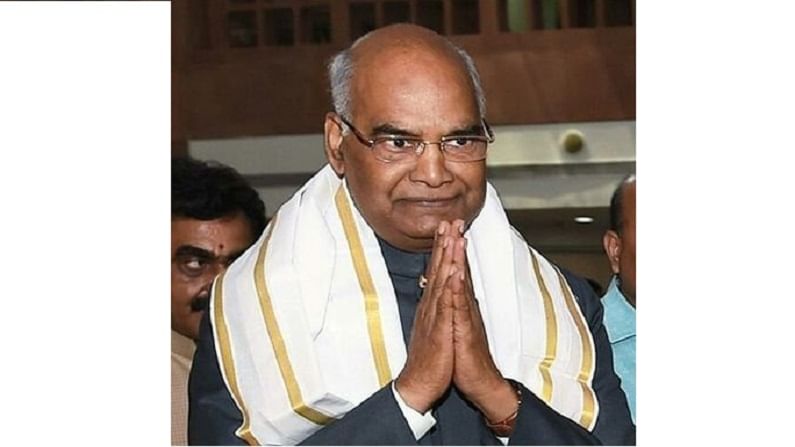

The math behind President Kovind’s tax outgo

The President's salary is charged from the Consolidated Fund of India, which is the kitty into which all tax and revenues of the government flow

- Ankur Sengupta

- Last Updated : June 29, 2021, 16:12 IST

In a programme in his native place, President Ram Nath Kovind said he does earn a healthy salary of Rs 5 lakh a month as President of India but he pays Rs 2.75 lakh as tax every month, and therefore, is not able to save much.

But why does the President pay 51% of his salary as tax is something he did not clarify.

“I have no idea how 51% income tax can be levied on anyone,” Narayan Jain, income tax lawyer, told Money9.

“Though Section 17 of IT Act 1961 has provisions of taxing perquisites, I don’t think they will add up to 51% in any situation. I am not aware of it,” said Arvind Agarwal, income tax consultant.

President’s salary

The President is the first citizen of the country and the commander-in-chief of its armed forces. The salary and emoluments are decided by the President’s (Emoluments and) Pensions Act, 1951 that was amended recently when the President’s salary was hiked to Rs 5 lakh from Rs 1.5 lakh in 2017.

The President’s salary is charged from the Consolidated Fund of India, which is the kitty into which all tax and revenues of the government flow.

In May 2020, during the first wave of the Covid pandemic, President Ram Nath Kovind decided to forego 30% of his salary for the whole year. That means his salary was Rs 3.5 lakh since May to December 2020.

However, it is not clear whether the voluntary cut still exists.

The tax math

According to the Income Tax Act 1961, a senior citizen (as the age of the President is around 75 years) whose annual income exceeds Rs 15 lakh has to pay 30% income tax along with 4% cess.

Both put together, the tax rate would come to 34%.

He has to pay Rs 20.4 lakh as IT, which turns out to be Rs 1.72 lakh in every month.

But President said he has to pay Rs 2.75 lakh every month.

If we consider the 30% pay cut, then the annual income of the president Kovind stands at Rs 3.5 lakh X 12 months = Rs 42 lakh a year.

So, 34% tax on Rs 42 lakh turns into Rs 14.28 lakh. Then the actual income would be Rs 27.7 lakh, which, in monthly term, stands at Rs 2.31 lakh.

If we consider the voluntary cut of 30% continuing and benchmark it with the original salary of Rs 5 lakh, the difference between the gross salary and the amount in hand would come to Rs 2.69 lakh. That is close to the Rs 2.75 lakh that the President mentioned, However, in that case the amount deducted is not due to tax alone.

In the October 2017, the Government of India decided to increase the salary of The President of India from Rs. 1.5 lakh /month to Rs 5 lakh / month.

In addition to the salary the president receives other allowances in which free medical treatment, housing and other perks are provided for life.

Neither the Income Tax Act nor the President Emoluments and Pension Act specifically exempt the salary of the President of India from taxation. Therefore, it appears that President does pay tax on his income.

However, the government of India spends around Rs 4 crore annually on other expenses such as the President’s accommodation, office staff, food, guest accommodation.

Retirement benefits

According to current rules, the President receives a monthly pension of Rs 1.5 lakh. A former President would be given a type-VIII rent-free furnished bungalow to live.

This is the biggest and best accommodation provided by the government of India to anyone apart from the incumbent President and prime minister.

A former President is also given two landlines and a mobile phone and the bills paid by the government. Five personal staff, including a private secretary, are also allotted.

Free electricity, water and first class train and air travel with one person for the rest of the lifetime are also provided.

Perks also include a free official car along with Rs 60,000 as staff expense per month. The President is also given 250 liters of free petrol a month. If a former President uses personal vehicles for travel instead of the one provided by the government, the Centre also pays the salary of the driver.

Download Money9 App for the latest updates on Personal Finance.

Related

- नॉर्मल ETF से कितने अलग हैं Smart Beta ETF?

- खुला है निप्पॉन इंडिया का रियल्टी और ऑटो सेक्टर का NFO, 28 नवंबर को होगा बंद

- अब कोचिंग सेंटर नहीं दे पाएंगे भ्रामक विज्ञापन, सरकार ने जारी की नई गाइडलाइन्स

- BOB Card से खरीदारी पर यहां मिल रहा बंपर डिस्काउंट, फ्रिज, टीवी, एसी पर 45,000 रुपये तक बचत

- EPF, ESIC और EPS में बड़े बदलाव की तैयारी में सरकार, बढ़ा सकती है बेसिक सैलरी लिमिट

- वेस्टर्न कैरियर्स के IPO में लगाने जा रहे हैं पैसे? यहां जान लें पूरी डिटेल