SIPs still the favourites, rake in Rs 15k cr in July

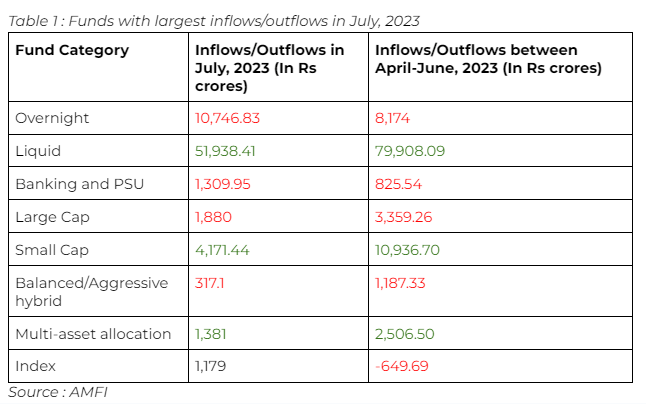

Passive funds, particularly Index funds made a stellar comeback after a red quarter. Index funds saw outflows worth Rs 905.74 crores in June 2023, but registered greens worth Rs 1,179 crores last month.

Equity mutual funds saw their inflows fall to Rs 7,625.96 crore in July. While June saw them rake in 8,637 crore, equity funds had raised about Rs 18,358.08 crore between April and June, 2023, according to AMFI data released on Wednesday. The star in this segment continued to be small-cap funds, which hauled up Rs 4,171.44 crore, despite many AMCs halting inflows in this segment since July.

However, large cap funds continued to bleed, with outflows of about Rs 1,880 crores in July. The situation was no better last quarter as well, when these funds saw exits worth Rs 3,359.26 crores.

On the other hand, debt funds managed to raise about Rs 61,440.08 crores in July, 2023. The biggest outflows in this segment, after overnight funds (Rs 10,746.83 crores) came from banking and PSU funds, which saw Rs 1,309.95 crores exiting the fund. Even categories such as credit risk (outflows worth Rs 166.33 crores), short (exits worth Rs 305.39 crores) and medium duration funds (outflux worth Rs 67.51 crores) failed to gather investor attention.

Says Himanshu Srivastava, Associate Director – Manager Research, Morningstar India, “Overnight fund category witnessed the highest net outflows through the month. This could be attributed to investors redeeming from these funds and investing in other, better performing assets such as equities. Investors normally tend to park their short term money in these funds and hence the flows in them tend to be volatile”.

On liquid funds receiving the highest inflows, Srivastava noted that often, “after the quarter end, many corporates and institutions choose to park their excess short term capital in these funds, which is a regular practice”.

SIPs continue to grow

Inflows via SIPs maintained a healthy momentum, receiving Rs 15,242.7 crores in July, 2023. The assets under management for SIPs also rose from Rs 7.93 lakh crores in June to Rs 8.32 lakh crores last month. The average AUM of the mutual fund industry also touched Rs 46.2 lakh crores, from about Rs 44.82 lakh crores in June, 2023.

Says Vikas Singhania, CEO, TradeSmart, “Investing needs to be inculcated as a habit. MF serves as a good platform for those who lack the know-how and the time required to do a proper analysis before investing. However, one needs to be careful at such elevated levels. It may not be a wise idea to put a lump sum money in equity or mutual funds in current markets. One can begin small, and spread the investment over months with SIPs.”

Passive funds, particularly Index funds made a stellar comeback after a red quarter. Index funds saw outflows worth Rs 905.74 crores in June 2023, but registered greens worth Rs 1,179 crores last month.

Gold ETFs, too, continue to attract flows, as they receive a net inflow of INR 456.15 crores. This is sharply higher than the net inflow of INR 70.32 cr in June. Notes Srivastava, “Pertinent risks still engulf developed economies. With continued hike in interest rate in the US, inflation still higher than expectation, and growth rate slowing down, the appeal of Gold as a safe haven and hedge against inflation is expected to continue. Moreover, Gold prices in recent times have come-off from its all-time high levels, thereby providing some buying opportunity”.