SGBs shine brightest in June. Should you invest?

June 2023 recorded gold purchase worth 7.769 tonnes, which far surpasses the average subscription of the 64 series before it, which stood at 1.72 tonnes.

It was a bright, bright month for sovereign gold bonds (SGBs), as Indians purchased a massive 7.769 tonnes at an issue price of Rs 5,926, amounting to Rs 4,604 crore for the first tranche of SGBs for 2023-24. The rush for the golden asset comes amidst both Nifty and Sensex touching record highs. While Nifty rose 4.87% over the last month, Sensex jumped 5.13% during the last 30 days.

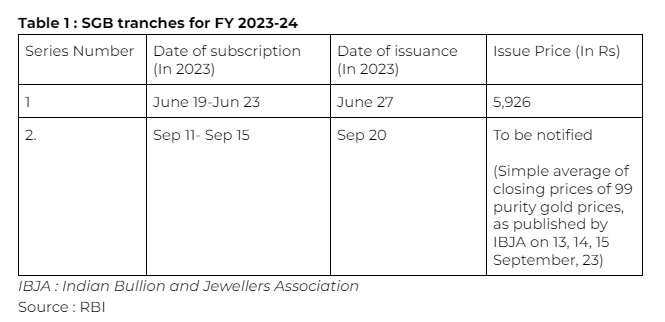

RBI announced the opening of the first series of SGBs for FY 2023-23 last month, while notifying that the second lot will open for public subscription in September, 2023.

Are SGBs worth your funds?

SGBs were launched in November 2015 as a digital alternative to gold, and over the last 7 years and 7 months, it has seen 64 series being made public. However, June 2023 recorded gold purchase worth 7.769 tonnes, which far surpasses the average subscription of these 64 series, which stood at 1.72 tonnes.

Says Pune-based financial planner and founder of Wishing Tree Fin (OPC) Pvt. Ltd, “If you are looking to diversify, then SGBs are a safe and worthy option in comparison to physical gold. Being a financial asset, it offers more liquidity with no storage costs and risks. Moreover, it pays 2.5% interest semi-annually, offering stable, safe returns. So, if diversification coupled with safety is of priority, then SGBs are good addition to your portfolio”.

Over the last year, gold, conventionally seen as a way to protect your funds from inflationary punches, has delivered 15.67% returns. And over a 5-year period too, gold has managed to earn 13.29% annual returns for its buyers.

Dip in premature redemptions as well

SGBs come with a 8-year tenure, with the option to make premature withdrawal only after 5 years. However, data highlights a consistent dip in early redemption of SGBs, indicating that more and more subscribers buy these bonds with a long-term horizon. This augurs well for them in turns of returns as well. Data suggests that SGB have delivered 13.7% returns (annualized), since they were launched in 2015.

SGBs are also available for trade in secondary markets, although their availability varies due to their limited liquidity. But, as SEBI RIA Jay Thacker notes, in instances where SGBs are available at a discount to market prices, their attractiveness as an investment option increases.

However, it is not as if these SGBs are not without their share of pitfalls. As Buch points out, “the buying price and maturity value are subject to gold price prevalent at that time. If gold price is at high while buying and at the time of maturity if the price is at low, then there is a risk of capital loss. Moreover, SGBs are not ideal for capital growth, given that they grow your funds at a rate which is lower than that of equities.

That is why Sanjeev Dawar, a financial planner advises not to go overboard while investing in SGB. “Around 10% of total corpus is recommended in precious metals including silver as a hedge against inflation”, he says.

Thacker calls SGBs an excellent way for portfolio diversification. “Investors seeking to diversify their portfolios and reduce reliance on market-linked investments find SGBs to be a comparatively safe and trusted asset class. Although the overall volumes of SGBs remain modest when compared to the organized and unorganized gold market in India, they present an attractive investment option. If global uncertainties in areas such as inflation, economic growth, and geopolitical crises persist, SGBs can anticipate significant inflows in upcoming tranches, including the one scheduled for September 2023”, he signs off.