Your MUVs are now on GST radar. Know all that changed on GST for utility vehicles

Early analysis suggests that 10 MUVs, produced by 6 makers, namely KIA, Maruti, Mahindra and Toyota are set to see a slight increase in prices. But the announcement has not ruffled many feathers in the auto industry.

Following the GST Council’s 50th meeting yesterday, all multi-utility vehicles (MUVs) will now be subject to 22% compensation cess. This means that irrespective of your vehicle being an SUV (sport utility vehicle), you will have to pay 22% cess, over and above 28% GST, which was already applicable for SUVs and MUVs. However, sedans have been kept out of the purview of this cess.

Notably, while 22% cess on SUVs had been notified back in 2017, some MUVs were still under the 20% cess criteria. This was because one of the conditions for any car to qualify as an SUV was that it should be known as one in popular parlance. This has now been done away with. Experts are estimating a 2% rise in MUV cost after the announcement.

How will this impact your pocket?

SUVs are one of the highest taxed item in India’s GST list, with 28% GST and 22% compensation cess. If your car meets any of the following criteria, it will now be classified as an SUV

- Measures 4 meters or above in length

- Has an engine capacity of 1,500cc or more

- Has unladen ground clearance of 170 mm or more.

No major impact anticipated

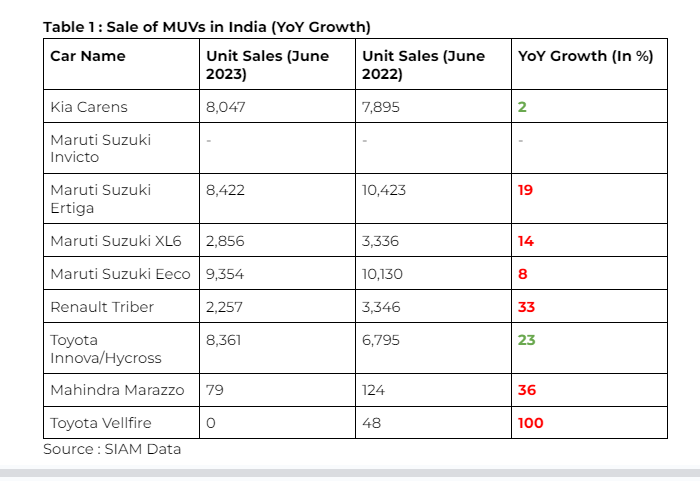

Early analysis suggests that 10 MUVs, produced by 6 makers, namely KIA, Maruti, Mahindra and Toyota are set to see a slight increase in prices. But the announcement has not ruffled many feathers in the auto industry, given that MPVs make for less than 15% of the total utility vehicle sales in India. Moreover, most of these MUVs have reported negative YoY growth in terms of domestic sales, with the exception of Toyota Innova.

Sample this. The frontrunners in the MUV category, namely Ertiga, Crysta and Carens account for only 12.65% of the total utility vehicle sales in FY2023. For perspective, data from SIAM suggests that April 2023 saw a whopping 20,03,718 utility vehicles being sold, a 35% jump from the previous year.