Your loans won't get costlier; RBI keeps rates unchanged

The Reserve Bank kept policy rates unchanged at 6.5% and growth target for FY24 at 6,5%. It has kept the inflation rate target at 5.1%

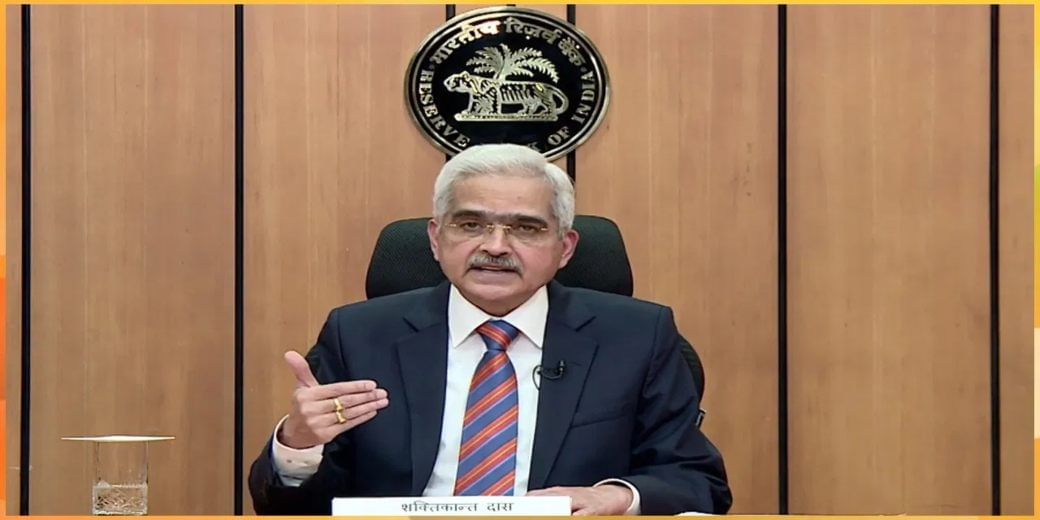

In line with expectations, the Reserve Bank of India kept the repo rate unchanged at 6.5%, expecting a continuation of the moderation of near-term inflation. Expressing satisfaction that the monetary policy committee actions are yielding desired results, RBI governor Shaktikanta Das said following the monetary policy committee meeting.

RBI MPC extended the pause in rate hikes for the second time after a first unexpected pause in its previous committee meeting in April.

Inflation at 5,1%

On the inflation front, Das predicted that the CPI will remain at 5.1% for FY24.

“CPI is projected to be 6.4% for Q1, 5.2% for Q2, 5.4% for Q3 and 5.2% in Q4,” said Das.

Among the uncertainties that might plague the economy, the RBI governor pointed to monsoon (El Nino impact), the geopolitical situation and commodity prices. He made a special mention about crude oil, sugar and rice.

Earlier, in order to tame runaway inflation, RBI kept on raising the repo rate from 4% in May 2022. The last hike took place on February 8, 2023 when the rate was hiked from 6.25% to 6.50%.On Thursday Das said RBI will remain nimble in its liquidity management while ensuring resources are available for the growth of the economy.

Growth forecast

He retained the GDP growth forecast at 6.5% while underscoring the fact that in FY23 the GDP surpassed the pre-pandemic levels by 10%.

Das also expressed satisfaction in the fact that trade deficit has narrowed in the recent months.

By 2030, India is trying to reach $1 trillion value of exports. The current account deficit has moderated significantly in Q4 of FY23 and will remain manageable in FY24, the RBI chief said.

He also said that data suggests that foreign direct investment too improved in April. Significantly, in FY23, FDI in India fell for the first time in several years. The external sector remains stable, said Das. He said that the forex reserves stood at $595.1 bn as on June 2, 2023. Ratios such as external debt to GDP were comfortable too.