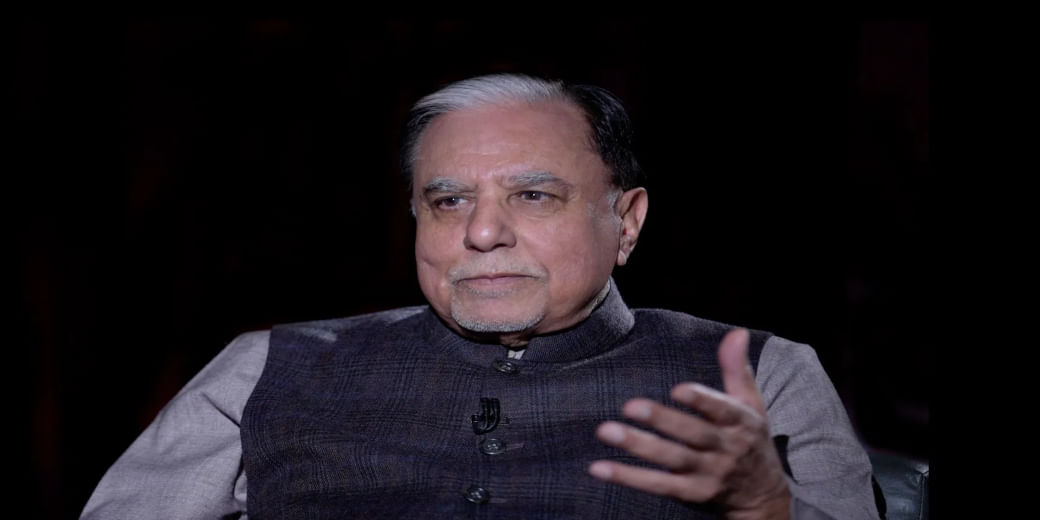

Subhash Chandra, Punit Goenka can’t be directors

Markets regulator SEBI has passed an interim order barring former Essel Group chairman Subhash Chandra and his son Punit Goenka from holding key positions in any listed company

On Tuesday, Zee Ent’s stock saw an intraday fall of up to 6.5 percent. In fact a new hurdle has come in the way of Zee Entertainment and Sony Pictures merger On Monday evening Markets regulator SEBI has passed an interim order barring former Essel Group chairman Subhash Chandra and his son Punit Goenka from holding key positions in any listed company. The order, which came after a probe by SEBI, said that while holding key positions in Zee Entertainment, both of them misused their position for personal gain and siphoned off funds. SEBI has directed Zee Entertainment to place this order before the company’s board within 7 days. Along with this, 21 days time has also been given to Subhash Chandra and Puneet Goenka to submit their response.

According to experts, this decision of SEBI may delay the Zee-Sony merger. SEBI said in its order that on September 4, 2018, Subhash Chandra had issued a letter of comfort or LoC in lieu of the loan taken from YES Bank on behalf of some group companies. Not only this, Sebi has also noticed misrepresentations related to receipt of funds in Zee’s annual report. Sebi said that Zee has given wrong information that the company has received funds from associate entities.

After the news, shares of Zee Entertainment opened at Rs 184.95, made low of Rs 182.6 and high of Rs 194.7. Other company of the group Zee media opened at Rs 8.2 traded in the range of 7.98 and Rs 8.2. Stock market expert and founder of Mantri FinMart, Arun Mantri has suggested that investors should avoid both these stocks and if you have already invested then find right opportunity to exit.

Download Money9 App for the latest updates on Personal Finance.

Related

- ओला इलेक्ट्रिक ने S1 Zen3 स्कूटर की आपूर्ति शुरू की

- बासमती चावल पर GI टैग पाने के लिए भिड़े भारत- पाकिस्तान, क्यों खास है यूरोपियन यूनियन की ये मुहर

- आ गया नया इनकम टैक्स बिल, जानें अब ओल्ड और न्यू रिजीम में कहां-कहां बचेगा पैसा

- BlackRock भारत में देगी 1200 लोगों को नौकरी, AI एक्सपर्ट के लिए जल्द शुरू होगी हायरिंग

- Budget Highlights 2025: 12 लाख तक कोई Income Tax नहीं, कैंसर की दवाइयां होंगी सस्ती; जानें 10 बड़ी बातें

- कैफे में बैठने के लिए भी अब पैसे लेगा Starbucks, 29 जनवरी से बदल जाएगी कंपनी की पॉलिसी