Which are the funds to invest your payouts

Your bonus money should not be limited to equity mutual funds for long-term goals; one should also consider debt mutual funds to fulfil short-term obligations

- Himali Patel

- Last Updated : December 1, 2023, 10:06 IST

Today, given that many of the government and private sector employees receive their yearly bonuses around Diwali, this may be an ideal moment for them to start investing in mutual funds.

However, with the Indian stock market at a record high and investors in equities mutual funds can be worried about escalating geopolitical tensions, and investing can be a daunting task.

Experts suggest investing wisely in bonus money instead of splurging into buying goods. However, your bonus money should not be limited to equity mutual funds for long-term goals; one should also consider debt mutual funds to fulfil short-term obligations.

Let’s take a look at mutual funds you can invest with your Diwali Bonus:

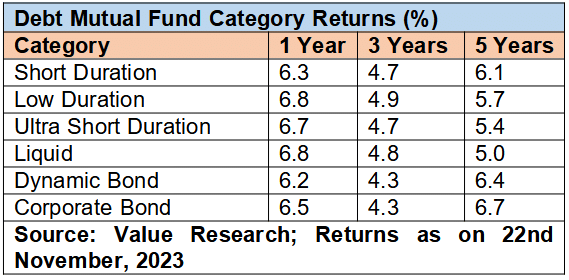

Debt Mutual Fund

Investing your bonus depends mainly on two things: first, your short- and long-term goals, and second, on your risk appetite. For example, if you plan to purchase a new car or plan a short-term holiday trip, you should invest in some debt mutual funds.

Experts usually recommend funds like liquid mutual funds, short-term duration funds, and corporate bond funds. Below are the returns of a few debt mutual funds that can aid you in fulfilling your short-term goals.

Debt fund investments will no longer be eligible for the LTCG indexation benefit as of April 1, 2023. Instead, the investor’s gains will be taxed as part of their taxable income. No matter how long debt fund units are held, all profits on newly purchased units after April 1, 2023, will be considered STCG.

Equity mutual funds

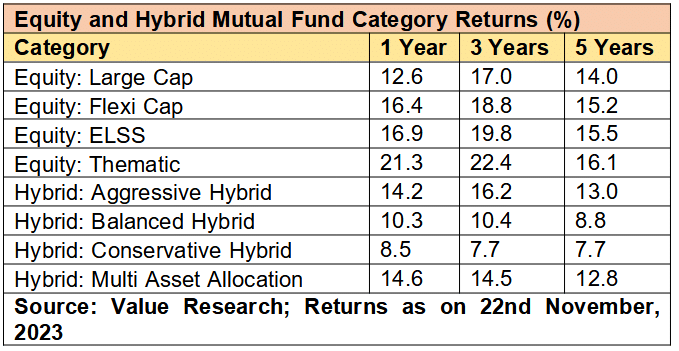

Investing in equity or hybrid mutual funds over a long-term investment horizon can fetch you much higher returns.

For instance, an investment in mutual funds through systematic investment plans (SIPs) of Rs 5,000 every month for 4 years at 12% rate of return, if invested in equity mutual funds, can create a corpus of Rs 3.05 lakhs.

Experts recommend investing in equity funds like Flexicap and hybrid mutual funds, which should be considered with an investment horizon of 3 years and above.

“When it comes to Diwali bonus, in equity, we recommend investing in Flexicap funds for gaining complete exposure across sectors and market caps and risk-averse investors; a hybrid mutual funds investment can also be considered,” said Satish Ramanathan, CIO-Equity, JM Financial Mutual Fund.

Below are the returns for equity and hybrid mutual funds for investors looking to invest in long-term goals.

Financial experts say investing in lower-risk index funds is another option; an investor can invest if unsure about pure equity mutual funds.

Investors should also consider the taxation part of the investment. Under an equity mutual fund, if you redeem before one year, returns are subject to a 15% tax. After a year, you must pay a 10% long-term capital gain tax on returns of Rs. 1 lakh or more in a fiscal year.

Conclusion

For the investors, apart from understanding their risk appetite, it is crucial to check the expense ratio, the fund’s past performance, and the fund manager’s history before deciding which category of mutual fund to invest in.

Download Money9 App for the latest updates on Personal Finance.

Related

- मैक्सिको के 50 फीसदी टैरिफ पर सरकार ने शुरू की बातचीत; जल्द समाधान की उम्मीद

- इंडो- US ट्रेड डील में पहले हट सकती है पेनाल्टी, रिपोर्ट में दावा

- रुपये ने फिर बनाया ऑल टाइम लो, जानें क्या है वजह

- बैंक कस्टमर के लिए बड़ी खबर, RBI हटाएगा ओवरलैप फीस,

- मैक्सिको ने अपनाई US जैसी पॉलिसी, 1400 से ज्यादा प्रोडक्ट लगाया भारी टैरिफ

- SpiceJet विंटर सीजन में जोड़ेगी 100 नई फ्लाइट्स! Indigo के कटे रूट्स का करेंगी भरपाई