between the scheme’s returns and the benchmark. Silver ETFs are investments that seek to track the price of silver, as set by the London Bullion Market Association (LBMA).

According to Sebi rules, if the tracking error of a silver ETF exceeds 2%, the fund house must mention this on its portal. Mutual fund houses will purchase 30 kg silver bars of 99.9% purity based on LBMA standards.

“We think investing in silver ETFs will benefit investors. Both gold and silver provide a hedge against rising inflation and potential economic or market downturns. But silver is more tied to the economy due to its usage in heavy industry and high technology (like in solar-panel cells, smartphones, tablets & automobile electrical systems),” explains Satish Dondapati, ETF fund manager Kotak Mahindra Asset Management Company.

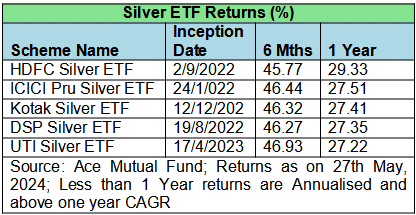

Returns

As per Ace Mutual Fund, the average one-year return delivered by sliver ETFs was 26.9% as of 27 May 2024.

Should you invest in Silver ETFs?

Silver ETFs are more suitable for experienced investors who understand how metals and commodities work.

Also, a long investment horizon is required in such an investment, as it will take time for the returns of new Sliver ETFs to eventually start showing results, as most of them are newly launched. “Given the current market scenario, the short-term outlook for silver is bullish mainly due to the expectation of Fed rate cut, weakening US dollar and upcoming inflation data, all these will give support to silver prices going forward,” says Satish Dondapati, ETF fund manager Kotak Mahindra Asset Management Company.

Download Money9 App for the latest updates on Personal Finance.

Related

- मैक्सिको के 50 फीसदी टैरिफ पर सरकार ने शुरू की बातचीत; जल्द समाधान की उम्मीद

- इंडो- US ट्रेड डील में पहले हट सकती है पेनाल्टी, रिपोर्ट में दावा

- रुपये ने फिर बनाया ऑल टाइम लो, जानें क्या है वजह

- बैंक कस्टमर के लिए बड़ी खबर, RBI हटाएगा ओवरलैप फीस,

- मैक्सिको ने अपनाई US जैसी पॉलिसी, 1400 से ज्यादा प्रोडक्ट लगाया भारी टैरिफ

- SpiceJet विंटर सीजन में जोड़ेगी 100 नई फ्लाइट्स! Indigo के कटे रूट्स का करेंगी भरपाई