Small-cap funds are in vogue. But should you jump on this bandwagon?

Small-cap mutual funds are lapping up funds, receiving massive inflows over the last 6 months. But there are not investment opportunities to deploy them effectively.

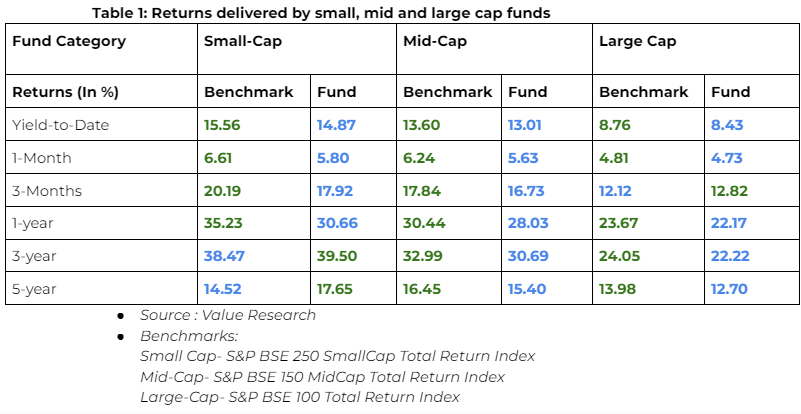

The S&P BSE SmallCap index touched an all-time high of 33,358.31 points today. Small caps are the current investor favorites, given that they have been delivering solid returns over both long and short periods. While this may explain the market’s positive sentiment towards them, is this the right market time to jump on the small-cap juggernaut?

Why the rush?

Notes Nema Chhaya Buch, founder of Pune-based Wishing Tree Fin (OPC) Pvt. Ltd, “Small caps are in vogue because with the market currently on the bull run, their valuations are surging and hence, offering attractive returns. This has led investors to believe that it will continue for some more time, and thus, are being aggressive in making the most out of this bull run”.

Small-cap mutual funds are lapping up funds, receiving massive inflows over the last 6 months. Says financial advisor Sanjeev Dawar, the allure of small-cap companies lies in their vast potential to deliver in terms of revenue, profits and growth, as they gradually transition to becoming a mid-cap and then, a large-cap company.

Moreover, despite the run-up in valuations, small-caps are still at a discount to large-cap stocks, highlights RIA Kanika Shah. “Small caps offer more flavors and investment themes as compared to large caps”.

AMCs turn gatekeepers

Despite this, throwing all caution and your hard-earned funds to the wind, simply on the promise of returns these funds offer would be foolhardy. Noticing a sharp spike in investors entering small-cap funds, many mutual funds houses are pausing new subscriptions.

The most recent example of this is the Nippon India Mutual Fund, which announced the barring of fresh subscriptions in the fund till further notice, today. However, it clarified in its statement that this will not affect existing SIPs, and also that SIPs and STPs (Systematic Investment/Transfer Plans) up to Rs 5 lakh/day per every PAN card will be allowed.

Last month, Tata Capital also suspended all lumpsum investments in its small-cap scheme. STP and SIPs are still allowed without any restrictions. SBI has already capped the maximum investment via SIP/STPs in its small-cap scheme at Rs 25,000/ month.

This is a sign that this space is extremely saturated, at least for now. As per SEBI RIA Jay Thacker, “fresh inflows in small-cap are exceeding the planned investments or the opportunity available in the small cap stocks space. Since too much liquidity is an issue in this space due to lack of quality stocks being available at attractive valuations, fund houses are halting fresh subscriptions”.

Time to add small-caps to your portfolio?

Only if you are looking at an investment horizon of at least 10 years, says Kaustubh Belapurkar, Director-Manager Research at Morningstar India.

“Small Cap funds can be great long term wealth creators, but they come with increased volatility in the short term. Thus, investors should not do away with the proper asset allocation while investing here”, he says.

Buch agrees, since small-caps are the first to rise when markets thrive, but also the first to fall when markets don’t perform well. “When the market is on the bull run, small caps would be the first to rise and show glamorous returns but when it enters the bear phase, at that time as well small caps would be the first to fall that too drastically. Hence they should determine their risk appetite before jumping on the thrill ride to take the advantage of market momentum”, she notes.

While some experts suggest up to 20% exposure in this space, strictly from a long-term view, Thacker advises against it.

“Small cap funds should not be a preferred investment option, even via SIP mode. At least, it shouldn’t be part of the core portfolio of retail investors as a dedicated fund option”, he signs off.

(Disclaimer: Stocks recommendations by experts or brokerages are their own and not those of the website or its management. Money9.com advises readers to check with certified experts before taking any investment decisions.)