Corporate fixed deposits: Pros & cons of investing in company instruments

Corporate FDs are term deposits that are offered by corporate companies and non-banking financial companies (NBFCs) and are held for a fixed period of time at a fixed rate of interest

When it comes to investment and security, then fixed deposits are still the most preferred option of an average Indian as it gives guaranteed returns within a fixed tenure ranging from 7 days to 10 years. But now with the falling rates of bank FDs and increasing investment options in the financial world, people are shifting towards them.

One such option is corporate fixed deposits that people are looking into with an aim to get better returns. So, read on to understand how these instruments work and the returns they offer.

Corporate Fixed Deposits

Corporate FDs are term deposits that are offered by corporates and non-banking financial companies (NBFCs) that are held for a fixed period of time at a fixed rate of interest. It is almost acts like bank FD but gives a better return than the bank FD. The maturity period of corporate FD varies from few months to few years.

With higher return comes a higher risk. When you buy a corporate FD, it is like an unsecured loan to the company. The risk here is whether the company will be able to return your money at the time of maturity. It all depends on how the company has been performing in its core business. The preferred tenure period of a corporate FD generally ranges between 1-3 years.

“You should invest only in AAA or AA+ rated companies, track the results of the company you have invested in, and diversify within the corporate deposits. You should limit the investment in a CD to 10% of your money as it comparatively risky,” explains Vishal Dhawan, Founder & CEO – Plan Ahead wealth advisors

Advantages:

– Corporate FDs offer 0.75 -2% higher returns than regular fixed deposits.

– Penalty in the case of early withdrawal is lower than bank FDs.

– They allow premature withdrawals without any restrictions.

– Corporate FDs offer cumulative and non-cumulative interest payouts.

– They feature safety ratings by credit agencies like ICRA and CRISIL.

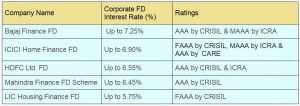

Here’s the list of Top 5 rated Corporate FDs:

Conclusion

If you want to achieve a goal in 1-5 years with better returns than FDs, then you can invest in Corporate FDs as bank fixed deposit interest rates are going down. But before buying, do not forget to check the credit rating of the company you car planning to invest in.

Dhwan further clears the air by concluding, “If you want to invest in high return instruments and if liquidity is not an issue, then you can invest in corporate deposits. Also, you should try to buy a corporate deposit for 1 or 2 years rather than lock in for 5 years even though you may get a relatively higher return.”