Why are NFOs not doing well?

A SEBI study also revealed that 27% of funds generated during NFOs came via switch transactions. This means that instead of fresh funds being invested, money was simply being switched/transferred from one scheme to another.

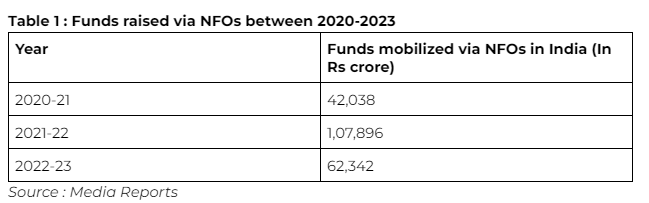

After battling a SEBI-imposed 3-month ban in 2022, new fund offerings (NFOs) are off to a lukewarm start this year as well. During 2021-22, mutual funds in India gathered 42% less money via their NFOs, as compared to 2022-23

This was the case even as 2022-23 saw 256 new launches worth Rs 62,342 crore. significantly higher than the 176 NFOs launched in 2021, which earned Rs 1,07,896 crore. In 2023, January saw 15 NFOs, followed by 18 others until March.

A SEBI study also revealed that 27% of funds generated during NFOs came via switch transactions. This means that instead of fresh funds being invested, money was simply being switched/transferred from one scheme to another.

Presently, there are five NFOs open for subscription. This includes a defence fund (HDFC), a tax saver fund (NJ), a value fund (Baroda BNP Paribas), among others.

So, why have NFOs delivered such underwhelming performances of late? For starters, NFOs usually perform best in a thriving market, buoyed by investor optimism. Currently, amidst rising inflation and lowering consumer expenditures, NFOs are not high on the investors mind.

That is also why Index funds ace the list of NFO launches between 2022-23. The focus was clearly on them, as the segment saw 84 new schemes, followed by 71 fixed term plans.

But is it a good idea for a retail investor to participate in every NFO? It can be tempting, since most new schemes launch with an NAV (Net Asset Value) of Rs 10. NAV denotes the market value per share of a particular mutual fund. Hence, it is easy for investors to fall for low NAVs, in the hope that one day it will earn high returns.

However, that is a myth one should not fall for. As per Sanjeev Dawar, a Pune-based financial advisor, “An urge to grab every IPO or NFO is never the right approach. A choice can be made in case it’s giving an edge to strengthen an existing portfolio. But it is always wiser to test the waters before taking a plunge”.

Cheaper NAVs do not guarantee rich returns. Moreover, if a fund has higher NAV, that means it has been around for a longer-time, and its fund manager has a proven track record of effectively generating returns for its investors.