Want to invest in gold? Here's a golden opportunity you don't want to miss

Looking to invest in the golden metal? The government’s sovereign gold bond (SGB) scheme, which goes live next week, is just what you’re looking for. With two tranches of SGBs opening for subscription between June and September, here’s all you need to know about SGBs. What is the issue price of current series of SGBs […]

Looking to invest in the golden metal? The government’s sovereign gold bond (SGB) scheme, which goes live next week, is just what you’re looking for. With two tranches of SGBs opening for subscription between June and September, here’s all you need to know about SGBs.

What is the issue price of current series of SGBs 2023-24 i.e. series 1?

The price for Series-I 2023-24 is fixed at Rs 5,926/gm. Notably, each unit of gold bond equals 1 gram of gold.

What are SGBs?

Simply put, SGBs are government securities or bonds, which are marked in grams of gold, with 1 gram being the basic unit. Effectively, they are substitutes of physical gold, and are issued by the RBI. Since they are backed by the government, they are generally considered a safe investment avenue.

So, they’re completely risk-free?

No. See, you’re saved from any payment defaults, thanks to SGBs being government-backed. But nevertheless, there’s the risk of the value of your investments dipping if the price of gold falls down. Even then, the number of units that you purchased remain unharmed. The other major risk protection offered by SGBs is that they save you the financial costs that you might incur if you buy, sell or physically store gold bars or coins.

When do the subscriptions open?

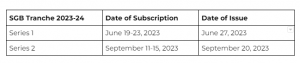

For the first half of 2023, here is the schedule :

How are SGBs taxed?

Per CA Nitesh Buddhadev, interest received on SGBs are taxed at the individuals applicable slab rate. However, the maturity amount is exempt from capital gain tax.

“Long term capital gain ( i.e. applicable after three years of purchase)on redemption of a SGB is subject to an LTCG of 20%”, he adds.

How much do I earn on SGBs?

The bonds, which have a maturity period of 8 years, allow premature redemption post the 5 year period. Investors who subscribe online and pay digitally for SGBs are charged Rs 50/gram less on the issue price. Hence, for this series, the bond price for those who pay via digital modes, will come down to Rs 5,876 per unit.

Additionally, SGB subscribers earn a fixed interest of 2.5% p.a, which is paid out twice an year.

How many SGBs can I hold?

If you’re an individual, you can buy a maximum of 4 kgs in a fiscal year. The same is applicable for an HUF. But if you’re a trust, the limit is 20 kgs in one financial year.

When should I invest in SGBs?

According to Rohit Shah, who heads Getting you Rich advisory, SGBs are a long-term game. “Besides earning gold price appreciation, you are also earning interest and if you hold on till maturity, the capital gains are exempt too. We normally recommend 5% to 10% of exposure to gold assets”.

Adds Mr. Nish Bhatt, Founder & CEO, Millwood Kane International, “Investment in paper, digital gold provides high liquidity, eliminates storage costs, and is easier to sell than physical gold. Investment in SGBs comes with an interest coupon payable semi-annually. Gold prices have gained 18% in FY23, around 8% YTD. Also, SGB has posted double-digit gains since its inception in 2015”.

“Gold prices have been trading near their all-time highs domestically as well as globally. The recent moves by the US Fed and RBI capped gains for gold, leading to softness in the prices. In fact, expectations of global central banks easing rates from CY24 onwards will provide support to the yellow metal”, he notes.