Old loans, revolving credit haunt SBI Cards

The bank’s proportion of revolving creditors i.e. those who carry forward their pending balances instead of paying them off completely has been stagnant at 24% since 2022. The figure stood unmoved even in Q1 FY24 i.e. between January and March 2023.

- Ira Puranik

- Last Updated : August 2, 2023, 08:00 IST

Recent quarterly results of SBI Cards & Payment Services have thrown up worrying trends about India’s credit consumption patterns. India’s second largest credit card issuer saw a 51 bps Q-o-Q rise in its credit cost, from 6.3% to 6.8% between January and March this year. Overall, the credit cost rose 60% YoY, from 630 crores to 719 crores.

Correspondingly, it also saw a 31 bps quarterly decline in its ROA, from 5.4% to 5.1%. One of the reasons for worsening credit, as mentioned by SBI, is the high loan delinquency rates of a customer base acquired pre-pandemic in 2019, which were identified by the bank after significant delay. According to reports, this segment makes up about 16% of SBIs cards, and 20% of SBIs current NPAs. The bank noted that it has seen improved borrower quality from upcoming cohorts.

Unhealthy borrowers

The average amount spent per credit card in the retail category also inched up marginally from Rs 1,36,000 in the last quarter of FY2023, to Rs 1,37,000 in the first 3 months of this year.

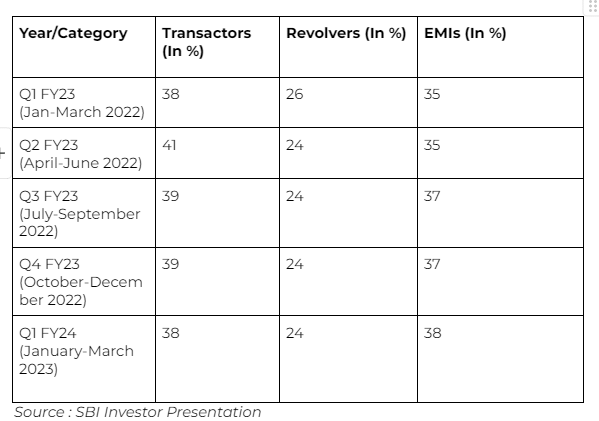

The bank’s proportion of revolving creditors i.e. those who carry forward their pending balances instead of paying them off completely has been stagnant at 24% since 2022. The figure stood unmoved even in Q1 FY24 i.e. between January and March 2023.

While 38% chose to settle their credit card bills in full to avoid additional penalties and interest, 38% spread their due amount over a longer period through EMIs (Equated Monthly Installments).

While these may mean some relief for the bank, it indicated that more people are being added to the EMI and revolver mix, as compared to transactor category.

These trends are partially reflective of India’s dangerously perched credit scene, given that SBI has captured about 19.2% of the entire market with about 1.68 crore active credit cards at present. It is next only to HDFC, which has a 20.4% market share, and about 1.78 crore active credit cards.

Stay away from revolving credit

Paying off minimum balances every month to keep credit card interest and penalties at bay is a bad idea. Says Pune-based personal finance advisor Nema Chhaya Buch, “When the credit card bill becomes due, settle the entire due amount. It is not advisable at all to make the minimum payment and then roll over the rest of the amount to the next billing cycle. Also, you should not take multiple credit cards in your name, since it reflects poorly on your credit score”, she signs off.

Download Money9 App for the latest updates on Personal Finance.

Related

- मैक्सिको के 50 फीसदी टैरिफ पर सरकार ने शुरू की बातचीत; जल्द समाधान की उम्मीद

- इंडो- US ट्रेड डील में पहले हट सकती है पेनाल्टी, रिपोर्ट में दावा

- रुपये ने फिर बनाया ऑल टाइम लो, जानें क्या है वजह

- बैंक कस्टमर के लिए बड़ी खबर, RBI हटाएगा ओवरलैप फीस,

- मैक्सिको ने अपनाई US जैसी पॉलिसी, 1400 से ज्यादा प्रोडक्ट लगाया भारी टैरिफ

- SpiceJet विंटर सीजन में जोड़ेगी 100 नई फ्लाइट्स! Indigo के कटे रूट्स का करेंगी भरपाई