S&P BSE 500: An index for diversification and complete market participation

The index has a blend of large, mid and small-cap stocks, spread over an entire gamut of sectors and is representative of a large proportion of the overall market capitalization of Indian companies itself

- Chintan Haria

- Last Updated : March 17, 2024, 16:30 IST

When investing in equity markets, investing in specific pockets of the market is a challenging or confusing task, especially when the indices are at elevated levels. At such time, one sound option would be to consider looking at the entire market. And one of the easiest ways of taking exposure to a wide basket of stocks can be through an investment in the S&P BSE 500 index.

The index has a blend of large, mid and small-cap stocks, spread over an entire gamut of sectors and is representative of a large proportion of the overall market capitalization of Indian companies itself.

For investors, the ETF or index fund route is available for taking exposure to the S&P BSE 500 index.

Given below is a detailed account of the index’s composition, the many advantages of investing in it and the benchmark’s performance track record.

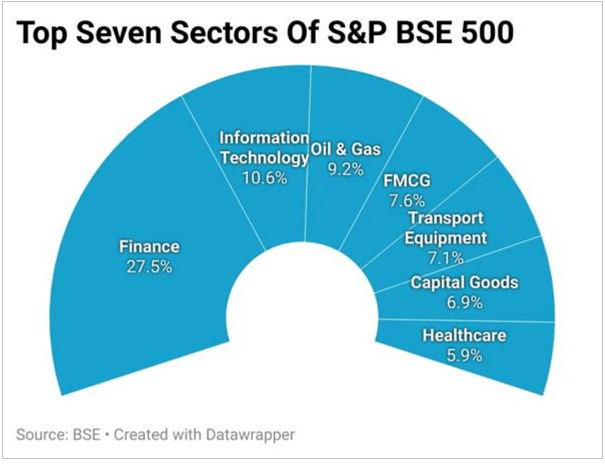

Gaining from the index: The S&P BSE 500 index has stocks of 500 listed companies with a total market capitalization of Rs 351 lakh crore (as of Feb 27, 2024). When the free-float market capitalization is taken the figure is Rs 160.3 lakh crore. As many as 22 sectors get represented in the S&P BSE 500. The index is rebalanced on a semi-annual basis.

Investing in the benchmark holds many positives for investors looking for passive exposure to the market.

Captures entire market movement: The entire market capitalization of all BSE-listed companies totals up to Rs 393 trillion. When we consider the S&P BSE 500 index, at Rs 351 trillion, it represents nearly 90 per cent of the market capitalization. Therefore, a single index helps you capture or reflect, almost completely, the trend of the overall market.

Large, mid and small caps in a single index: Given that the index has 500 companies, investors are able to gain exposure to 100 large cap, 150 midcap and 250 small cap stocks in various proportions. Thus, there is a multi-cap approach via a single index and a product, giving exposure to every market segment. Largecaps provide access to companies with stable cashflows and strong balance sheets, midcaps offer considerable growth potential and small caps provide scope for enormous expansion as well as access to emerging areas, niche industries etc.

Excellent diversification: As mentioned earlier, the 500 stocks would by themselves be a great source of diversification. An added factor is that these come from 22 different sectors, thus providing considerable balance to the portfolio. Given the wide gamut of companies, there would sectors that are cyclical in nature, some that are defensive, and others that are interest rate sensitive. A portfolio of 500 stocks would mean that when one set of sectors underperform, others would do well and help maintain reasonable portfolio balance.

Passive benefit: Investing in the S&P BSE 500 via the exchange traded fund (ETF) or index fund route would provide a low-cost option to gain exposure to a large bouquet of stocks with no fund manager risk. As a part of portfolio diversification, investments made over the long term of 7-10 years at least can be rewarding for investors.

Performance Record The returns from S&P BSE 500 TRI from multiple standpoints throws up a healthy performance record over the long term.

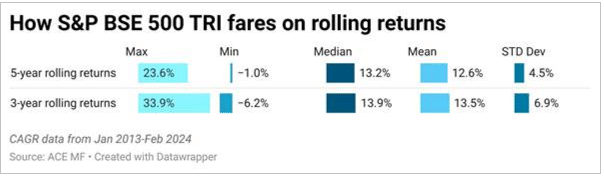

When 5-year rolling returns (daily NAV) over the period Jan 2013-Feb2024 are taken, the index has given mean return of 12.6%. The median return is healthier at 13.2%.

Taking 3-year rolling returns over the same period mentioned earlier, we get an average return of 13.5% and median return of 13.9%.

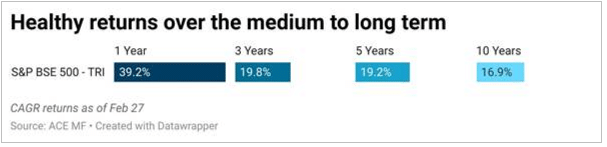

On a point-to-point basis, the S&P BSE 500 TRI has managed to consistently deliver 16-20% compounded annual returns over the medium to long term of 3-10 years.

Finally, taking the SIP (Systematic Investment Plan) route would also pay off. A 5-year monthly SIP in the index would have delivered an XIRR of 22.4% to investors. When a 10-year monthly SIP period is taken, the returns are at a healthy 16.7%.

Retail investors looking for passive diversification outside their active exposure to mutual funds can consider the S&P BSE 500 index for investments via the ETF or index fund route. However, investors must ascertain where the index fits in their portfolio by aligning it to their overall asset allocation pattern or core-satellite framework, after consulting their financial advisor.

The author is Principal-Investment Strategy, ICICI Prudential AMC. Views are personal.

Download Money9 App for the latest updates on Personal Finance.

Related

- Top 25 Best Selling Cars in the US Q1 2025 Ford Leads Tesla Holds, and Sedans Make a Comeback

- Vegan vs Non-Vegetarian: Which Diet Is More Nutritious and Better for Your Health?

- होंडा ने हेडलाइट समस्या को ठीक करने के लिए वापस मंगवाई CB300R मोटरसाइकिलें

- RBI ने लगातार दूसरी बार रेपो दर में कटौती की, कर्ज होंगे सस्ते

- Tata Motors की वैश्विक थोक बिक्री चौथी तिमाही में 3% घटकर 366177 इकाई

- सुरक्षा मानदंडों को पूरा करने की बढ़ती लागत की वजह से दाम बढ़ा रही हैं कार कंपनियां