Going for a gold loan? Here's how the sharp fall in gold prices will impact borrowers

Gold loans act as a saviour for many in need of money, especially for those who do not have a stable job or a muted credit score

Gold prices have been on a downward spiral for some time and have slipped considerably from its lifetime highs reached last year. On MCX, gold April futures were trading Rs 44,570 per 10 grams last week, down by Rs 11,621, or around 21% lower than its record high of Rs 56,191 per 10 grams in August 2020.

While you would be a worried person if you had invested in gold last year when it was ruling at high levels due to the uncertain times, what does the current massive fall in prices mean for gold loan borrowers?

Gold loans act as a saviour for many in need of money, especially for those who do not have a stable job or a muted credit score. Loans against gold act as a popular and quick means to raise funds. With the yellow metal as collateral, lenders are only too eager to extend a loan.

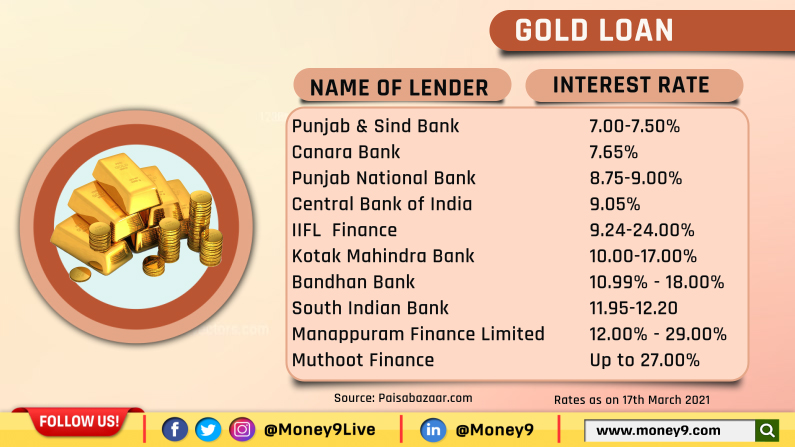

Gold loans are typically for a short term, say a year or two, though in some cases they may go beyond that. The lenders — banks and non-banking financial companies — typically lend up to 50 to 80% of the value of the gold offered as collateral. For example, if you have gold worth Rs 2 lakh, then applying the loan to value ratio of 60%, the lender may offer you a loan of Rs 1.2 lakh. This loan can be repaid in equated monthly installments or you may choose to service the interest each month and repay the capital at the end of the term. The rate of interest is much lower than the personal loans. The rate of interest charged varies from lender to lender and can be as low as 7% to as high as 27-28%.

Last year, in the wake of the Covid-19 pandemic, the Reserve Bank of India allowed banks to lend up to 90% of the value of the gold in August 2020 to assist the borrowers to raise funds. This relaxation is available till March 31, 2021. Earlier this loan to value ratio stood at 75%. If you are an existing gold loan customer, then you should prepare yourself accordingly. If you have been a customer of a bank, then it is likely that the lender has not lent you much as they are conservative lenders by nature compared to NBFCs.

“The relaxation in the upper cap of gold loan LTV ratio from 75% to 90% is applicable to banks and not NBFCs, and that too till March 31, 2021. Most banks have capped their gold loan LTV ratios at 75%,” said Ajay Mishra, Head, Gold Loan, Paisabazaar.com.

There are some situations where the fall in gold prices can hit the borrower. Think of a situation where the lender applied a loan to value ratio of 90% and lent Rs 9 lakh against gold valued at Rs 10 lakh. Since the gold prices have corrected sharply, the lender may ask for some prepayment of loan, if the borrower has so far only paid interest.

In such a scenario, the borrower may have to pay some money towards the repayment of principle and cut the outstanding. Any default on the interest payment due or inability to cut outstanding will make the lender auction the gold and recover the money. In most cases, the lenders alert you and give some time before they auction the gold.

“If correction in gold prices leads the LTV ratio of the disbursed loan to exceed regulatory cap on LTV ratio of gold loans, then the lenders might ask gold loan borrowers to deposit cash or cheque or pledge more gold to make good the exceeded LTV component. Failing to meet the lenders’ requirements may lead them to sell the gold pledged as collateral,” Mishra said.

Also in the wake of fall in gold prices, if you are a potential borrower, expect lenders to cut their loan to value ratio drastically. You may get relatively less amount of money as lenders may turn conservative. “Going forward, the decision of lenders whether to become conservative while setting LTV ratios for their gold loan applicants will primarily depend on their take on the future trajectory of gold prices,” Mishra pointed out.

The industry participants will also keep an eye on the RBI notification about loan to value ratio of gold loans. If the RBI extends the timeline and gold prices stabilise, then expect some liberal lending against gold by lenders.