Rising gold prices: Tap gold mining fund for higher returns

DSP World Gold Fund a global fund which invests in the global gold/silver/platinum mining companies. Whenever demand for gold/silver increases this fund may tend to deliver superior returns, experts point out

When gold prices bounce back, gold ETFs and sovereign gold bonds seem to be the preferred choices for many investors. But savvy investors are always on the hunt to maximise their gains.

One such way is to invest in shares of gold mining companies. DSP World Gold Fund (DGF) invests in units of Blackrock Global Fund – World Gold Fund, which in turn invests in shares of gold miners across the world. When gold prices do well, gold miners stand to benefit, as the output — gold mined by them — is sold at a higher price while costs moreover remain static.

“This fund is a global fund which invests in the global gold/silver/platinum mining companies. This is a unique feature of this fund. However, the underlying portfolio is global equity and hence the returns cannot be compared with the commodities.

This fund invests about 83% of the assets in gold mining, 10% in silver mining and about 4% in platinum mining companies. The return on this fund purely depends on the performance of its underlying equity portfolio. Whenever demand for gold/silver increases this fund may tend to deliver superior returns,” said S Sridharan, founder, Wealth Ladder Direct.

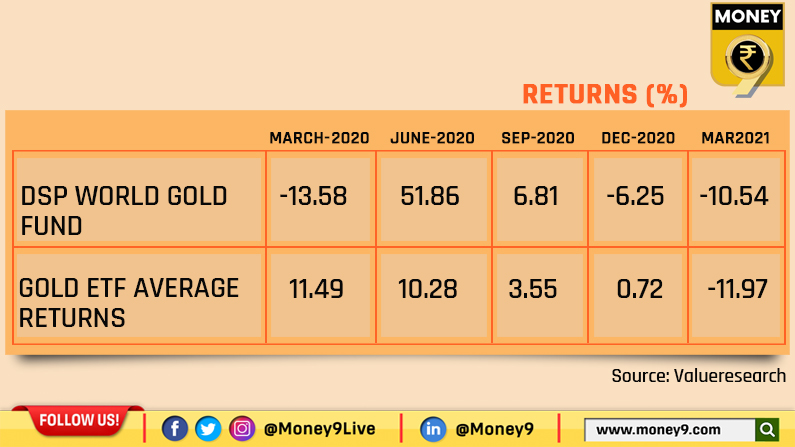

Sometimes, the sentiment in equity markets however, may impact the share prices of gold miners. For example, in the quarter ended March 2020 the gold prices went up and gold ETF soared (+11.49%), but DGF lost money (-13.58%).

However, the correlation between gold prices and DGF was established in subsequent quarters as mentioned in the chart below:

The price spike seen in gold was an outcome of safe haven demand, in a volatile phase in financial markets. As the central bankers and governments came together to revive the economy with a swift policy response, the gold prices cooled down. However, going forward the investment demand for gold is expected to be robust and more sustainable. Due to infusion of abundant liquidity, there is an expectation of sticky inflation in the global economy. Gold is seen as a hedge against inflation. This along with low interest rates which leads to low or negative real interest rates (nominal interest rates minus inflation) should make gold an attractive investment option.

This should benefit gold miners in terms of rising profits and thereby rising share prices. DGF can be a way to take advantage of rising gold prices. You may see more returns by investing in this fund, with some amount of volatility and additional risks, compared to gold ETF if gold prices continue to rise.

In the past one month, DGF has given 11.46% returns, according to data sourced from Value Research.

Being a thematic fund is a high risk investment. Only savvy investors should allocate a small sum to this fund.

“Investors should understand that this fund is not an equivalent of investing in gold ETF. The underlying portfolio consists of global equity and hence it tracks the fundamentals of the underlying companies’ performance. Since it is a global fund, it carries currency risk and the market risk. If the US dollar appreciates and the US market does well, the investor has both currency appreciation and market appreciation. If it happens reversely, then it hits the investors both the ways. This is a sector focused fund which carries high risk. The sector funds are cyclical in nature. So if investors invest at the fag-end of the up-cycle then they have to wait for a long period to see good returns,” Sridharan said.