Your money will double in this scheme

The attractiveness of this scheme has increased further due to the fluctuations in the interest rates of fixed deposits of banks

For investment, a large number of people still look for such options where their amount doubles in a fixed period. In areas where modern investment options like mutual funds are not yet available, the attraction of ‘double’ the amount is more. Kisan Vikas Patra (KVP) is a good option for such people. The attractiveness of this scheme has increased further due to the fluctuations in the interest rates of fixed deposits (FD) of banks. At present, KVP is giving 1% more interest than bank FD.

For whom this scheme is useful

People associated with jobs and agriculture buy Kisan Vikas Patra with small capital for the security of their future. A large number of people also invest in this scheme for the purpose of their daughter’s marriage. Fixed interest income over a longer period adds to the attractiveness of this scheme. For the people of rural areas, Kisan Vikas Patras proves to be very helpful in difficult times. KVPs are useful when money is needed for fertilisers and seeds for farming. Loan is easily available by pledging these letters. You can get these letters again when the harvest comes. People of urban areas are also taking great advantage of this scheme.

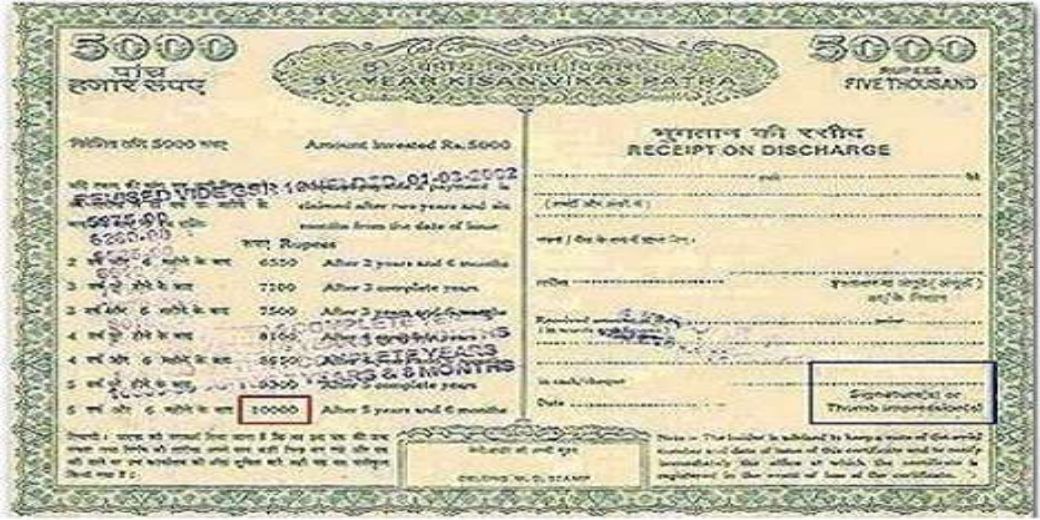

How much interest will be received

If you invest in KVP now, this amount will double in 115 months i.e. nine years and seven months. At present, this scheme is getting 7.5 percent interest annually, which is much better than bank FD. In this, the maturity and interest rate have been adjusted in such a way that the invested amount doubles at the time of maturity. In this way Rs 1,000 invested in KVP will double in 115 months. You can register your nominee in KVP like FD schemes of banks. The calculation of tax on KVP and FD returns is the same.

Interest on five-year FD

Bank of Baroda 6.50%

SBI 6.50%

Canara Bank 6.70%

Axis Bank 7.00%

HDFC Bank 7.00%

How to invest

The process of investing in KVP is very simple. Generally, KVPs are also available in post offices where savings account opening facilities are available. Any adult individual can invest in KVP. Two persons can also buy this certificate jointly. Parents can also invest in KVP in the name of their child. NRIs are not allowed to invest in this scheme. A minimum investment of Rs 1000 can be made in KVP. There is no limit on maximum investment.

Prepayment

The government has prepared this small savings scheme with easy terms so that large number of people can take advantage of it. If a person needs money before maturity, then this amount can be withdrawn after two and a half years. However, in this situation some deduction is made in the interest. The rate of deduction depends on the period of investment. Banks and other financial institutions also provide loan facility on KVP.