Stock at Stake: HUL pulls the lever growth?

Focus on customer reviews and surveys to asses evolving consumer needs. It would allow company to asses how advertisement and premiumization has impacted price elasticity and respond accordingly (Given this is executed properly).

- Shaurya Bishnoi

- Last Updated : July 6, 2023, 18:34 IST

In the News

HUL is in the news as it has decided to cut the prices of its products as input costs have fallen. Price cuts will happen in shampoos, detergents and soaps. At the same time, there would be some volume increase. Meanwhile, in HFD (Health Food Category) there is a price increase due to high input costs in the form of expensive cereal, milk and barley.

External Outlook

The FMCG sector for a long time has been going through the doldrums. Input costs for commodities were high while volumes were tepid or negative. Consumers were shifting towards non-branded products and it showed high price sensitivity of consumers. As a result, companies moved to bridge packs and decreased the grammage of packets. Now dawn for the sector is emerging, volumes appear to be on a revival path and commodity prices are sliding downwards. Still, it is expected that the positive effect will come with a lag. Nielsen expects the FMCG market to grow 7-9% in 2023.

Company Profile

HUL is a subsidy of global FMCG firm Unilever. It is India’s leading FMCG company. HUL owns 29 factories, 50+ manufacturing partners and more than 1,300 suppliers. It has 32 distribution centers, 3,500 redistributors and around 9 million retail outlets.

It operates in various business segments of FMCG. Their contribution as per revenues are

1) Beauty & Personal Care (37%)

2) Home Care (36%)

3) Foods & Refreshments (25%)

4) Others (2%)

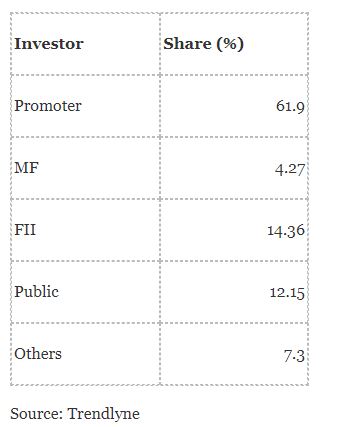

Shareholding Pattern (As on 31st March 2023)

Growth Drivers

1) Revival in FMCG segment

2) Premiumisation, new product launches and high spend on advertisement to support revenue growth. Here premiumization can reduce price elasticity but advertisement can increase elasticity if it will attract price sensitive customers

3) Fall in commodity prices to aid margins

4) Cost reduction to help with volume growth

5) Focus on digital channels for distribution

Competitive Advantage

1) Diverse product portfolio with 16 FMCG categories and market leadership in 85% of the company’s portfolio.

2) Strong brand preference among consumers.

3) Focus on customer reviews and surveys to asses evolving consumer needs. It would allow company to asses how advertisement and premiumization has impacted price elasticity and respond accordingly (Given this is executed properly).

4) Using digitisation and data analytics to create partnerships with distributors for creating a future-fit ecosystem. Created e-B2B app Shikhar and 1.2 million outlets use it.

5) Focus on digitization for end-to-end supply chain resiliency. This would help with cost efficiency. The company also set up 7 Nano factories for producing niche products with more agility

6) Creating strong relationships with suppliers for strategic advantage and better cost efficiency

7) Managerial, product and innovation support of parent company UL

8) Strong reward structure to bring the best out of employees

Risks

1) Volatility in commodity prices

2) Unable to clearly asses changing customer preferences

3) Intense competition with the entry of Reliance and Adani in the sector

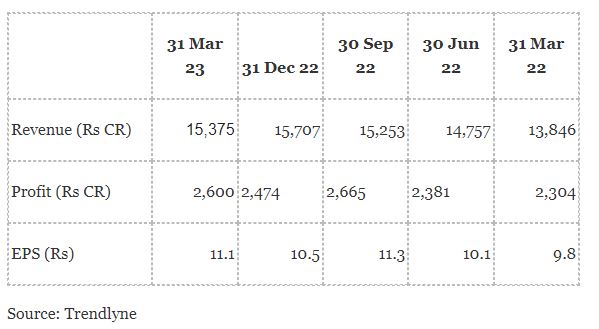

Financials (Consolidtaed)

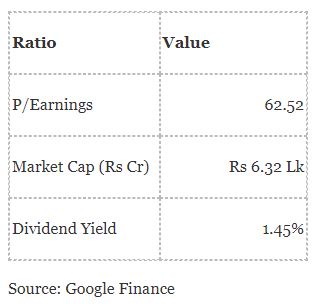

Valuation Ratios

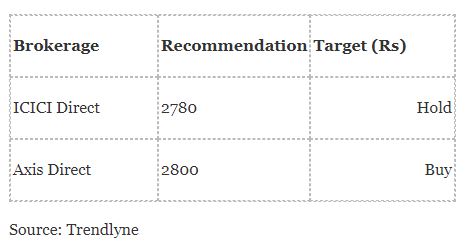

Target Price

Download Money9 App for the latest updates on Personal Finance.

Related

- Budget’24: New LTCG rule to hit long-term property owners hard

- Looking to buy gold? Buy now before it’s too late!

- PhonePe vs. GPay: Indian digital payment giants up for a tussle

- Budget 2024: What is NPS ‘Vatsalya’ scheme? How to apply & other benefits?

- Budget’ 24: Startup ecosystem all smiles with scrapping of angel tax

- Why are e-comm users turning extra cautious? How to avoid dark pattern attacks?